Table Of Contents

Legal Trust Definition

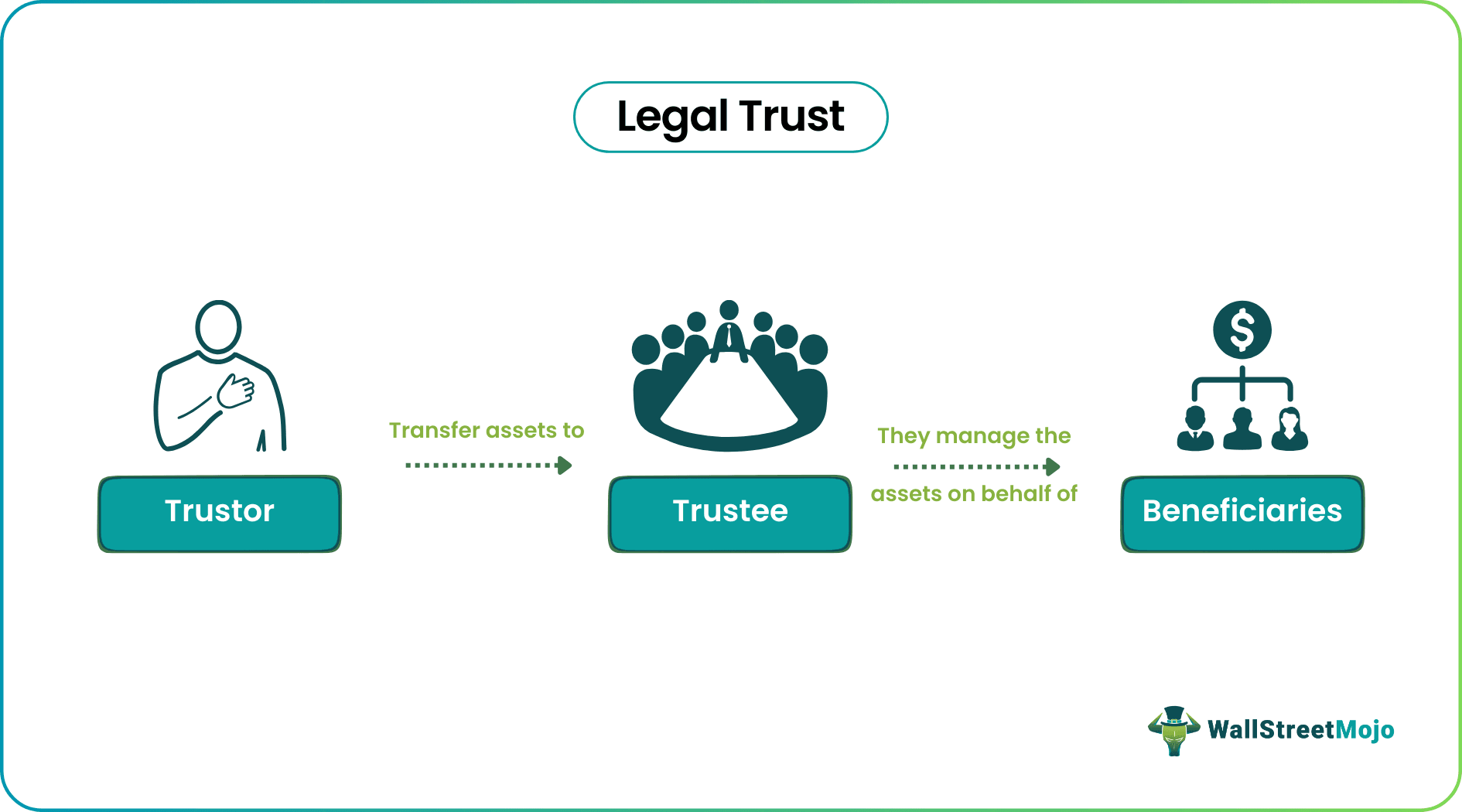

A legal trust is a legal arrangement where the trustor transfers assets to another person or entity, the "trustee", to manage for the benefit of a third party, the beneficiaries. Therefore, a legal trust aims to provide a structured legal framework for managing the trustor's assets to ensure they are allocated as they wish.

It also allows proper distribution of property among beneficiaries of the asset or property. A trustee manages a trust's operations, and the trust manages all the settlor's assets. Furthermore, people frequently utilize these trusts for a range of purposes, such as estate planning, asset protection, charitable giving, and managing funds for minors or individuals with special needs.

Table of contents

- Legal Trust Definition

- A legal trust is a formal arrangement in which a person, referred to as the "grantor" or "settlor," transfers ownership of assets to a separate legal entity known as the "trustee."

- The primary benefits of holding property and assets on the settlor's behalf are tax reduction, improved security, and financial privacy.

- It comes in various forms, including revocable trusts, irrevocable trusts, living trusts, joint trusts, and many more.

- Unlike a will, which becomes effective only upon the owner's death, a trust becomes active as soon as the trust paperwork is signed.

Legal Trust Explained

A legal trust is a legal arrangement where one party, the trustor, transfers ownership of assets to the trustee, who holds and manages those assets for the benefit of specified individuals or entities, known as beneficiaries. Moreover, the settlor creates trust with the help of their lawyer. In addition, a legal trust agreement is a powerful tool that allows individuals to manage their assets, plan for the future, and provide for loved ones in a structured and legally sound manner.

Moreover, legal trust documents define the roles and responsibilities of the trustor, trustee, and beneficiaries, as well as the details of the trust property and its management. Besides, the primary objective of a legal trust fund is to protect, grow, and distribute assets according to the terms outlined in the trust agreement.

The most important thing is to know what makes a legal trust valid. So, to create a legally valid trust, one must consider the following points.

- The settlor must work with an experienced estate planning lawyer to create and register the trust properly.

- Here, the settlor must have a clear intention of creating a trust.

- Moreover, the settlor must be the property owner or asset being transferred to a trust.

- Thus, the deed of settlement or the declaration of trust must outline the subject matter plus the assets or property of the faith.

- Founding documents must contain the name of the beneficiary.

- All the duties and rights of the trustee or the asset manager must find their place in the creation documents.

- Consequently, the trustee must legally receive all the assets to manage within the trust.

- The trust must undergo registration in accordance with government law.

Moreover, trusts act as the best means to save for the next generation, save on taxes, and maintain the legacy of the settlor.

Types

Several legal trusts are designed to serve specific purposes and meet different goals. Here are some common types of legal trusts:

#1 - Revocable Trust

This type of trust is created during the trustor's lifetime and can be modified or revoked by the trustor.

#2- Irrevocable Trusts

Once established, beneficiaries usually cannot alter or revoke an irrevocable trust without their consent. Hence, individuals use it for various purposes, including asset protection, reducing estate taxes, and ensuring specific distribution objectives.

#3- Living Trusts

It helps the settlor to pass on the property and benefits to their inheritors. It bypasses the costly probate process for a straightforward succession of successors.

#4 - Joint Trusts

Most married couples create this legal trust for jointly owning the ruts during their lifetime. If one passes away, the other becomes the trustee immediately.

#5 - Testamentary Trusts

This trust gets established through a will and only comes into effect upon the trustor's death. It's a common choice for managing assets for minors, individuals with special needs, or other beneficiaries who might be incapable of independently managing assets.

#6 - Charitable Trusts

It is an irrevocable trust created for the benefit of a charitable organization. Here the trust offers tax benefits to the beneficiary plus produces regular income sources.

#7 - Special Needs Trusts

It serves as a special trust designed to assist disabled individuals under the age of sixty-five with lifelong healthcare and living needs, all while preserving their eligibility for government social benefits.

#8 - Asset Protection Trusts

It gets created to protect one's assets, although it becomes quite costly for the person.

#9 - Blind Trusts

Here the beneficiaries need to learn of their share in the trust's assets or property to avoid any conflict of interest.

#10 - Insurance Trusts

It comes into existence through the inclusion of an insurance policy as the trust's asset, ensuring the avoidance of taxes on the insurance proceeds received after the death of the insured settlor or grantor.

#11 - QTIP (Qualified Terminable Interest Property)Trust

It comes into existence through the inclusion of an insurance policy as the trust's asset, ensuring the avoidance of taxes on the insurance proceeds received after the death of the insured settlor or grantor.

#12 - Credit Shelter Trusts

These cater to the highly affluent sections of society aiming to reduce substantial estate taxes and transfer their assets to beneficiaries with maximum benefits.

Moreover, many individuals also establish legal trust accounts to safeguard funds for their beneficiaries, utilizing trust creation facilitated by legal trust accounting software.

Examples

Let us understand the topic using a few examples.

Example # 1

Suppose, the "Prosperity Wealth Management Trust," is a legal trust founded by Elizabeth Thompson, a seasoned financial advisor. Therefore, this trust is aimed at ensuring wealth management for her clients' enduring financial objectives. Hence, the trust's core objective is to grow and safeguard its entrusted assets through strategic investment and prudent financial planning.

Furthermore, the trust document specifies that a team of experienced investment professionals will manage the assets. This team will diversify the portfolio across various asset classes and actively monitor market trends.

Beneficiaries of the trust include Thompson's clients and their designated heirs, who will receive periodic distributions to support their financial needs and aspirations. Moreover, the "Prosperity Wealth Management Trust" stands as a testament to Mrs. Thompson's commitment to financial excellence and the well-being of her clients, providing them with a reliable avenue for wealth preservation and growth.

Example # 2

After losing in court, a Leicestershire NHS trust was ordered to pay £35,000 in legal costs to the Harborough District Council, England.

The University of Leicester Hospitals NHS Trust requested an additional £1 million to address the demands of a recent housing development adjacent to Lutterworth. Harborough District Council rejected the request, and the trust sued.

Besides, the Lutterworth East project, which calls for constructing 2,750 dwellings, a village center, two primary schools, and sports fields, received planning approval in 2020.

According to a representative for Harborough District Council, the council applauded the judge's decision to deny the trust's appeal and compel it to pay for the authority's legal expenses.

Legal Trust vs Will

Let us understand the difference between the two using the table below:

| Will | Legal Trust |

|---|---|

| A legal document specifying how a person's assets will be distributed after their death. | These suit people who want to pass on their assets to their beneficiaries while still alive. |

| Moreover, it suits people with minor children or family members. | These suits people who want to pass on their assets to their beneficiaries while still alive. |

| Here, there are no savings | Legal trust helps save estate taxes of the grantor |

| No such benefits are available. | They reduce the probate cost after the death of the grantor. |

| Furthermore, it provides guardianship to the beneficiaries. | Additionally, these trusts do not provide any guardianship. |

| However, it does not provide any such tax benefits. | Only irrevocable trusts can save from estate taxes. |

| Hence, it requires probate, so the finances may not maintain their privacy | Trusts do bypass probate and preserve the privacy of finances. |

Frequently Asked Questions (FAQs)

To set up a legal trust, one needs to do the following:

·One should make a decision regarding which assets to include within the scope of the trust.

·Here, one must also identify the legal beneficiary of the trust so formed.

·It's essential to clearly outline the rules and regulations, and when it comes to selecting trustees, one must exercise careful consideration.

· Take the help of an experienced attorney to prepare the trust document the trust.

It involves a legal arrangement wherein a third party, known as the trustee, holds a grantor's assets and funds in custody, ultimately benefiting the true beneficiary of the trust, who can be either an individual or an organization.

The duration of a trust depends on the terms specified in the trust document. While some trusts are designed to have a specific duration, others can be perpetual, enduring for generations.

Recommended Articles

This has been a guide to Legal Trust and its definition. Here, we explain it in detail with its types, examples, and comparison with will. You can learn more about it from the following articles –