Table Of Contents

What Is Key Man Clause?

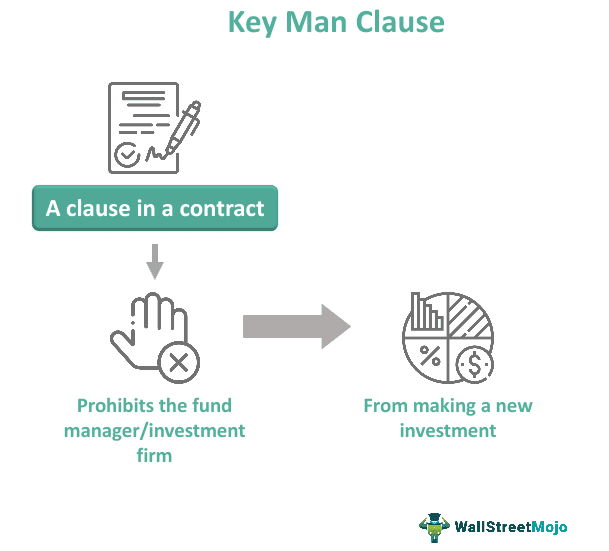

Key Man Clause is a clause used in a contract which is used for one or more "key man" (main person of the contract, usually fund manager or key partner) to do or not to do a specified action and may result in termination of the contract is breached.

It is mostly seen in limited partnership companies, venture capital organizations and mutual fund companies. They usually handle a large volume of financial transaction. Such a clause in their agreement with the investors ensure investor’s faith and save them from risk because no investment is done without the keyman in place.

Key Takeaways

- Key Man Clause refers to a clause utilized in a contract for one or more "key man," i.e., the contract's main person, usually the fund manager, who performs or does not perform a particular action.

- It is an essential clause for an investment firm that restricts them from making investments if the key executives are unavailable or cannot give time to the assets.

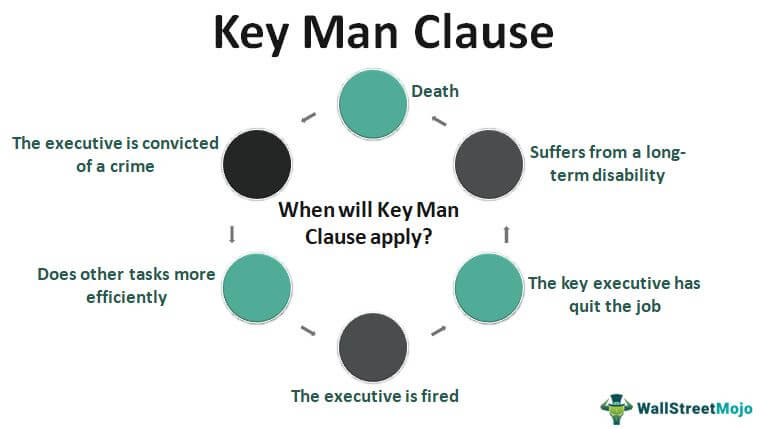

- This clause is applicable during death, when one suffers from long-term disability, when the critical executive leaves the job or is fired, when they perform the task more efficiently, and when the Keyman is criminal.

Key Man Clause Explained

It is an important clause for an investment firm that prohibits them from making investments when the key executives are not available for failing to devote time to the investments. It says if certain numbers of executives are absent, the investment firm won’t make any new investments until these key executives are replaced first.

Since managing investments is a huge task, the key executives (in charge) invest a lot of time. So when they’re unable to do that, according to the key man clause template, they should be replaced, and there can be many reasons why the executives aren’t able to perform their tasks quite well.

Now, let’s look at the possible causes for which the key executives cannot provide enough time to manage investments.

When To Apply?

Among these causes, some are unavoidable causes, and some are avoidable causes.

- Death: If the key person dies, nothing can be done about it. In that case, this clause will apply.

- Suffers from a long-term disability: This is also one of the unavoidable causes. What would the key executive do if she suffered from a disability or disease?

- The key executive has quit the job: If the executive has got a new job with better prospects, an investment firm can do nothing about it.

- The executive is fired: If the key executive is fired for any reason, this clause will apply.

- Do other tasks more efficiently: If the critical executive does another job more efficiently than managing the investments, it’s high time she is removed and replaced by someone more responsible.

- The executive is convicted of a crime: This is a serious threat to an organization. What if the clients know that the investment manager is a criminal? What would the investment firm do? The Keyman clause will apply here as well.

Example

Let us understand key man clause example given below:

Let us assume the scenario of ABC Capitals, who have three founder members and are a venture capitalists, providing funds for startups. They have a huge client base and deal in high volume of funds. With every contract they make with any client, they mandatorily provide a keyman clause that ensures that the firm will continue its investments only in the presence of at lease two out of the three members. As per this key man clause example, business will halt till the two members are replaced.

Importance

- A huge amount of money is at stake: To an investment firm, it’s a huge responsibility to manage investments. And they do not only manage the investments of one or two clients. The number is huge, often more than a million or a billion dollars. In that case, if the executives managing the investments aren’t sincere (or have unavoidable issues), then the investment firm must replace them.

- The reputation of the investment firm: If the investment firm decides not to replace them, then the efficiency of the investment firm will be questioned. And this is by no means a good thing for that particular investment firm’s prospects.

- Investments firm need to produce key man clause: Now, many start-ups, foundations, and investors are asking for a key man clause as their guarantee before employing an investment firm. These start-ups, foundations, and investors want to ensure that the investment firm takes the utmost care of their investments and doesn’t allow any executive to handle the investment until the person is the most qualified and eligible. Nowadays, this clause has become a mandatory clause that every investment firm must think about.

How To Implement?

If an individual is running an investment firm (or an investor and wants to understand how this works), here’re three things they should keep in mind regarding a key man clause template –

#1 - Add the “key man clause” to everyone under a contract with the firm.

First, they need to look at the contract of those making critical decisions for clients’ investments. And then they need to add the key man clause in their contract. Later, it would be best to create a mandate that everyone who joins the investment firm should have this clause inserted into their contracts.

#2 - Keyman insurance

If it a small firm and they really can’t take the risk of replacing limited resources, then buying key man insurance is the right thing to do. If it a big firm and have ample resources and budget to replace the key decision-makers, don’t need to buy key man insurance.

#3 - Think about the worst-case scenario

Adding the key man clause to the contract of the key decision-makers and buying key man insurance is a great starting point. But it would be best if they also prepared for worst-case scenarios. If it is not possible to write down an emergency plan and adhere to it, they will be prepared for any worst-case.