Table Of Contents

Keiretsu Meaning

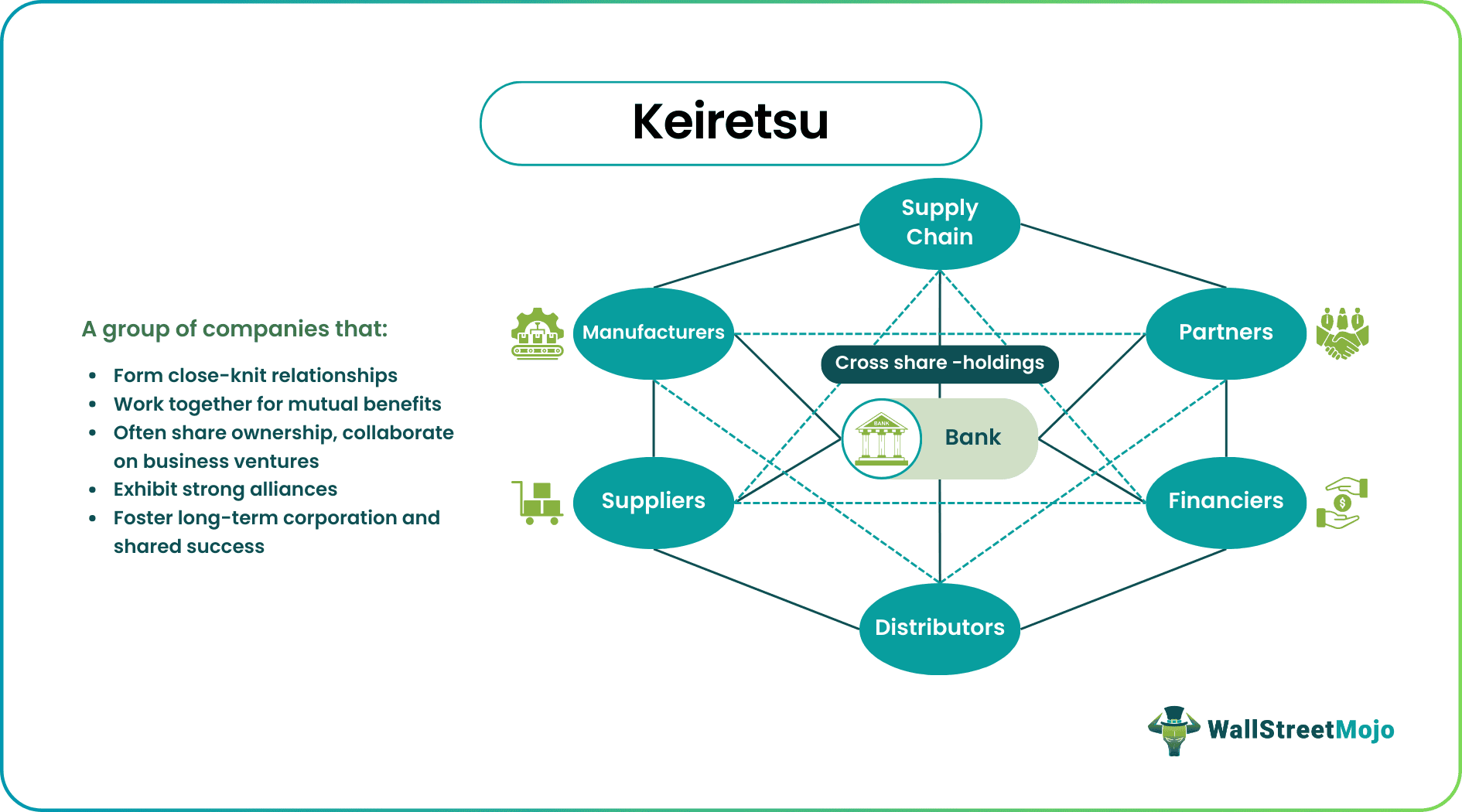

Keiretsu, which means "conglomerate," refers to an alliance of diverse businesses that establish a robust corporate structure through cross-shareholdings, benefiting all participants. Its objective is to provide a stable and reliable supply chain infrastructure, ensuring the sustainable, continuous, and protected exchange of licensed technology among its members.

Additionally, Keiretsu offers a perpetual source of financing for the business needs of its participants. By reducing competition among the member companies, it fosters growth and development. However, it is important to note that Keiretsu can also give rise to monopolistic tendencies within the member businesses. There are two types of Keiretsu: horizontal and vertical. In each type, companies hold small shares in one another.

Key Takeaways

- Keiretsu refers to a conglomerate formed by a group of companies, including a bank, trading company, and others, who buy each other's shares to maximize profits and stabilize their market share.

- Keiretsu helps companies within the group to mitigate cutthroat competition, hostile takeovers, and market volatility, promoting sustainable business practices.

- Keiretsu can be categorized into two types: vertical and horizontal. Mitsubishi, a global conglomerate, exemplifies the horizontal structure.

- While Zaibatsu and chaebol, both vertical structures, belong to Japan and South Korea, conglomerates can have vertical and horizontal structures.

Keiretsu Explained

The Keiretsu system is a network of interconnected companies that acquire each other's shares, with banks playing a central role. It originated after Japan's defeat in World War II at the hands of the Americans. However, recognizing the need for a strong partner in the Eastern hemisphere, the United States allowed the existing zaibatsu system to continue, which later evolved into conglomerates.

Keiretsu is often established to facilitate the exchange of best practices, enhance risk management by reducing uncertainties, and provide businesses with a stable source of financing. Japanese companies tend to acquire significant shares in each other to deter hostile takeover bids, allowing for the cultivation of close relationships among conglomerate members. This arrangement ensures a steady supply chain, consistent investment flow, and protection of proprietary technology and prevents sensitive information from being disclosed to rivals.

However, while conglomerates provide stability and security to their members, they can also pose challenges for companies. They may even invite sanctions in certain countries, as explained in the following section.

Keiretsu is divided into two forms: horizontal and vertical.

1. Horizontal

A Japanese conglomerate of this type is characterized by the following:

- Collection of independent firms operating across various sectors.

- Absence of a holding or parent company.

- Larger companies retain control over their activities.

- Trading companies oversee the trading aspect.

- Banking institutions serve as the capital backbone of the Keiretsu.

- Inclusion of a significant manufacturing company.

- Banks play a major role in providing substantial funding.

- Trading companies also contribute to trade coordination within and outside the group.

2. Vertical

This type of conglomerate exhibits the following characteristics:

- A hierarchical structure with a dominant holding company at the top.

- Other members are typically smaller in size and capacity, acting as suppliers to the larger firm.

- Resembles a pyramid structure with lower-tier suppliers involved.

- First-tier suppliers directly supply commodities to the holding company.

- Second-tier suppliers provide products to the first tier.

- Subsequent tiers extend as necessary.

- Smaller firms may not be aware of the main holding company.

- The main holding company may not be aware of the smaller companies.

- Vertical keiretsu networks can potentially be extensive, comprising numerous smaller companies within the pyramid.

Example

Let's examine the Mitsubishi Group as a prominent example of a horizontal conglomerate to illustrate the concept further. It encompasses companies from diverse sectors that hold shares in one another. The composition of this conglomerate is as follows:

- The Bank of Tokyo Mitsubishi serves as the central entity.

- Mitsubishi Motors

- Meiji Mutual Life Insurance Company

- Mitsubishi Trust and Banking

- Mitsubishi Shoji is another constituent of the conglomerate.

Additionally, Mitsubishi Shoji is recognized as a trading company within the group.

Advantages And Disadvantages

Let's examine the advantages and disadvantages of the conglomerate system. However, it's worth noting that while conglomerates can provide certain benefits, they also come with drawbacks:

Advantages

- Conglomerates can offer stability and security to their member companies.

- They provide a reliable supply chain, ensuring consistent product availability.

- Conglomerates facilitate the sharing of best practices and knowledge among members.

- They can provide a stable source of financing for business needs.

- Conglomerates foster close relationships and cooperation among companies within the network.

Disadvantages

- Manufacturers within conglomerates may be less responsive to customer demands, resulting in potential delays or reduced customer satisfaction.

- Economic changes may not prompt immediate and appropriate actions from companies within the conglomerate.

- Companies may be resistant to changing their work culture or adapting to new technologies, hindering innovation and growth.

- In the absence of competition, markets within the conglomerate system may become closed, potentially leading to reduced choices and limited consumer benefits.

- Customers may experience difficulties and challenges, including diminished services and limited options.

- Every economic and supply chain aspect may be controlled and manipulated within the conglomerate, potentially impacting fair market practices.

- The conglomerate structure can create monopolistic market conditions, which may attract legal sanctions in foreign jurisdictions.

Keiretsu vs Zaibatsu vs Chaebol

Let us look at the differences between Keiretsu, Zaibatsu, and Chaebol in the table below:

| Keiretsu | Zaibatsu | Chaebol |

|---|---|---|

| Mainly exists in Japan. | Existed in Japan but ended with the American victory over Japan. | Mainly exists in South Korea due to the Japanese occupation from 1910-1945. |

| Forms many independent companies. | Companies were under family control. | Mainly family-owned firms form the group. |

| Has a lesser number of companies. | It no longer exists after World War 2. | Has a larger number of companies. |

| Can be horizontal or vertical. | Has a vertical structure. | Mainly follows a vertical alignment. |

| Controlled by a presidential council. | Received government contracts due to family control and resources. | Family controls the group. |

| Response to challenges and changes is relatively slow. | Laid the foundation for a stronger Japan in the World War era. | Highly aggressive in responding to requirements and changes. |

| Moderately aggressive in new product development. | Historically, they were monopolistic. | Highly aggressive in product development. |

| Run by professional managers, resulting in fewer bad business decisions. | All decisions were profit-motivated under family leadership. | Poor managerial decisions can happen quite often. |