Table Of Contents

What is LBO Financing?

LBO Financing essentially means that in a leveraged buyout transaction, a private equity firm acquires another company or a part of it by investing its little equity and the balance consideration, which is the major part of using the debt or leverage.

In an LBO transaction, a private equity firm acquires a company or part by investing a small amount of equity and majorly using leverage or debt to fund the remainder of the consideration. To finance an LBO, a private equity firm primarily uses borrowed money to meet the cost of acquisition. The Private Equity firm uses debt to lift its returns. Using more leverage means that the PE firm will earn a higher return on its investment.

LBO Financing is a tough job. Even if, on the surface, it looks easy, private equity funds need to go the extra mile to finance an LBO transaction. This article will look at the various options the private equity firms have for such LBO financing.

Table of contents

- What is LBO Financing?

- LBO financing is used to acquire a company by using a significant amount of debt to fund the acquisition. In addition, it is an essential part of debt or leverage utilization.

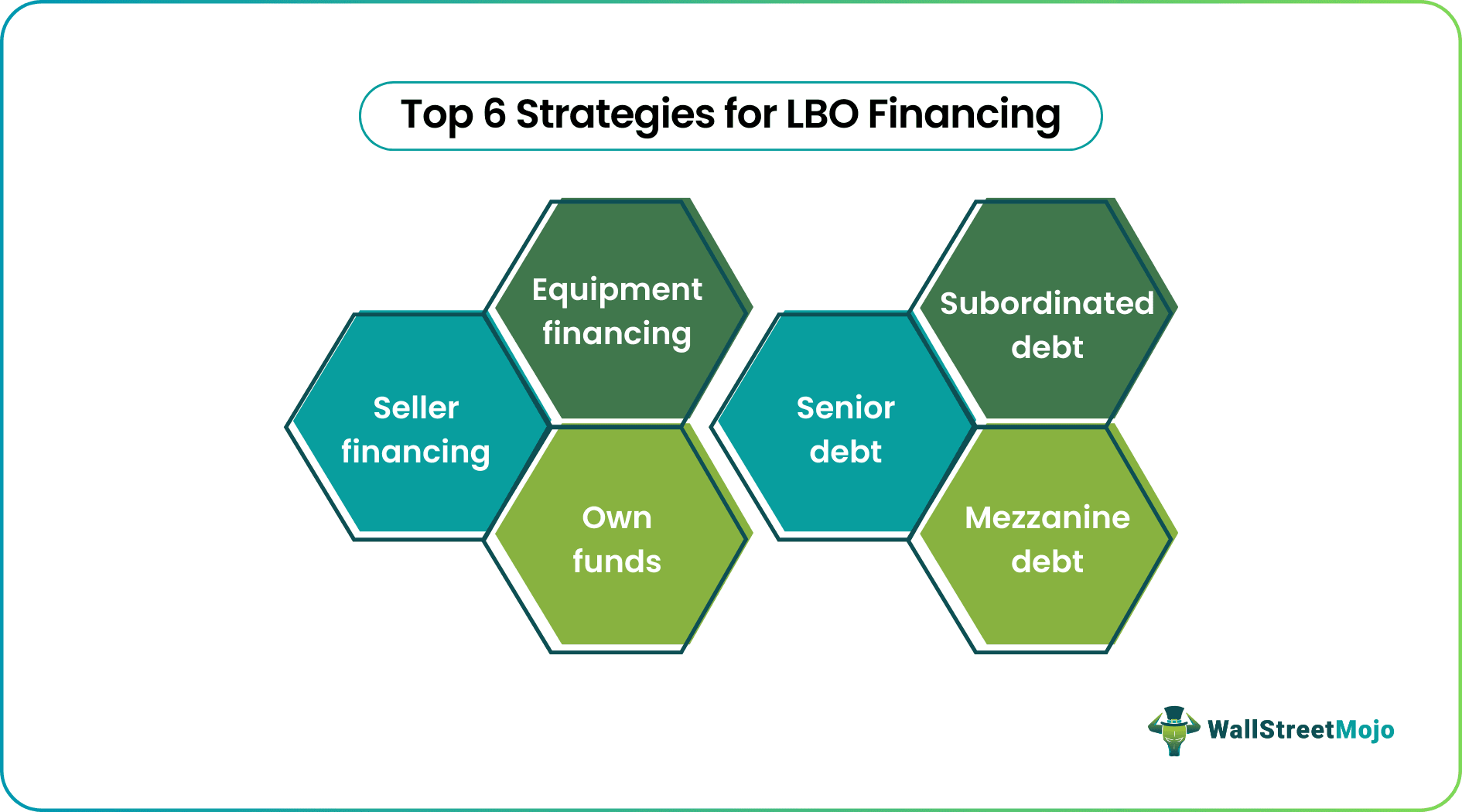

- Seller financing, equipment financing, own funds, senior debt, subordinated debt, and Mezzanine debt are the top six strategies for LBO financing.

- A private equity firm uses borrowed money for LBO financing to fulfill the acquisition cost.

Top 6 Strategies for LBO Financing

When private equity invests in an LBO, it needs to put in a lot of borrowed money. Let’s look at how a private equity firm finances an LBO.

LBO Financing in Video

#1 - Seller Financing

This LBO Financing strategy is often seen when the seller is pretty much interested in making the sale. That’s why the seller can be convinced to extend a loan, which can amortize over the years. Seller financing is also very helpful for the buyer because the buyer gets the comfort of paying off the debt when enough money flows into the business.

#2 - Equipment financing:

It is another form of LBO financing used by the buyer. If the company owns any free equipment and there is no way this equipment will be used in the future, then part of the purchase price can be used. Moreover, if the equipment has equity, that can be financed too.

#3 - Own funds:

In this kind of LBO Financing, the private equity invests 30% to 50% of the money in equity, meaning its own money. And the rest of the money is borrowed, meaning a form of debt. The percentage differs based on a deal and the market conditions at a given time. However, almost every LBO falls in the range between 30% and 50%. Private equity borrowed debts from separate lenders, usually 50% to 70%.

#4 - Senior debt:

If you take Senior debt as a private equity firm, you need to rank it first; before anything (all debt and equity), you need to repay it. The terms and conditions of this debt are also very strict. To take the debt, you need to show forth specific financial ratios and adhere to the standard the lender mentions. And this debt is also secured against the specific assets of the company. If the company cannot pay off the debt, the lender will acquire these assets. As this debt is very much secured, the interest rate for this debt is the lowest. As a private equity firm, you can take this sort of debt for four to nine years and pay off the debt at the end by a single payment.

#5 - Subordinated debt:

This LBO Financing using subordinated debt stands exactly below the senior debt. You can take this debt for a period of seven to ten years. And you need to repay the whole amount in one go at the end of the period. This debt comes next to senior debt because, in terms of liquidation, this debt gets preference after senior debt. The only pitfall of this debt is that subordinated debt has a high-interest rate. As this debt is not as secure as the senior debt, the risk is usually higher for the lender; they charge a higher lending cost than the senior debt.

#6 - Mezzanine Debt:

This LBO financing through debt has the most risk for lenders, and that’s why it costs a lot more than other types of debts. This debt stands after senior debt and unsecured debt. And the repayment method is a bit different than other debts. Here’s how it works. If you take a debt of 100 shares in the form of mezzanine debt and you need to pay 10% of interest every year, you will receive 5% in cash and 5% in kind. The latter part of interest is called PIK (paid in kind). In the first year, you will pay 5% in cash, and the rest 5% will accrue in the next year, along with 10% of the next year's principal amount. And this method will go on until the whole debt is being repaid. Mezzanine debt is usually given for ten years or less. So you, as a private equity firm, need to pay off the debt within ten years. Mezzanine debt also includes warranties or options so that the lenders can participate in equity returns or sorts.

How to Finance an LBO with thin assets?

What to do when the company’s assets have been too thin? We will take an example to illustrate this.

- Let’s say that Company MNC has a pre-tax income of $1.25 million, and the offer they get is $5 million. So they go to the lenders and try to arrange some debt against their assets. The only problem is that they don’t have enough assets to use as collateral. Company MNC has around $2 million worth of assets, including the equipment, but still, there is a huge gap of $3 million.

- In this situation, the only option is to finance the LBO through cash flows. For that, cash flows have to be huge. It should cover the senior debt, the subordinated debt, and the entrepreneur's salary. If the cash flow is not that big, there’s no point for which you should go for the buyout.

- There’s another option available if the asset value is higher than the cash flows and the price. You can sell off the company's assets (also called equipment finance), and then with the rest, you can run the company.

Conclusion

- LBO financing is a great business by itself. If you can buy a great business, you would be able to make huge profits by putting in some of your own money and borrowing the rest of the money as debts.

- The only crucial thing you need to take care of is due diligence. It would be best if you made sure that before you ever decide to purchase the company, you know everything about the company – the operations, the products/services, how the company is run, the senior management and how they make decisions, the cash flows coming in, pre-tax income every year, the capital structure, and the strategy of the business for future expansion.

- If you can do a thorough analysis and find it satisfactory, you should only go for an LBO. Otherwise, it’s better to invest your money in other investment opportunities.

Frequently Asked Questions (FAQs)

The three fundamental risks connected with LBOs are interest rate risk based on the financing structure type, operational risks, and the probability of an industry shock. It can also limit the company's ability to invest in growth opportunities and market strategic acquisitions.

The term of this financing typically ranges from five to ten years, although the exact time can vary depending on the transaction and the specific financing structure.

The first LBO financing with high-yield bonds was initiated in the early 1980s. It was invented by Michael Milken, commonly called 'junk bonds.' Moreover, it is also an essential financing source.

Recommended Articles

This has been a guide to what LBO Financing is. Here we discuss the top 6 strategies private equity firms use to finance an LBO. We also look at the other options when the assets are thin. You can learn more about Investment Banking & Private equity from the following article –