The differences between both the concepts from a business perspective are given as follows:

Table Of Contents

Leased Asset Definition

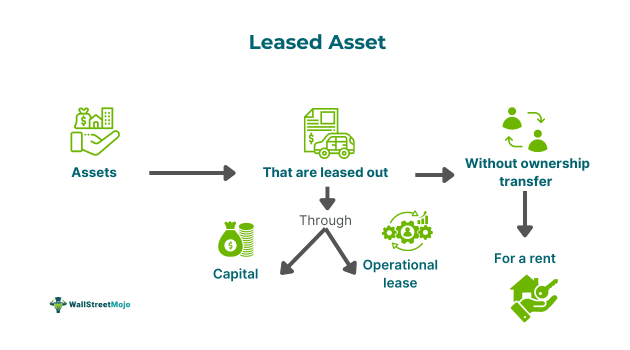

Leased assets are assets given for lease by their owner to another individual or entity. An agreement is entered between the owner and the other party to use the asset temporarily. The agreement may also contain the terms and conditions to be followed while using the asset.

Under such agreements, the legal ownership of the asset remains with the lessor or the owner. They are, however, denied daily access to the asset but have the authority to terminate the lease in case of breach by the other party. It provides the owner an opportunity to earn a fixed income.

Key Takeaways

- Leased assets are those assets that are temporarily leased to another party. The asset's ownership remains with the owner.

- Leases can be of two types: capital or finance and operating leases. Those leases that are not capital leases are operating leases. They have zero impact on the balance sheets.

- Depreciation under IFRS16 is spread across the lease term and includes the rental periods. It is calculated based on the useful life of the asset. The treatment would be similar to any assets purchased.

- From an accounting perspective, leased assets do not appear as long-term assets on the lessee's balance sheet but incur regular lease payments recorded as expenses.

Leased Asset Explained

A leased asset is an asset that its owner currently leases to another party. The asset could be equipment, property, a vehicle, or other tangible, non-consumable and identifiable assets. There are two types of leases: capital or finance lease and operating lease. The accounting treatment, however, depends on the nature of the agreement between the owner and the leasing party and also varies from one country to another. IFRS 16 (International Financial Reporting Standards 16) deals with lease accounting.

Under a capital lease, the lease term shall be greater than 75% of the asset's useful life. The lessee is given the option of acquiring the assets at the term's end at a lower than market price. In such cases, the ownership of the asset is transferred to the lessee after the lease period ends. The present value of the lease payments, as specified in the agreement, exceeds 90% of the asset's fair market value at the beginning of the lease.

Operating lease payments are considered expenses, and the lessee faces no obsolescence. The depreciation and interest expense lowers the lessee's taxable income. Furthermore, leasing provides an opportunity for organizations to free capital for investments through leasing rather than buying.

Moreover, these assets give the owners an opportunity to earn fixed or passive incomes. This is, hence, a method of diversifying their investment choices. They can customize such assets as per their needs. Similarly, the lessee may not always have bulk amounts to buy assets for a short tenure. In such cases, it becomes handy for them. They are able to rent them and yield profits without making a dent in their pockets.

Accounting Treatment

Accounting treatment for capital and operating lease differ.

#1 - Capital lease

Capital leases affect the lessee's financial statements, including interest expense, assets, depreciation expense, and liabilities. Under a finance lease, the initial accounting allows the lessee to capitalize the leased asset and recognize a lease liability for its value. Subsequently, the asset is depreciated, and the lease liability is reduced over time as payments are made.

#2 - Operating lease

Operating leases don’t affect the company’s balance sheet. This is because, under operating lease accounting, the rewards and risks of the asset's ownership are not transferred. Instead, the rent received under operating leases is charged to the profit or loss statement on a straight-line basis over the lease term. The differences between the charged amount and the actual amount paid will be in the accrual category or the prepayments.

How To Depreciate?

The following are some pointers with regard to the treatment of depreciation under the IFRS16.

- It requires the depreciation along with interest charges to be spread across the lease period. This shall include the rent-free periods without manual adjustments to the general recognition models.

- Depreciation shall occur in a normal manner under capital leasing. Periodic depreciation is based on factors such as recorded asset cost, useful life, and salvage value.

- On disposal of the asset, the fixed asset account is credited as it was originally recorded under it. The accumulated depreciation is debited to eliminate the balance. If there are differences between the sale price and the net carrying amount, they will be recorded as a loss or gain for the disposal period.

Examples

Let's look at some examples to understand the concept better.

Example #1 - Hypothetical Example

Imagine, Dan runs a small event management company and decides to expand his operations. He needs a more extensive setup for it, which means more decor items. Dan finds it expensive for his current budget and opts to lease out from small shop owners to manage costs. He uses leased asset accounting to understand the correct use of the asset and records it in the balance sheet due to its capital nature.

Leased asset management is challenging, especially when sourcing from small shop owners, as it requires balancing cost reduction and efficient expense management. Similarly, accounting for leased assets can be complex due to the need to record depreciation. If returns are made within a year, depreciation may not need to be accounted for. However, growing the business within that short timeframe would be difficult.

Example #2

Organizations often rent or lease assets to earn profit or prevent them from being idle. The U.S. government also often comes up with such sales or lease applications. They often lease out properties for lease. The offerings can be found on the U.S. General Services Administration website. By entering into such leases, the government can effectively manage its assets and give private firms important chances.

Leased Asset vs Fixed Asset

| Aspect | Leased Asset | Fixed Asset |

|---|---|---|

| 1. Concept | The business leases these assets. | Fixed assets are those tangible or intangible assets owned by the business. |

| 2. Ownership | Such assets are not owned by the businesses leasing them. The lessor owns them and is available for usage only for the period as agreed in the agreement. | The company owns fixed assets, which they can utilize as needed until they are disposed of. |

| 3. Accounting treatment | Fixed assets are treated as assets in the company's balance sheet. They are subjected to depreciation. | These assets require regular payments, which are recorded as expenses. |