Table Of Contents

What is the Itemized Deduction?

An itemized deduction can be defined as an eligible expenditure that the individual taxpayers incur on various types of products or services for claiming these expenditures on FIT (federal income tax) returns solely to reduce their tax implications; in other words, these are various sorts of tax-deductible expenditures that are incurred throughout the year.

An itemized deduction checklist enables individual taxpayers to claim various expenses and save much money in taxes. On the other hand, this can be time-consuming since it requires a lot of documentation and effort, and there are even restrictions on a few itemized deductions. These deductions have advantages and disadvantages, and individual taxpayers must consider them before opting for them.

Itemized Deduction Explained

Individual taxpayers claim itemized deductions to lower their tax burden. These are tax-deductible expenditures that can be reduced from AGI to lower the tax burden of an individual taxpayers. The tax bracket of an individual taxpayer and their filing status will ultimately determine the amount of concession they might receive on the tax burden. These options are only available to taxpayers eligible to receive standard deductions.

Types of itemized deductions are Investment interest expenses, home mortgage interests, Charitable contributions, Medical expenses, Dental expenses, property, state, and local IT (income tax), Job-related expenses, and such other items, Interest, and taxes already paid by the taxpayer and Miscellaneous deductions.

Mortgage interest deduction (MID) is a common component of itemized deductions, allowing homeowners to deduct interest payments made on their mortgage loans throughout the tax year. This deduction is particularly beneficial for individuals with high mortgage interest payments, potentially lowering their taxable income.

Moreover, itemized deductions limits offer opportunities for homeowners to claim deductions beyond the standard limits. For instance, individuals can deduct a portion of their property taxes and claim costs associated with qualified home improvements. This incentivizes homeownership and encourages investments in property-related enhancements.

While itemizing requires careful documentation and record-keeping, the potential tax savings make it a worthwhile endeavor for those with substantial deductible expenses. Navigating the intricacies of itemized deductions often necessitates professional advice, ensuring taxpayers leverage available opportunities to optimize their financial positions and minimize their tax liabilities.

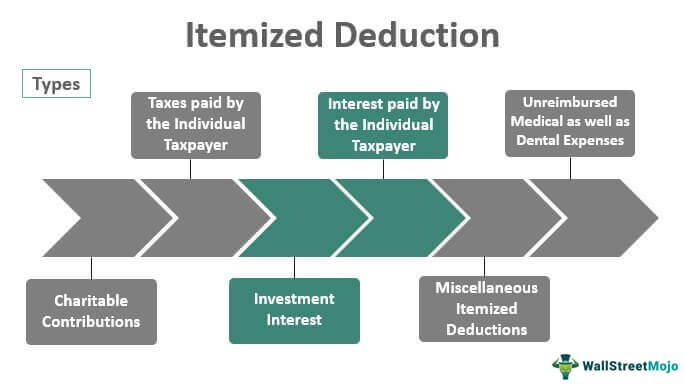

Types

Let us understand the different types and their itemized deduction limits through the points below.

- Taxes paid by the Individual Taxpayer (Sales Taxes, Property Taxes, Family Leave Taxes, Unemployment Taxes, etc.)- Prepaid taxes are not eligible for the deduction. Still, state and local taxes paid during the year can be applied for the deduction.

- Interest paid by Individual Taxpayer- These include home equity loan interest or mortgage interest paid expenses.

- Unreimbursed Medical as well as Dental Expenses- include doctors' fees, prescription charges, insurance premiums, non-cosmetic surgery expenses, ambulance or transportation costs, etc. The medical and dental expenses exceed ten percent of the taxpayer's adjusted gross income and 7.5 percent if the taxpayer is above 65 years of age.

- Charitable Contributions- Deductions can be claimed up to 30 percent of tax payer’s adjusted gross income for property-related donations and 50 percent in cases of cash donations.

- Investment Interest- Only a certain amount earned from investments shall qualify for deductions.

- Casualty as well as theft losses (if any);

- Miscellaneous Itemized Deductions- Such expenses can be deducted if all of these exceed 2 percent of an individual taxpayer's adjusted gross income.

List

Below is an itemized deduction checklist for your perusal.

- Investment interest expenses

- Home mortgage interests

- Charitable contribution

- Medical expenses

- Dental expenses

- The property, state and local IT (income tax)

- Job-related expenses and other items

- Interest and taxes already paid by the taxpayer

- Miscellaneous deductions.

Examples

Now that we understand the itemized deductions checklist and other related factors, let us also understand the practicality of the concept through the examples below.

Example #1

Ian, a taxpayer who owns a home and has significant mortgage interest payments. He decides to itemize deductions on his tax return. Throughout the tax year, he paid $12,000 in mortgage interest, exceeding the standard deduction.

By choosing to itemize, he can deduct the full $12,000 from his taxable income, potentially leading to a lower tax liability. This decision to itemize becomes financially advantageous, especially when coupled with other eligible deductions like state and local taxes paid or charitable contributions.

Example #2

The Tax Cuts and Jobs Act of 2017 brought a substantial increase in standard deductions, raising them from $6,500 to $12,000 for individual filers, $13,000 to $24,000 for joint filers, and $9,550 to $18,000 for heads of household. Consequently, this significant boost in standard deductions has led to a notable decline in the number of taxpayers opting to itemize their returns and claim the Mortgage Interest Deduction (MID).

To determine whether itemizing is beneficial, individuals are advised to calculate the total interest paid on their mortgage and any other planned deductions. If this sum falls below the standard deduction, the process of itemization may not be necessary. However, it's essential to explore additional tax breaks for homeowners. For instance, if one wishes to deduct a portion of property taxes or claim home improvement costs, itemizing becomes crucial for maximizing potential tax savings.

How to Claim?

An individual taxpayer seeking to claim and understand itemized deductions limits can begin by filling out a Schedule A form. This is a separate form; it can be downloaded along with a 1040 form from the IRS website. Schedule A form will mention all the steps an individual taxpayer must follow to calculate deductions. The final amount calculated from the Schedule A form should then be filled out in the 1040 form in the deductions segment.

Advantages

Let us understand the advantages of the itemized deduction checklist through the points below.

- It enables individual taxpayers to claim more eligible expenses- This is probably the best of all the benefits of opting for itemized deductions. It enables the individual taxpayers to claim a range of expenses like dental expenses, charitable contributions, medical expenses, investment interest expenses, property, state and local IT (income tax), job-related expenses, home mortgage interests, casualty as well as theft losses, and such other items, interest, and taxes already paid by the taxpayer and Miscellaneous other deductions.

- Individual taxpayers can even save a lot of money- It enables them to itemize more deductions, which means they can easily save a lot of money as they will be able to reduce their tax implications and apply for a higher tax refund.

Disadvantages

Despite the various advantages, there are a few points that are a cause of concern. Let us understand them through the points below.

- It takes a lot of documenting and hard work- These deductions can be tiresome for taxpayers since it requires a lot of documenting and effort.

- Time-consuming- These deductions can also be time-consuming because a lot of time goes into documenting processes.

- Restrictions on the individual taxpayer- The presence of unnecessary restrictions also discourages individual taxpayers from availing of this option.

Itemized Deductions vs. Standard Deduction

Both itemizing and standard deductions help reduce the tax burden of an individual taxpayer. However, itemized deduction limits must not be confused with the that of the standard deductions.

- An individual taxpayer must report every qualified deduction in an itemized deduction. On the other hand, in the case of the standard deduction, an individual taxpayer will only be required to subtract a flat amount.

- Itemized deductions can be availed after compulsory completion of Schedule A and other forms. In contrast, standard deductions do not require an individual taxpayer to complete all these formalities.