Table Of Contents

What Is The Kiddie Tax?

Kiddie Tax is a tax law prevalent in the United States of America, and it imposes a tax on unearned passive income such as interest, dividends, rentals, capital gains, etc., of a child less than nineteen years old (or less than twenty-four years and a full-time student).

If the investments held and unearned income of the child exceeds the prescribed annual limit, then tax is levied in the hands of the child irrespective of whether the child is dependent or not. Kiddie's tax return shall be filed after adequately considering the applicable tax rate based on the kind of income and considering the standard deduction available per tax laws. Also, one shall consider whether the income can be considered in the parent's return if it specifies the conditions mentioned in the article.

Kiddie Tax Explained

The kiddie tax is a special law related to the taxation of any investment or unearned income of an individual who is less than 19 years old. In this law of kiddie tax rate, the parents of such individuals cannot avoid the taxation procedure by transferring the assets to the child’s name and taking advantage of the taxation system.

In case of such investment or income, the amount is taxed according to the marginal income tax rate of the parents. This is applicable if the child is either below 18 years or within 19 to 24 years of age and is a depending student. But is the individual falls under the above age groups but are married, then this tax law does not apply.

Before kiddie tax was introduced, parents would invest in their child's name or gift the investments and other assets to the children, and the resultant income will be taxed at the lower rate applicable to a child's income. Thus, by introducing this tax, the revenue department could end the loophole that the parents were misusing.

The income can be in many forms like dividends, interest on investment, any rent received, a royalty earned, or falls under the category of capital gains. This tax rule of kiddie tax rate was, however, temporarily changed in the year 2017 by the Tax Cuts And Jobs Act, where it was decided that such incomes would be charged as per the rates that are applicable to estates and trusts instead of the rates applicable to the income of parents of the child. But for some families, this system became very expensive and gave rise to a lot of protests. So, finally the Congress reverted back to the old Kiddie Tax rules.

How To Calculate?

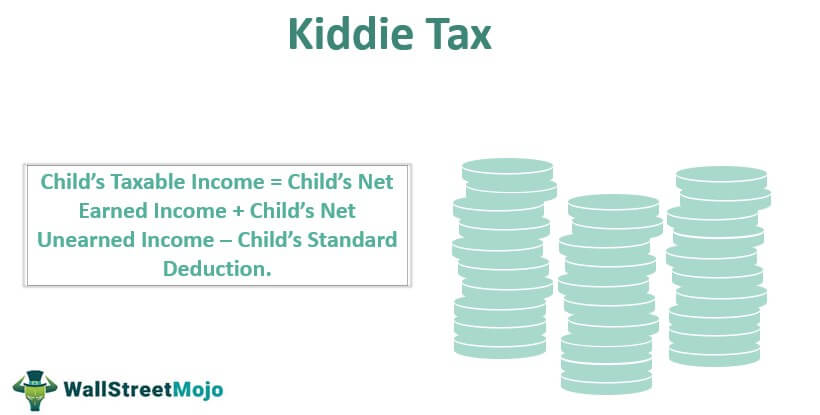

To calculate kiddie tax, one needs to calculate the child's taxable income in the first instance.

Child's Taxable Income = Child's Net Earned Income + Child's Net Unearned Income – Child's Standard Deduction.

As per the above equation, in order to arrive at the taxable income of the child, both the earned and the unearned income needs to be considered in a kiddie tax law. After adding both, we can take away the standard deduction amount from the income to arrive at the taxable income amount.

Here, when we calculate kiddie tax, it is necessary to know the fact that any unearned income in the form of interest on 529 Plans will not be subject to this Kiddie Tax. A 529 Plan is a kind of investment account that has some tax benefits when they are used to pay for educational expenses like college or K-12 tuition, a loan repayment for students, or an apprenticeship program. Such an account is used to save for higher studies.

Requirements

Reporting and levy of kiddie tax are affected as follows:

- No tax is charged on the child’s unearned income, if it remains within $1,250, as per the kiddie tax law. If the amount is more than this, then for the next $1,250, the tax rate of the child will be applicable. Now, above $2,500 of earnings, the tax will be charged as per the rate of their parents’ marginal rate.

- As per 2023, for a child, the standard deduction is either $400 plus the unearned income of the child or $1,250, whichever is greater.

Form 8615 shall be filed for kiddie tax. The same shall be filed in the name of the child if the following conditions are met:

- The unearned income of a child exceeds $2,200.

- Any of the following conditions are met concerning age:

- The person's age does not exceed 18 years at the end of the tax year.

- The person's age equals 18 years at the end of a tax year, and the person's earned income does not exceed half of his support's income.

- The person's age is at least 19 but less than 24 years at the end of the tax year, who is a full-time student, and the earned income of the person does not exceed half of his support's income.

- At least one of the parents was alive at the end of the tax year.

- The tax return is not to be filed for the tax year.

- A joint return is not being filed for the tax year.

However, it is to be noted that in case the unearned income is more than $13,850, then tax returns should be filed separately for children. If the income falls within the amount range of $1,250 to $13,850, then the amount will be included in the income tax return filed by the parents. In case there is kiddie tax capital gains, which means there is a profit or an increase in the overall amount that is invested, then it is considered as a capital gain. They can be for both short term or for long term. Thus, if the individual has such gains then they are subject to kiddie tax capital gains, which should be filed with the tax return of the parents or their own tax return.

Thus, it can be conclude that this taxation system has been able to restrict the unfair usage of tax law in the federal system, where the parents would save tax by transferring investments in huge amount to their child’s name. This would result in a huge loss in revenue for the government, which has now been rectified successfully by the implementation of this tax.

Example

A person name Jacob, aged 17 years, earned and unearned income of $15,000 during a tax year. We assume that the earned income is $9,000 and unearned part is $6,000

Solution:

Calculation of the Child's taxable income will be as follows:

Child's Taxable Income = Child's Net Unearned Income – Child's Standard Deduction

Therefore, since, in case of a child, the standard deduction is the greater of earned income plus $400 or $1,250, and can go upto the limit of $13,850, as per 2023 rules, in this example, Jacob will get a deduction on $9,400. However, his unearned income is $6,000. So any amount above $ 2,500 as unearned income will be taxed as per the rate applicable to the income tax for parents.

Now, we need to calculate the taxable income of Jacob. So, as per the above example, his total income was $15,000. If we take away the standard deduction and the amount that is taxed as per the parents’ rate, then the calculation will be:

Total income (earned + unearned) = $15,000

(-)Standard deduction = $9,400

(-)Income taxed as per the parents’ rate = $2,500

The remaining amount = $3,100. This amount will be subject to Jacob’s tax rate, which is typically lower than the tax rate of parents.