Table Of Contents

What Is Lending Ratios?

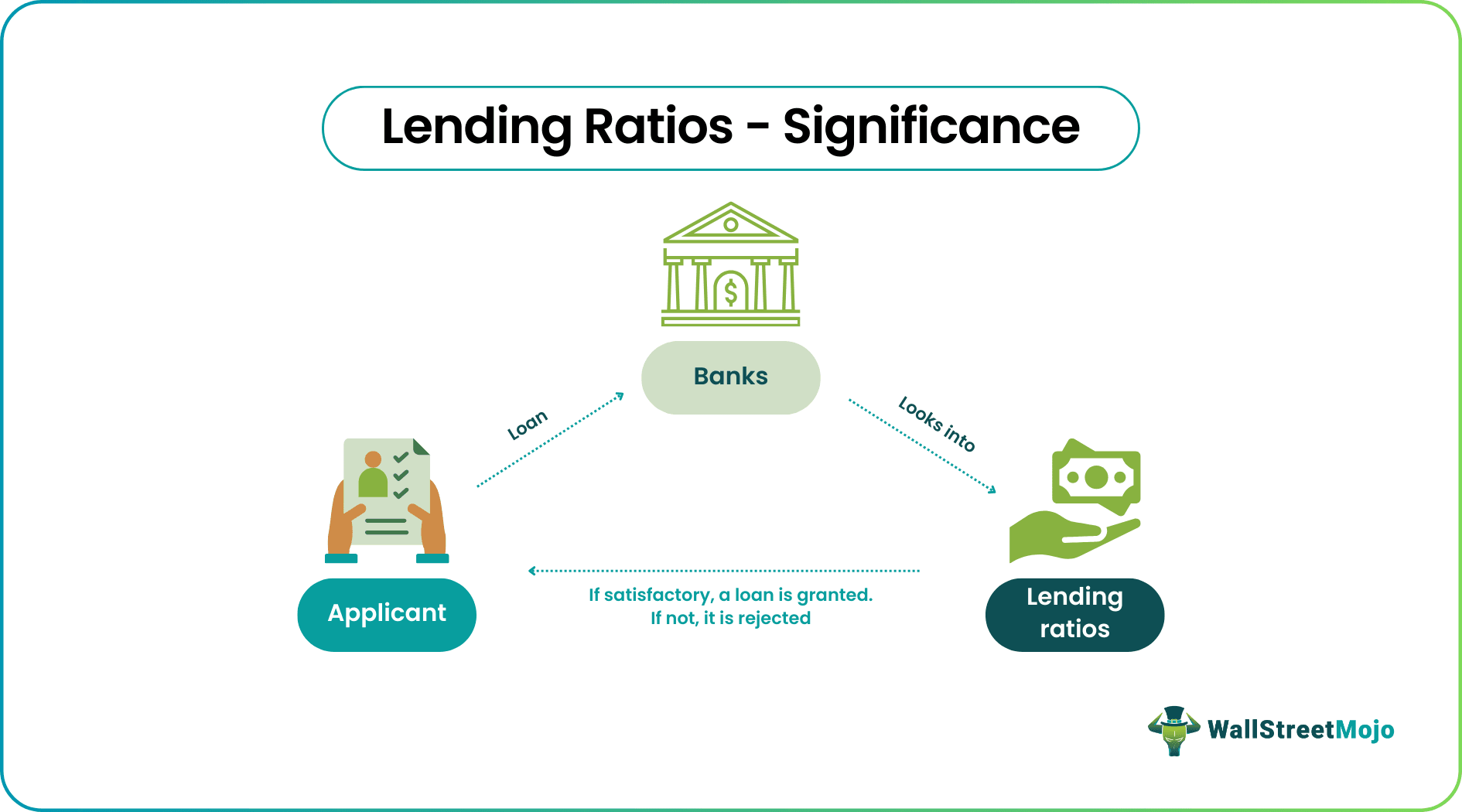

Lending Ratios are parameters banks and other financial institutions consider while processing a loan application. The purpose is to check whether an applicant will be a responsible borrower. When the evaluation is positive, it results in a loan application being accepted.

The assessment of lending ratios helps banks process and approve loan applications. The ratios reveal an applicant's financial status, the ability to make profits in business, and the ability to repay debts, among other things. It is carried out because lending involves risks, and if credit is extended without proper analysis, financial institutions might incur losses.

Key Takeaways

- Banks and other financial institutions use lending ratios while reviewing loan applications.

- These ratios enable banks to confirm whether an applicant will be a worthy borrower.

- If they find these ratios favorable post-analysis, the loan application will be accepted, and the loan will be granted.

- They help determine a credit applicant’s financial status and loan eligibility, as banks can adequately measure repayment capacity and estimate potential losses through these ratios.

- Many ratios help banks assess commercial loan applications; among them are the debt-to-income ratio, debt service coverage ratio, quick ratio, and debt-equity ratio.

Lending Ratios Explained

Lending ratios help determine the financial status of a credit applicant. When an applicant wants to open a line of credit or apply for a loan, the service provider (financial institution) checks their credit scores to determine their loan eligibility. The higher the applicant scores, the better their chances of receiving the credit. The process of evaluation is not limited to analyzing ratios.

These financial institutions also have annual and monthly revenue requirements, and for this, they verify an applicant's earnings. Some lenders also review profit and loss statements to determine whether the applicant has positive cash flows. They check if the business can afford a loan. However, analyzing ratios provides a better quantitative, overall analysis for the institutions to make a decision.

The credit score applicants obtain through this evaluation helps banking and financial institutions determine the likelihood of timely repayment. Additionally, it helps lenders, creditors, and vendors determine the risk of losses they might incur. The method of evaluation differs from one institution to another.

However, banks and financial institutions typically examine the industry in which the firm operates, the operations commencement date, credit lines detail, the firm’s credit utilization ratios, the applicant’s payment history, and overall financial performance before lending money. Ratios covering the above parameters depict a borrower’s financial performance and determine if they qualify for business loans/finance.

Types

Several commercial lending ratios can be used to analyze a company’s financial position and repayment capacity. The major ones considered while reviewing commercial loan applications are:

#1 - Debt-To-Income Ratio

Lenders use the Debt-to-Income (DTI) ratio to determine whether an applicant can service additional debt. The DTI figure is computed by dividing monthly debt by monthly gross income. If DTI is high, lenders mark an applicant as risky and may refuse loans or charge a higher interest rate if the loan is granted.

The formula for calculating the debt-income ratio is given below.

Debt-to-income Ratio = Monthly Debt Payments / Monthly Income

#2 - Debt Service Coverage Ratio

The Debt Service Coverage Ratio (DSCR) is a commercial lending ratio that measures a business's annual net operating income with respect to its annual debt. The annual net operating income is a method to determine the Earnings before Interest, Taxes, Deductions, and Amortization (EBITDA). DSCR can be calculated by dividing EBITDA by the total annual debt.

Hence, the formula is:

Debt Service Coverage Ratio = EBITDA / Total Annual Debt

Cash, receivables, and marketable securities are components considered current assets when calculating the quick ratio. In addition to cash, receivables and marketable securities are considered highly liquid. It means they can be quickly converted to cash.

#3 - Debt-Equity Ratio

A Debt-to-Equity Ratio measures the relative contribution of shareholders and creditors to the business capital employed. It measures long-term debt to equity capital. The ratio gives the lender an idea of how much debt or borrowed capital can be serviced/covered by shareholders’ contributions. Although a ratio of 1:1 is ideal, the ratio can be relaxed to 1.5:1. It is calculated using the formula:

Debt-equity Ratio = Total Liabilities / Equity

Examples

A few examples have been discussed below to explain the concept in greater detail.

Example #1

Let us take the hypothetical example of ABS Ltd. If their monthly debt is $5000 and gross monthly income is $30000, their DTI ratio will be $5000/$30000 = 16%.

The company will be considered less risky since the ratio is less than 20%. Therefore, the financial institution will likely be willing to lend if other ratios are also suitable. It should be noted that the minimum DTI requirements vary from one borrower to another. However, keeping it low (below 35%) is always recommended.

Example #2

Let us take another hypothetical example of XYZ Company. The company had applied for a business loan. Its annual total debt stood at $225,000 (including a business loan) and an EBITDA of $500,000.

Hence, the DSCR is 500,000/225,000 = 2.2.

The ratio is 2.2, a value greater than what is considered good (1). According to the Small Business Administration (SBA), US, the minimum requirement is 1.15. Considering both factors, XYZ did well. Hence, the financial institution will likely lend to XYZ if other ratios are also favorable.

Importance

Banks are heavily regulated, and they are required to maintain stipulated reserves at all times. While they lend money to people and offer fee-based services to earn revenues, they may still operate on small margins. As a result, there may not be much room for bad loan write-offs. Lenders use various ratios to track a firm’s performance and capacity to meet loan obligations while determining the profitability of a commercial loan.

Ratio analysis is a technique financial institutions use to assess a company's financial position. The company's income, profit and loss, balance sheets, and cash flow statements are analyzed. Creditors or lenders use the information to understand and monitor a business' performance. These ratios help them make banking decisions judiciously, keeping profit margins and profitability in view.