Table Of Contents

What Is Kelly Criterion?

The Kelly criterion or Kelly strategy is a formula used to determine position sizing to maximize profits while minimizing losses. The method is based on a mathematical formula designed to enhance expected returns while reducing the risk involved. It helps calculate the optimal amount one should place on a bet or an investment.

Also known as Kelly bet, the strategy has practical applications in investing and gambling. The idea got birthed by J.L Kelly, a researcher in Bell labs. One of the most successful and famous investors of all time, Warren Buffet, applied the Kelly criterion method for value investing.

Table of contents

- What Is Kelly Criterion?

- The Kelly criterion or Kelly strategy is a mathematical equation used to determine position sizing for investors and gamblers.

- It is designed to enhance an individual’s efficiency by increasing the bet when the odds are in their favor and decreasing it when the odds are against them to protect them from potential risk.

- The number generated from the formula will be in decimal form. When converted to a percentage, it represents the amount one should bet on a trade.

Kelly Criterion Formula With Explanation

The Kelly criterion formula is as follows:

f=Bp-qB= edge odds

or

K = p x B (1 – p) / B

Where:

- f = fraction of wealth wagered or % of making the highest profit on investment or gambling.

- B = fractional odds (reward to risk) or the ratio of the win to loss

- p= probability of winning against the odds

- q= probability of losing or (1-p)

The Kelly criterion formula is a straightforward equation often explained as the edge over the odds. One must have heard of the expression “having an edge,” which means one has an advantage over something.

On the other hand, the odds are considered a person's chance of winning. A “good bet” would typically involve something in which one has an edge, and the odds are in their favor.

When it comes to investing, the edge is also referred to as the total expected value, which considers all the possible outcomes and the probability of them.

One of the hardest things for investors to understand and put into practice is the idea of position sizing. In many instances, investors can find good investment opportunities but falter regarding the money allocated to the particular investment. They may also be over-diversified, limiting their ability to realize gains.

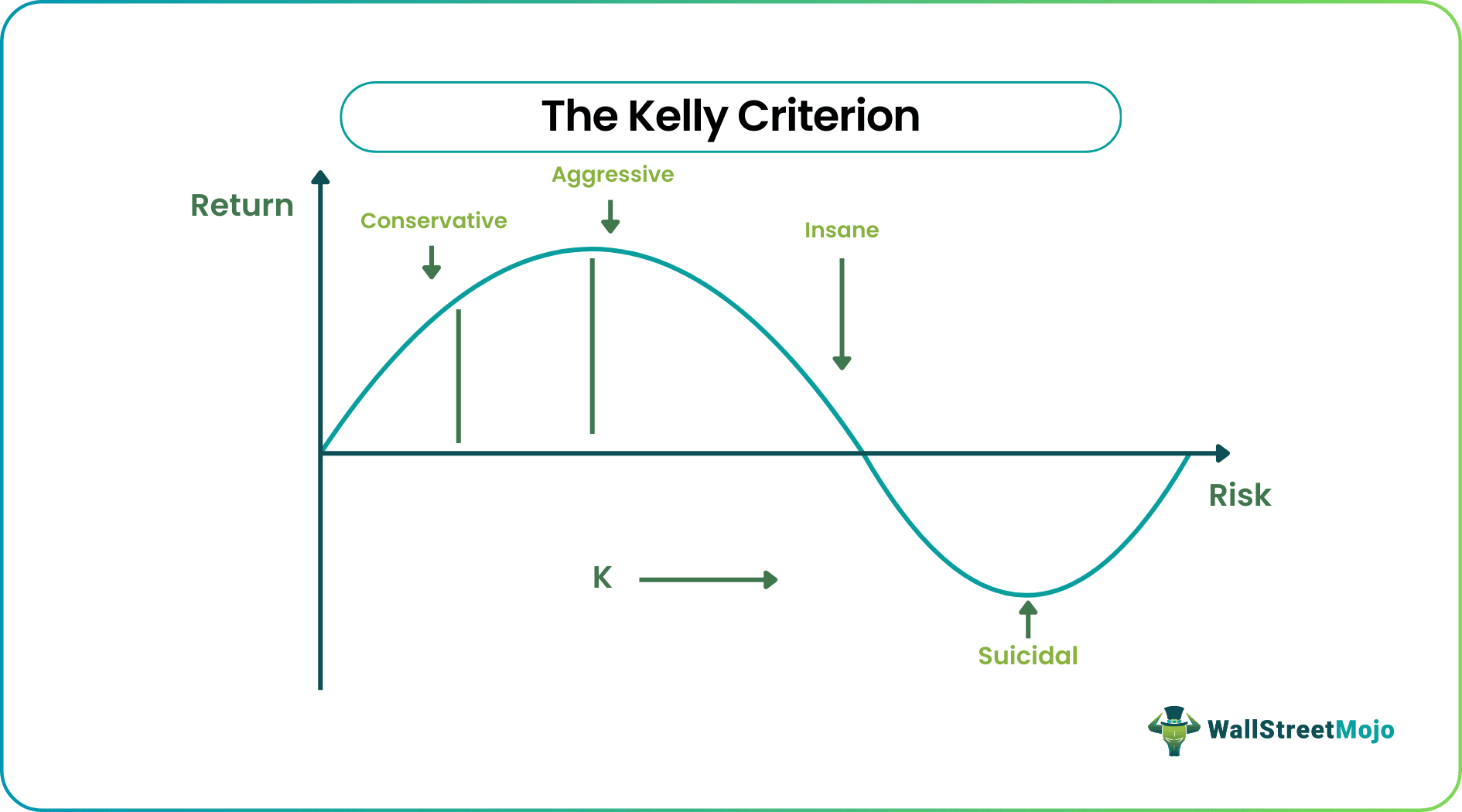

There is a fine line between the amount of risk and profit involved in investing. Knowing when to invest less and when to invest more can help investors protect their capital and become more efficient.

Kelly criterion or Kelly strategy is intended to help investors distinguish between the two. It works best as a long-term strategy to promote efficient capital growth and appreciation.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Step by Step Calculation with Examples

Check out these examples to get a better understanding of the concept.

Example #1 - Stock Trading

Let’s assume, a stock trader is looking to enhance his winning efficiency. So he tries out the Kelly criterion. His reward to risk ratio, in this case, is 1:1; or in other words, he can lose the exact amount that he can potentially win. Based on the data, he wins trade setups like this 55% of the time.

f=Bp-qB= edge odds

or

K = p x B (1 – p) / B

B = 1

p = 55% or .55

q =(1-p) =(1-.55) = .45

1. = ((1)(.55)) – (.45) / 1

2. = .55 - .45 / 1

3. = .1 / 1

4. = .1 or 10%

In this instance, the Kelly criterion formula implies that he should allocate 10% of his portfolio or account towards this trade.

Example #2 - Sports Betting

In this example, a person is betting on an NFL sports game. Let’s assume the game is a rematch of the 2020 Super bowl where the Tampa Bay Buccaneers play the Kansas City Chiefs. The Tampa Bay Buccaneers are favored to win with 2:3 odds. The bet costs her $50, but the potential payout is $100 or a 2:1 risk to reward. The formula would look like this:

f=Bp-qB= edge odds

B = 2:1 or simply 2

p = If she has 2:3 odds, it will equate to 67% or .67

q = (1-p) = (1-.67) = .33

1. = ((2)(.67)) – (.37) / 2

2. = 1.34 - .37 / 2

3. = .97 / 2

4. .49 or 49%

According to the Kelly criterion, she should wager 49% of her account on the bet. This number is generated based on the idea that she has a higher multiple or a greater reward than the risk (2:1). The formula combines that information with the fact that she has a 67% chance of winning the trade, leading it to produce and suggest a higher amount to allocate the bet.

Interpretation and Analysis

The Kelly criterion method can be a helpful tool for individuals looking to determine position sizing. Here are some things to keep in mind while using the formula.

- The Kelly criterion isn’t a perfect method. It’s more practical when used in a longer time frame.

- If the formula generates a negative number, it implies that one should avoid the trade as the equation predicts an outcome, not in their favor. (If the person is using the method to trade derivatives, such as options or futures, it can be interpreted to take the opposite position in some instances.)

- A significant advantage of using the Kelly criterion method is learning how position sizing can change based on a balance between risk and reward. It is one of the hardest things for investors and gamblers to learn and work into their strategy.

- Remember that it is only as effective as the probabilities one input into it while using the formula. If the input values are inaccurate, it will throw off the formula, making the method worthless.

- In many cases, the Kelly strategy generates numbers that one can view as “overly-aggressive.” If they are betting anything over 15-20% of their account, they risk substantial capital.

- The method cannot predict black swan events that cause severe stock market declines.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Ask Questions (FAQs)

The Kelly criterion or Kelly bet is a mathematical formula that helps place a bet to bring optimum returns. The strategy allows investors or gamblers to maximize profits with minimum losses or risks.

The Kelly criterion is an extremely effective tool that has many practical applications. For example, famous investors like Warren Buffet have used the criterion for value investing.

The Kelly criterion can be applied using the formula:

K = P x B (1 – P) / B

Where K= Kelly %,

P= probability of winning

B= win to loss ratio

Recommended Articles

This has been a guide to What is Kelly Criterion & its Definition. Here we explain its formula along with step-by-step calculations and examples. You may also have a look at the following articles to learn more –