Table Of Contents

Formula To Calculate Leverage Ratios (Debt/Equity)

The formula for leverage ratios is used to measure the debt level relative to the size of the balance sheet. The calculation of leverage ratios is primarily by comparing the total debt obligation relative to either the total assets or the equity contribution of the business.

A high leverage ratio calculates that the business may have taken too many loans and is in too much debt compared to the business's ability to service the debt with future cash flows. The two key leverage ratios are: -

Key Takeaways

- Leverage ratios determine the level of debt in relation to the size of the balance sheet. Key leverage ratios include debt and debt-to-equity ratios.

- Leverage ratios compare the debt obligation to the business's assets or equity.

- Prospective lenders use leverage ratios to assess a business's debt-servicing capability.

- Significant leverage can be beneficial to shareholders as it indicates that the business is using equity to fund operations, potentially increasing the return on equity for existing shareholders.

Steps to Calculate Leverage Ratios (Debt and Debt-to-Equity Ratio)

Debt Ratio:

This leverage ratio formula compares assets to debt and is calculated by dividing the total debt by the total assets. A high ratio means that a huge portion of the asset purchases is debt-funded.

The formula debt ratio can be calculated by using the following steps: -

- Step #1: The total debt (includes short-term and long-term funding) and the total assets are collected and easily available from the balance sheet.

- Step #2: The debt ratio is calculated by dividing the total debt by the total assets.

Debt Ratio = Total Debt / Total Assets

Debt-to-Equity Ratio:

This leverage ratio formula compares equity to debt and is calculated by dividing the total debt by the total equity. A high ratio means that the promoters of the business are not infusing an adequate amount of equity to fund the company resulting in a higher amount of debt.

One can calculate the formula of the debt-to-equity ratio by using the following steps: -

- Step #1: The total debt and the total equity are collected from the balance sheet's liability side.

- Step #2: The debt-to-equity ratio is calculated by dividing the total debt by the total equity.

Debt-to-Equity Ratio = Total Debt / Total Equity

Leverage Ratio (Debt to Equity) Video Explanation

Examples of Leverage Ratios Calculation

Example #1

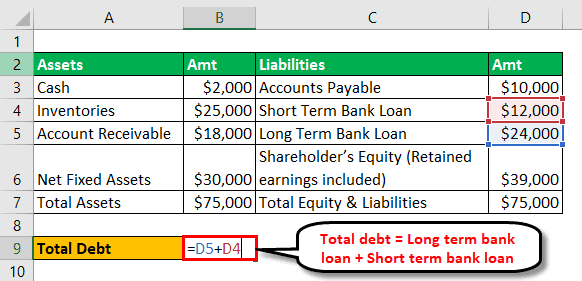

Let us assume a company with the following financials for the current year. Then, use the calculation of leverage ratios for the same.

From the above table, we can calculate the following: -

#1 - Total Debt

Total Debt = Long-term Bank Loan + Short-term Bank Loan

So, the total debt will be = $36,000.

#2 - Debt Ratio

Debt Ratio = Total Debt / Total Assets

So, the calculation of the debt ratio will be as follows: -

The debt ratio will be: -

#3 - Debt-to-Equity Ratio

Debt-to-Equity Ratio = Total Debt / Total Equity

So, the calculation of the Debt-to-equity ratio will be as follows: -

The debt-to-equity ratio will be: -

Example #2

Let us take an example of Apple Inc. with the following financials for the year ended on September 29, 2018 (all amounts in USD millions).

From the above table, one can calculate the following: -

#1 - Total Debt

Total Debt = Long-term Bank Loan + Short-term Bank Loan

Total assets will be: -

#2 - Total Equity

Total Equity = Paid-up capital + Retained earnings + Comprehensive Income / (loss)

So, from the above calculation, the total equity will be: -

#3 - Debt Ratio

Debt Ratio = Total Debt / Total Assets

The calculation of the debt ratio will be: -

So, from the above calculation, the debt ratio will be: -

#4 - Debt-to-Equity Ratio

Debt-to-Equity Ratio = Total Debt / Total Equity

The calculation of the debt-to-equity ratio will be: -

Debt-to-equity ratio = $114,483 / $107,147

The calculation of debt-to-equity ratio: -

So, from the above calculation, the debt-to-equity ratio will be: -

Relevance and Use

The concept of leverage ratios is essential from a lender's vantage point as it is a measure of risk to check if a borrower can pay back its debt obligations. However, a reasonable amount of leverage can be seen as advantageous to the shareholders since it indicates that the business is optimizing its use of equity to fund operations, which eventually increases the return on equity for the existing shareholders.

The assessment of the leverage ratios form is an important part of a prospective lender's analysis of whether to lend to the business. However, the leverage ratios formula per share does not offer sufficient information for a lending decision. It is a relative indicator and has to be seen with absolute figures. The lender must review the income statement and cash flow statement to check if the business generates adequate cash flows to pay back the debt. The lender must also examine the projected cash flows to check if the company can continue to support debt payments in the future. As such, the leverage ratios formula is used as a part of the analysis to determine whether it is safe to lend money to the business, given its debt servicing ability.