Table Of Contents

What Is A Large Cap Stock?

Large-cap stocks refer to stocks of large companies who are having value also known as the market capitalization of $10 billion dollars or more and these stocks are less risky as compared to others and are stable and they also pay a dividend and best return and it is safest option to invest.

These companies are the dominant players in the market and are normally very stable. Their stocks are less prone to frequent fluctuations and so they are suitable for long term investments. Investors can rely on them for continuous returns and dividends. They are listed in major stock exchanges in the world.

Table of contents

- What Is A Large Cap Stock?

- Large-cap stocks are shares of companies with a market capitalization of $10 billion or more. These stocks are known for their lower risk and greater stability compared to smaller-cap stocks.

- Investors tend to favor large-cap stocks, especially during challenging economic times, as they can withstand slowdowns better. While not recession-proof, they offer a safer investment option and are better equipped to handle tough economic situations.

- Large-cap stocks are particularly appealing to conservative investors due to their reliable source of income through dividends.

- While this opportunity offers the potential for substantial rewards, it comes with a high level of risk.

Large Cap Stock Explained

A large cap stock refer to the stocks of those companies that have a very large market capitalization or market cap.The market cap of these organizations is more than $10 billion. They are listed in all the world's big and recognized stock exchanges. They are also the stocks that are heavily traded in the market.

Market Capitalization helps in explaining the value of the company in quantitative terms. It is the wallet share the firm is having in the industry and is calculated by multiplying the number of a company’s shares outstanding by its stock price per share. Stocks are generally classified as:

- Large Cap (Greater than $10 bn)

- Mid Cap stock (between $2bn to $10 bn)

- Small-Cap (between $300mn - $2 bn)

The large cap stock list is also referred to as the bluechip stocks and normally these business houses are top leaders in their own sector. The market participants very widely recognize these dominant players because of their stability in the operational process and consistency in growth and expansion. Such companies are very proficient in recognizing long term growth opportunities and developing and advancing themselves technologically.

The level of productivity and financial strength of the best large cap stock is the main reasons why they are considered less risky, less affected by market fluctuations and dependable in terms of consistent dividend and return. These bluchip stocks are most sought after by investors who prefer less risk and want to maintain a balance to their portfolio.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Criteria

Let us look at some essential criteria for choosing such a stock.

- Rich history – They are long term market players who have been in the sector for many years. They have a rich operating history and have gained the trust of market participants.

- Low risk – They are financially strong and sound. Thus, market volatility does not affect them significantly and they have extremely less risk of dissolution or bankruptcy in case the market faces a downturn.

- Expensive – The best large cap stock is usually expensive because good track record, high performance and long term market participation.

- Liquidity – They can be easily bought and sold due to popularity among investors. It is easy to get buyers and sellers for them.

- Information availability – The company information is ready=ily available for them because they have the obligation to provide financial and other relevant information to the investors. Investors can evaluate and assess such data for the purpose of analysis and informed investment decisions.

Thus the above are some important criteria for identifying large cap stocks apart from their market capitalization.

Examples

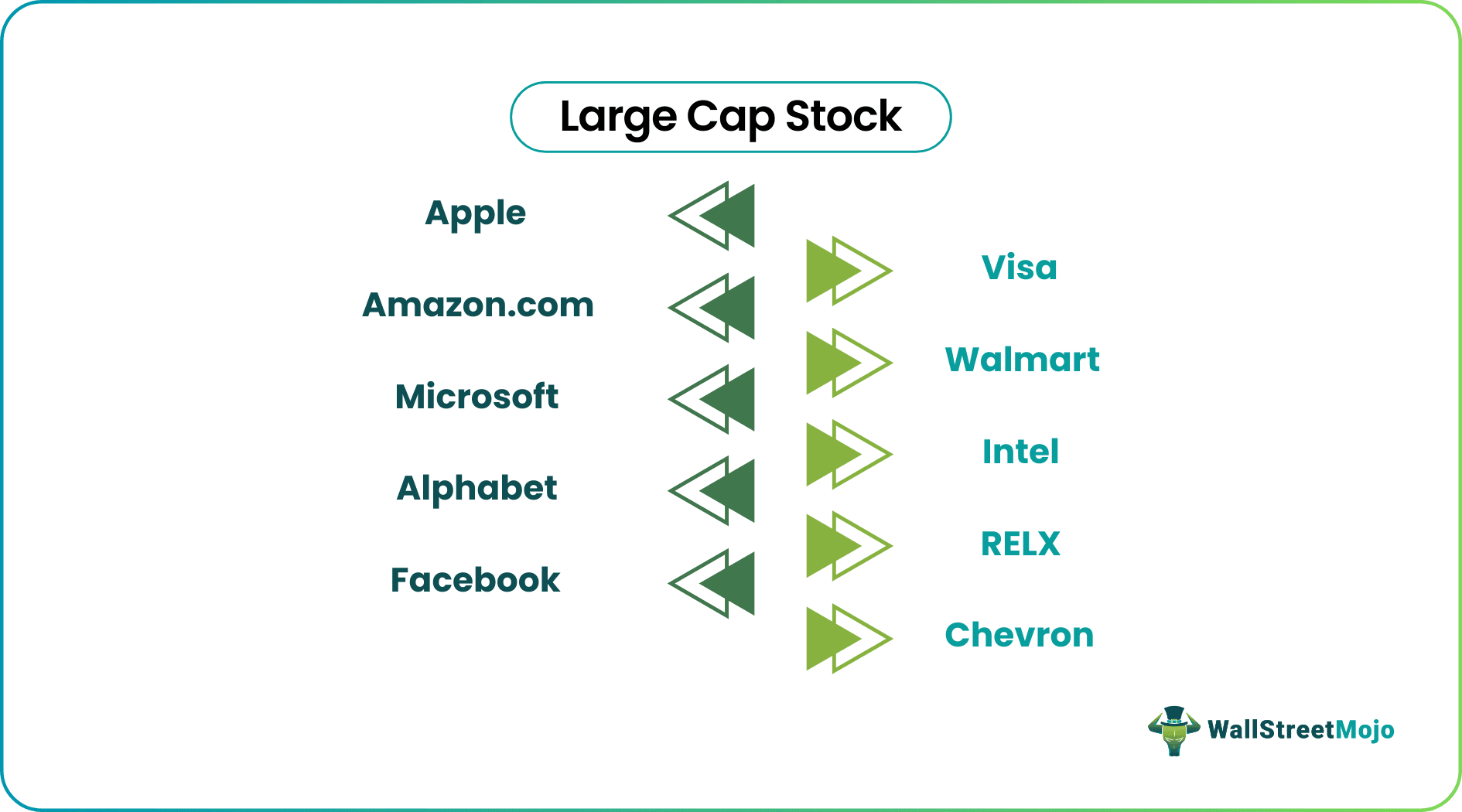

Given below are some examples of such large cap stock list along with their market capitalization.

| S. No | Name | Large Cap ($ bn) |

|---|---|---|

| 1 | Apple | 903.5 |

| 2 | Amazon.com | 767.1 |

| 3 | Microsoft | 731.1 |

| 4 | Alphabet | 730.0 |

| 5 | 511.2 | |

| 6 | Alibaba Group Holding | 484.7 |

| 7 | Berkshire Hathaway | 482.7 |

| 8 | JPMorgan Chase | 369.2 |

| 9 | Johnson & Johnson | 333.1 |

| 10 | Exxon Mobil | 325.7 |

| 11 | Royal Dutch Shell | 302.7 |

| 12 | Bank of America | 297.1 |

| 13 | Visa | 295.7 |

| 14 | Royal Dutch Shell | 291.3 |

| 15 | Walmart | 258.4 |

| 16 | Wells Fargo | 255.4 |

| 17 | TiGenix | 250.9 |

| 18 | Intel | 246.0 |

| 19 | RELX | 243.0 |

| 20 | Chevron | 239.9 |

Benefits

Some of the important reasons to invest in Large Cap companies are:

- Large Cap companies are generally very stable, making them a safer investment opportunity compared to others. They are the top businesses in their respective industries and can be considered as Market leaders. However, their stock prices may not grow as fast as other smaller companies making them less suitable for all kinds of investors. It is due to limited opportunities to grow after occupying a successful position in the industry.

- The large cap value stock is generally preferred in case of business cycles going through turbulent times. It is because they are a safer investment and can comparatively withstand a slow down without the threat running out of business. It does not mean they are immune to recessions but have a better ability to handle difficult economic scenarios.

- Generally, these large-cap stocks pay a dividend regularly as the companies know the stock probably will not appreciate as swiftly as a Growth Company. It offers another source of income for conservative investors. It benefits investors when bond yields are low. These companies may be profitable but need opportunities to grow. Accordingly, investors must be compensated for the stagnant stock price and have earnings in the form of a dividend.

- These large-cap stocks are more liquid, making them easier to exit at any point in time. These firms are used as Core long-term investments in a portfolio due to the above factors. Thus, they can occupy a significant section in the allocation of a client’s investment depending on their financial objectives and risk appetite.

Rally Of Large-Cap Stocks

The Large Cap stocks of the US have been outperforming since 2013 and are expected to continue in the short-run. The reasons for it are:

#1 - Large Cap Stocks are more Internationally oriented and gain from USD weakness

The S&P 500 has been outperforming the Russell 2000 along with the weakening dollar in 2017. It is due to the USD depreciation offering large MNC’s a boost through:

- Foreign Sales and Exports

- Demand Creation

- Effects of Positive Accounting translation

- Increased Competitiveness

Sub-par domestic economic outcomes and improving foreign prospects suggest US investors should stay focused on the S&P 500. Geographic revenue analysis states that the Large Cap companies of the US have foreign exposures as 30% of the S&P 500 revenues come from outside the US.

#2 - Earnings from Large Caps Companies Benefit from Lower Effective Corporate Tax rates

Incentives and credits can create a difference in how much a company pays in taxes by effectively lowering a firm’s taxable income. To be eligible for these tax breaks requires spending a significant amount of money, which may not be suitable for smaller companies and start-ups. The large cap value stock can reduce their financial resources in several ways since a lot of money is spent, which may not necessarily be justified.

The US Internal Revenue Service doesn’t tax income earned in foreign countries, and many of them have lower Corporate tax rates than the US. It makes them outsource many of their functions to foreign countries, which in turn proves to be a cheaper option.

#3 - Tighter US Monetary Policy and a Flatter Yield Curve Spurs Large Cap Leadership

The US Treasury yield curve is one of the leading economic indicators. A direct relationship existed between the yield curve and the performance of the Russell 2000 relative to the S&P 500. A steepening curve today indicates positivity for higher-beta segments of the equity market. Conversely, a flattening curve now points to more challenging economic conditions down the road and bad news for economy-sensitive segments of the stock market.

When the FED commences normalizing the monetary policy, raising of interest rates, flattening the curve, and not encouraging to take risks, the mature and the established firms in the US equity tend to benefit, which reflects the current scenario in the US.

Large Cap Stock Vs Small Cap Stock

Both the above terms refer to companies with two different market capitalization. However, there some important differences between them as follows:

- The most critical difference is the market cap. The former has a market cap of more than $10 billion where the latter has a market cap of less than $2 billion.

- The companies in the large cap stock index are well established, usually global company operating in the market for a long time, whereas the latter is a small newly established company operating the the market for few years and usually within the domestic space.

- The former has a great track record with stable returns and dividend payout anuually, whereas the latter’s track record and returns may not be very consistent.

- The volatility of companies in the large cap stock index is significantly lesser than the small-cap stocks. Since they earn good revenue and have a strong balance sheet, they are less prone to market fluctuations and have already grabbed a good part of the market share, unlike small-cap companies.

- The growth potential of the former is very high because they can identify growth opportunity and is usually the ones to adopt technological changes earlier than small cap companies. Thus, their stocks experience is faster and steady rise in prices.

- Investors prefer the former to the latter because of their stable return and less risk. Large cap stocks provide good long term investment opportunity.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Large-cap stocks are essential in the financial markets due to their significant market capitalization and the overall stability they bring to investors' portfolios. As established, well-known companies, they often offer reliable earnings and dividends. Additionally, large-cap stocks can serve as a benchmark for the overall market performance, providing valuable insights into the broader economic conditions.

Large-cap stocks are generally considered safer than small-cap or mid-cap stocks due to their established track record, widespread recognition, and financial stability. However, it is essential to remember that all investments carry some degree of risk, and market conditions can impact even large-cap stocks. While they are relatively safer, investors should still conduct thorough research and diversify their portfolios to manage risk effectively.

The main difference between large-cap and small-cap stocks lies in their market capitalization. Large-cap stocks refer to companies with a significant market capitalization, usually exceeding $10 billion. On the other hand, small-cap stocks are companies with lower market capitalization, generally ranging from a few hundred million dollars to a few billion dollars. Small-cap stocks tend to have higher growth potential but are also riskier due to their smaller size and volatility.

Recommended Articles

This article has been a guide to what is a Large Cap Stock. We explain its differences with small cap stocks along with examples & criteria for selecting them. You may also have a look at these articles below to learn more about Corporate Finance -