Table Of Contents

What Is Lease Payment?

Lease payments refer to the payments where the lessee under the lease agreement has to pay monthly fixed rental for using the asset to the lessor being the owner of such asset, and the asset is generally taken back by the owner after the expiration of the lease term.

The term "Lease Payment" is analogous to the rental payment. It refers to the payment made, as per the contract agreed, between the lessor and lessee for granting the use of an asset. It may include real estate, equipment, or other fixed assets, for a specific period.

Lease Payment Explained

Lease payments refer to the regular payments that the lessee makes to the lessor, who is the owner of the asset in a lease contract, in return for the right to use the particular asset over a period of time. Leasing is a widely used method in which the owner of an asset enters into a contract with another party who wants to use the asset for a time period. This is commonly done in businesses as well as among individuals.

In the lease agreement the terms and conditions clearly specify the amount of payment to be made and the frequency at which they are to be paid. To calculate lease payment, the payments are designed in various ways, which depends on the type of lease and the terms of the contract that is negotiated among the parties.

Lease financing is appropriate for businesses that don't intend to fund their asset purchase through debt or term loan to reduce the burden of CAPEX. Further, lease payments work best for companies in industries susceptible to technology obsolescence. On the other hand, it is also beneficial for investors who want to invest their money efficiently without participating in the business and earn interest.

It can be applied for many types of assets like real estate, vehicles, equipments, etc. The contract defines the terms related to payment, duration, any extra fees or expense related to the agreement. It is extremely important for both the parties to be clesr with the terms of the contract to ensure a healthy leasing experience and avoid any kind of misunderstanding, dispute or legal problems.

Components

The lease payment calculation depends on three components: depreciation fee, finance fee, and sales tax. Now, let us have a look at each of the components of progressive lease payment separately:

#1 - Depreciation Fee

The depreciation fee is analogous to the principal payment of a loan. It is what the lessee pays the lessor for the loss in value of the asset, which is spread throughout the lease or the time for which the lessee will use the asset. The depreciation fee is expressed as an equal periodic payment, which is derived by dividing the total depreciation by the term of the lease as shown below,

Depreciation Fee = (Net Capitalized Cost – Residual value) / Term of Lease

- Net Capitalized Cost is the addition of the selling price, any additional dealer fees, taxes that are not paid up-front, and outstanding loan balances (if any) minus any down payment and rebates.

- Residual value is the resale value of the asset at the end of the lease.

- The lease term is the lease contract's length (usually in months).

#2 - Finance Fee

The finance fee is analogous to the interest payment on loans, which is what the lessee pays the lessor for using their money. It is to be kept in mind that the finance charges are paid on the total depreciation and residual value. The finance fee is mathematically represented as below,

Finance Fee = (Net Capitalized Cost + Residual value) * Money Factor

The money factor can be calculated based on the interest rate mentioned in the lease agreement, which is mathematically expressed as shown below,

Money Factor = Interest rate (%) / 24

#3 - Sales Tax

It is the state or local tax charged on the sale price. It is usually paid at the time of signing the lease contract as part of the “due at lease signing” amount. It is mathematically expressed as below,

Sales Tax = (Depreciation fee + Finance fee) * Sales tax rate

Lease vs Rent - Explained in Video

Formula

The formula to estimate lease payment is derived by adding the depreciation fee, finance fee, and sales tax which is mathematically represented as,

Lease Payment = Depreciation Fee + Finance Fee + Sales Tax

Examples

Let’s see some simple examples of the lease payment to understand it better.

Let us take the example of John, who is planning to buy a car on lease. The lease will be for 36 months and charged an annual interest rate of 6%. John managed to negotiate the selling price to be $26,000 with a down payment of $4,000 and an outstanding loan balance of $5,000. The car is expected to have a residual value of $16,500 at the end of 36 months. The applicable sales tax rate is 5%. Determine the monthly lease payment for John.

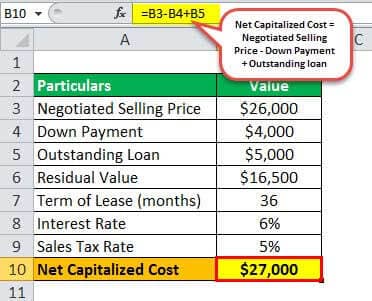

Net Capitalized Cost

The net capitalized cost can be calculated using the below formula,

Net Capitalized Cost = Negotiated Selling Price – Down Payment + Outstanding loan

= $26,000 - $4,000 + $5,000

Net Capitalized Cost = $27,000

Depreciation Fee

Depreciation fee = (Net capitalized cost – Residual value) / Term of lease

= ($27,000 - $16,500) / 36

Depreciation Fee = $291.67

Money Factor

Money Factor = Interest rate / 24

= 6% / 24

Money Factor = 0.0025

Financing Fee

Financing fee = (Net Capitalized Cost + Residual value) * Money factor

= ($27,000 + $16,500) * 0.0025

Financing Fee = $108.75

Sales Tax

Sales tax = (Depreciation fee + Finance fee) * Sales tax rate

= ($291.67 + $108.75) * 5%

Sales Tax = $20.02

Monthly Lease Payment

Therefore, the Calculation of the monthly lease payment can be done using the below formula,

Monthly lease payment Calculation = Depreciation fee + Finance fee + Sales tax

= $291.67 + $108.75 + $20.02

Monthly Lease Payment = $420.44

Therefore, John has to pay a monthly lease payment of $420.44.

Thus, the above examples clearly explains us how to calculate lease payment along with suitable cases where they are applied.

Advantages

Now, let us have a look at some of the advantages of progressive lease payment:

- The cash outflow or the lease payments are spread across the term of the lease agreement, which eliminates the burden of one-time substantial cash pay-out. It immensely helps the liquidity position of a business and eases the pressure on the cash flow profile.

- By choosing to estimate lease payment over-investment in an asset, a company releases the capital, which can be used to fund other business needs.

- In an operating lease, the lease is treated differently from debt as it is classified as an off-balance sheet liability and, as such, doesn’t appear on the balance sheet. However, the financial lease doesn’t offer this advantage.

- Leasing can be a viable option for businesses operating in industries vulnerable to the risk of technology obsolescence. By leasing, a company safeguards itself from the risk of investing in a technology that is likely to become obsolete.

Disadvantages

Now, let us have a look at some of the disadvantages of Lease Payment:

- In the case of a lease agreement for assets like land, the business is deprived of any appreciation benefit in the asset’s value.

- The lease expenses shrink a company's net income without any appreciation in value, which eventually results in limited returns for the equity shareholders.

- In the case of an operating progressive lease payment, the lease is not captured as part of a company's balance sheet. However, most investors deem it to be a long-term debt and, as such, adjust the valuation of the business accordingly.

- In the case of an operating lease, the lessee doesn’t have the option of owning the asset at the end of the leasing period. However, in the case of a financial lease, the lessee is given the option to purchase the asset subject to payment of the residual value.

Lease Payment Vs Loan Payment

Both the two types of payment mentioned above are related to methods of financing asset purchase. However, they vary a lot in procedure. Let us identify the differences.

- In case of the former, the asset ownership rests with the lessor, unless there is a purchase option, but in case of the latter, after making the entire payment of loan the borrower becomes the owner of the asset.

- At the end of the average lease payment term, the lessee return the asset to the lessor unless there is an option to buy the asset. But for the loan payment , the borrower does not return the asset to the lender after the loan is repaid.

- During loan payment, the borrower automatically becomes the owner of the asset. So there is no need of any purchase option in the contract. But for the average lease payment, purchase can be done only if the contract provides a purchase option.

- The former is usually treated as financing or operating expense which again depends on the kind of lease contract and the accounting standards. But the latter has payment of principle and interest component, and the interest is tax deductible.

It is important to be able to differentiate between these financial concepts before taking any related decisions and also consider the factors like cash flows, legal implications, tax benefits, nature of assets and requirement of asset ownership.