Table Of Contents

What is Junior Tranche (Subordinated Debt)?

A junior tranche is a type of debt that is unsecured and considered riskier but at the same pay a high-interest rate; it is the first that absorbs any losses accrued or earned on the value of securities, and it is also called a mezzanine tranche.

Key Takeaways

- A junior tranche is a high-risk, unsecured debt with a higher interest rate. It is the first to bear any losses or gains in the value of securities. It is also known as a mezzanine tranche.

- "Tranche" in structured finance means "slice" or "portion" in French. "Junior tranche" refers to the lowest tranche with higher risk and higher interest rates as compensation.

- Junior tranches, also called mezzanine tranches, bear the loss if the security value decreases. They make up only 10-20% of the total safety value.

Explanation

Junior Tranche (Debt) -For that, we will separate these two words – junior and tranche.

- The word “tranche” is used in structured finance. “Tranche” is a French word. And it means “slice,” “portion.”

- So, if we add junior to the tranche, we would get the meaning of the lowermost tranche of security. That means when we talk about the junior tranche; we talk about the lowest tranche.

This lowest tranche is the riskiest. And at the same time, it pays the highest interest rate as it accepts the most risk.

If there’s any loss in the value of the security, the junior tranche is the first to absorb it.

Junior tranches are also termed mezzanine tranches. If we compare the total value of the security with the value of junior tranches, junior tranches account for only 10-20%.

Why do you need to know about Junior Tranche?

source: reuters.com

As an investor (shareholder), you need to know about junior tranches to understand how you will get paid and when. The junior tranche is a subordinated portion of the debt, and is unsecured too. Thus, the risk is much higher, and the chance of repayment only comes after repaying the senior debt holders.

Let’s understand this with an example.

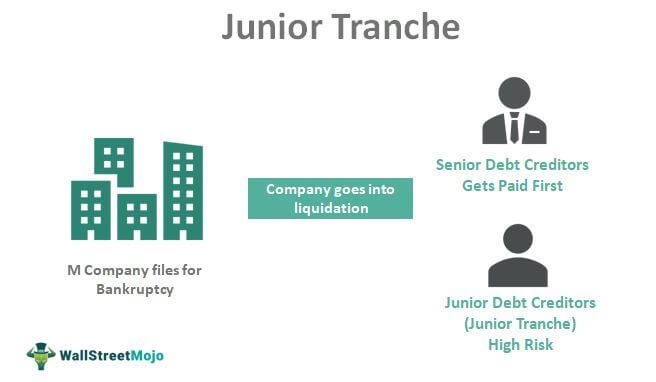

Let’s say that a company files for bankruptcy. And let's say the name of the company is M Company. Now, as M Company files for bankruptcy, the company will go into liquidation, and its creditors will get paid in order of preference.

At this stage, there are two debt creditors – senior debt creditors and junior debt creditors (junior tranche).

After the liquidation of Company M, senior debt holders will be paid first. If there’s anything left after paying the senior debt holders, the junior tranche will be paid next.

Since the risk of the junior tranche is much higher than the senior debt holders, to compensate for the risk, the junior tranche receives a higher interest rate.

You may wonder why junior tranches take so much risk when the chances of payment are always bleak.

It’s because when they get paid, they get paid well, and they get paid even before the shareholders of the company. Plus, before they ever invest in a company, they do their due diligence. And if they see that the company doesn’t have enough resources to pay off the senior debt holders, they abstain from investing in that particular company.

How junior debt holders do their due diligence?

The obvious question is, when there are so much risk and so little chance of getting paid, how do junior debt holders do their due diligence?

- The first thing they look at before they ever invest in a company is the total assets. If a company's total assets are huge liquidation, would easily get paid. If the company's total assets are not so huge, they avoid investing in the company. Looking at the total assets of the company is their first filter.

- The second thing they look at is the total liabilities. If the total liabilities are almost similar to the total assets (we keep the shareholders' equity aside), then it’s not a good deal for junior debt holders. But for senior debt holders, this can be a pretty good deal.

- Plus, the junior debt holders look at all other financial ratios of the company to ensure that they're investing in the right company and their chances of success are higher.

Where is junior debt recorded on the balance sheet?

As you already know, junior tranches are paid off after the senior debt. It would be recorded in the liability section.

Here’s how it is being recorded.

- In the balance sheet's liability section, current liabilities are recorded.

- After the current liabilities, the long-term liabilities are recorded.

- Under the long-term liabilities, the senior debts are recorded first since they would be paid off first in the case of bankruptcy. After recording the senior debts, junior debts are recorded.

Why are Junior Tranches used?

You may think, when the interest rate is so very higher for a company to take junior debt, why do they use it?

The alternative is not so prudent to do in terms of the company's perspective. They can issue new shares to the public, diluting the company's ownership. Thus, even if junior debt isn’t a preferred option for a company, it’s way better than issuing new shares to the public.