Legal Essentials Every Startup Founder Needs to Know

Table of Contents

Introduction

Are you looking to open a business with a super innovative idea? Well, you might miss out on what is necessary to operate one in this corporate world. Businesses do not just need to have a team or a product to sell. In fact, they must ensure legal compliance. For example, a startup may not be able to purchase goods and services from a vendor unless an agreement or contract is signed between them. That signifies how founders need to understand the legal requirements before entering into relationships.

In this blog, we will learn about the legal essentials for startup founders and how they play a crucial role in the foundation of a startup. Also, you will understand the role of agents, contracts, intellectual property (IP), and more.

Key Legal Essentials

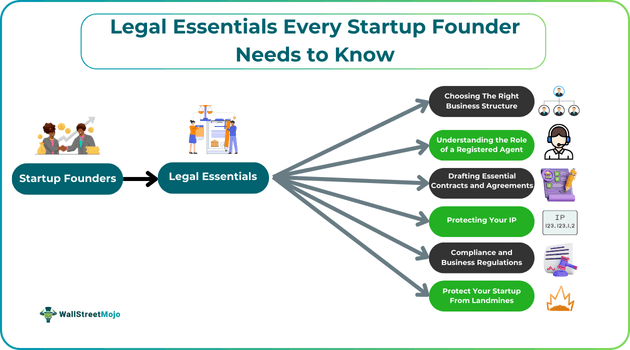

Every company has some key startup legal requirements, and founders must follow them without fail. Ignoring crucial legal aspects can lead to costly mistakes and even result in legal complications. Since the foundation lies on these legal essentials, meeting the associated requirements is vital to fulfilling the overall objectives of the business. In the following section, you get a clear idea regarding the legal essentials for startup founders before proceeding with the incorporation.

Choosing The Right Business Structure (LLC vs. Corporation)

Business can exist in any form. Be it a joint venture, partnership firm, Limited Liability Corporation (LLC), or even a traditional corporation. However, it is necessary to decide the structure and the hierarchy of executives and their authority. It is also important to consider the place or location of incorporation. Depending on the state, the rules and regulations will vary at the legal level.

Let us look at some aspects related to LLCs and corporations that individuals can consider to choose the business structure that is best suited to their requirements.

LLCs:

- It offers limited liability protection and tends to shield your assets from business debts as your identity stays distinct from that of the business entity.

- Founders have flexibility with respect to management and taxation.

- Also, it is simpler to set up and maintain compared to corporations.

Corporations:

- They also offer limited liability protection.

- Later on, corporations can raise capital more easily through the sale of stock.

- They own a more professional and formal structure with shareholders, directors, and officers.

- Generally, corporations are more complex with regard to taxes.

Note that the startup founders may also be required to file some essential documents and consider the Articles of Organization. However, the decision on the type of business structure should come before filing the Articles of Incorporation.

Understanding the Role of a Registered Agent

After deciding on the entity structure, it is important to have a point of contact or registered agent who will execute the same. A registered agent refers to a person or entity that receives and maintains legal documents and official notices on behalf of your business. They act as a point of contact between your company and the state. If you do not wish to rely on a third party, you can consider being your own registered agent to fulfill the legal requirements.

Let us look at some other key functions that such an agent performs:

- Ensures businesses receive important legal and tax notifications promptly

- Maintains compliance with state regulations

- Provides a consistent and reliable address for service of process

- They also maintain good standing with the state and avoid legal issues by monitoring the same.

Drafting Essential Contracts and Agreements

Creating contracts and agreements is another crucial component of legal basics for entrepreneurs. All key stakeholders (vendors, suppliers, customers, employees) associated with the business will have to enter into a contract. It helps in avoiding any legal complications and penalties in most cases. Some of the important documents are as follows:

- Operating Agreements (for LLCs)

- Partnership Agreements (state each partner's roles and responsibilities)

- Shareholder's or founder's agreement (regulates the relationship between the shareholders and the company)

- Employment Agreements (outline the terms of employment, which include compensation, benefits, rights and confidentiality)

- Service Agreements (outline the type and scope of services provided to clients)

- Non-Disclosure Agreements (NDAs) (protect your confidential information from being shared with unknown or unauthorized parties).

Protecting Your IP

Today, companies often work on a unique model, and securing that idea requires intellectual property (IP). The list of IPs includes trademarks, copyrights, patents, trade secrets, formulas, etc. Let us look at their purpose.

- Trademarks: Protect brand names, logos, and slogans

- Copyrights: Shield creative work, such as software, written content, and artwork

- Patents: Secure inventions and technological innovations

- Trade Secrets: Cushion your confidential business information to receive a competitive edge over others

Since IPs are a crucial asset to any company, including a startup, securing them is of utmost importance. Plus, protecting your IP can give you a competitive advantage and prevent others from copying your ideas. It eventually acts as a vital startup legal requirement to compete with the market in the long run.

Compliance and Business Regulations

With the wide framework of companies, there are certain business compliance tips to be followed. A strong compliance strategy can play a key role in building a sustainable and ethical business. However, any failure on the part of the company to comply with the regulations can result in fines or legal action. Thus, many businesses now prioritize these rules to avoid any financial losses or reputational damage in the future.

Ensuring legal compliance builds trust with customers and partners. Also, it ensures long-term business continuity and develops community-building ethics. Hence, staying up-to-date with relevant regulations (like labor laws and tax compliance requirements) is essential.

Protect Your Startup from Legal Landmines

Landmines are often discussed as explosive, but they have a similar meaning in the startup community as well. Many startups face unique legal challenges. At times, they can be quite stressful. By addressing these following legal essentials, you can minimize risks and construct a solid foundation for your business.

- Conduct regular legal audits

- Try maintaining accurate records in the system

- Seek professional advice to combat legal issues

- Stay informed about the changes in laws that may affect the business

Now that you are aware of the legal essentials for startup founders, make sure to use the tips shared above to build a strong foundation for your business. Remember, fulfilling the legal requirements is vital to building trust with clients and safeguarding the organization’s reputation. Hence, take the necessary measures for long-term success.