Table Of Contents

Invoice Tracking Template - Track Auto-billing and Payment Status

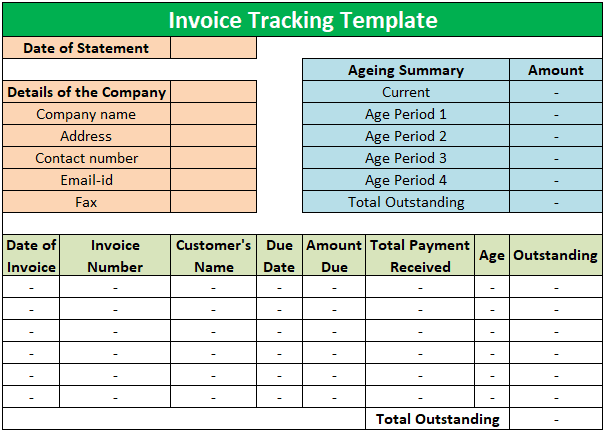

An invoice tracking template can be highly resourceful for an organization. It makes it easy for companies to evaluate the aging summary of their clients and track their payment status. With invoice tracking, companies can do auto-billing, invoice scheduling, gather insights about cash inflows and outflows, payment tracking, invoice tracking, and even customize their invoice templates.

Invoice tracking template in Excel makes it possible for companies to do invoicing and accounting in one place. It even enables them to send automatic reminders to their customers to clear their pending payments. Invoice tracking can be a seamless experience for companies since it becomes easy to create invoices and track pending payments.

About the Template

- A company that is willing to track its invoices can readily save time and energy with the use of this template. It has all the required elements that a company shall need to follow its invoices.

- The elements mandatorily mentioned in the invoice are the seller's details, the buyer whose invoice is required to track, invoice number, date of invoice, and all other information about every transaction undertaken by a company during the period the invoice is made for.

Purpose

Now that we understand the basics of the concept of a free invoice template, let us discuss the exact purpose behind using these templates from a business perspective through the explanation below.

- Efficient Record-Keeping: Invoice tracking templates facilitate organized record-keeping by allowing businesses to log and monitor all incoming and outgoing invoices. This helps in maintaining a clear and comprehensive financial history.

- Timely Payment Management: Businesses can use the template to track payment due dates, ensuring timely payments and avoiding late fees. This proactive approach contributes to better cash flow management.

- Identifying Outstanding Payments: The template enables businesses to easily identify outstanding payments and follow up with clients or customers. This is crucial for maintaining healthy relationships and ensuring a steady income stream.

- Financial Planning: By analyzing invoice data over time, businesses can gain insights into their revenue patterns and make informed financial decisions. This includes forecasting, budgeting, and identifying areas for potential cost savings.

- Tax Compliance: Invoice tracking aids in maintaining accurate financial records, simplifying the tax preparation process. It ensures that businesses have a transparent overview of their transactions, making audits and compliance less burdensome.

- Client Communication: The template serves as a reference point for client communication, allowing businesses to provide accurate and up-to-date information on payment statuses, reducing misunderstandings and disputes.

- Streamlining Operations: Overall, an invoice-tracking template streamlines financial operations, enhances organizational efficiency and contributes to the overall success of the business by promoting financial transparency and responsibility.

Elements

The details required in the above-provided invoice template in Excel or other such avenues are provided and discussed below-

#1 - Heading of the Template

The template must have a heading that states the “invoice tracking template.” The reason for providing this heading would be to ensure that the user can easily understand the purpose of this template.

#2 - Date of Invoice

The invoice date is crucial for the supplier and must not be wrongly mentioned or skipped. Therefore, one must provide the date at the topmost, on the right side of the template.

#3 - The Ageing Summary of the Debtors

A particular debtor aging summary must be displayed at the top left corner and offer the aging summary along with the dates. After providing all this information, one must calculate the total outstanding by adding up all the aging values. It will calculate this summary based on the details elaborated in the working part of the invoice.

#4 - Details of the Company (Seller)

The company at the selling front must necessarily offer its details in the invoice as and whenever asked. The top left-hand side of the invoice must contain the details of the supplier, such as the company's name, full address, postal code and country, email ID, fax, and reference number.

#5 - Debtors' Details

One must mention the debtor's name it must track in the invoice below the suppliers' details. Apart from the name, one must also provide his contact number and address in the tracking invoice. One must mention these details on the left-hand side just below the details of the supplier company.

#6 - Calculation Segment

One can divide the calculation segment into various subheads. These divisions are below:

#7 - Date

One must provide the date for each transaction in the invoice. It will ease out the following calculation process in evaluating the age of the debtors.

#8 - Invoice Number

One should provide the invoice number right after the date. It will ensure that the insert transactions are arranged serially and not randomly.

#9 - Customers' Name

- One must mention the debtor's or customer's name next to the date. The customers' names are critical to mention because this is not an invoice for individual clients. Instead, this invoice is created after incorporating details of all the transactions undertaken by a company with different types of customers.

- All the customers who transacted with the company for the period of the invoice prepared must be duly entered. It makes tracking the customers' payment status easy for companies and enables them to deal with their customers according to their payment patterns.

- For example, suppose a debtor delays his payments. In that case, the company will choose not to issue further goods to him on credit and ensure adequate follow-up processes, while a debtor who pays on time will always be upheld and valued by the company.

#10 - Other Details

The company must also provide due dates for each transaction and the payment due and received from a client. Accordingly, it calculates their aging summary and outstanding balance. Then, based on all this, evaluate their status.

How to Use This Template?

Following are the steps that one must follow to use the free invoicing tracking template:

- A person using a template has to enter all the details as required in the fields that are not already pre-filled.

- The user must start by naming the invoice so that one can learn its purpose.

- The user must mention his company's name, office address, contact number, email ID, and fax.

- The user must also provide the date of the invoice in the template.

- The user must mention the customer's name, address, and contact number or the client whose aging status and summary he is willing to learn.

- The user must move on to the next segment and fill in the details for each transaction, like serial number, date of transaction, client for that transaction, the due date of payment, the amount due, and the amount received against that transaction.

- Once all these inputs are provided, the user must calculate the aging summary, evaluate the outstanding amount for that client concerning his transactions, and mention his payment status accordingly.