Table Of Contents

Invoice Reconciliation Meaning

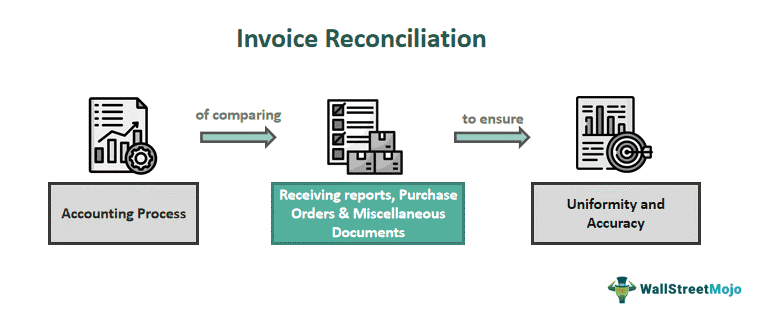

Invoice reconciliation refers to the procedure of accounting whereby a company matches invoices with receiving reports, purchase orders, and miscellaneous reports to ensure consistency and accuracy. It helps detect and correct errors and determine any discrepancies. Moreover, it ensures the accuracy of financial records and statements.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

It comprises authenticating that the funds recorded inside a firm's accounts receivable and payable remain accurate and equal to the amount on the invoices. It aids in confirming that the amount going out from an account matches the amount consumed and is equal at the closing of the recorded period.

Key Takeaways

- Invoice reconciliation is an accounting method of matching invoices against receiving reports, purchase orders, and miscellaneous reports.

- The process involves reviewing, matching, and resolving discrepancies to ensure financial accuracy and detect fraud.

- Key benefits are fraud detection, financial accuracy, dispute resolution facilitation, and strengthened vendor relationships.

- Best practices include automation, clear procedures, periodic audits, and open communication.

Invoice Reconciliation Explained

Invoice reconciliation is a process of accounting through which a firm compares the receiving report, purchase orders, and miscellaneous documentation against invoices. This process is done to ensure consistency and precision. It allows businesses to check and confirm that the goods or services they receive are in accordance with the orders and payments they have made.

The invoice reconciliation process involves several key steps: document gathering, information matching, resolving discrepancies, recording transactions, and authorizing payments. This streamlined process saves companies time and prevents overspending. Additionally, it ensures accuracy in balance sheets and bookkeeping.

Moreover, by using invoice reconciliation software, businesses can allocate resources, time, and money to spend on productive tasks. A routing use of invoices reconciling plays a vital role in working capital & cash flow for firms. Moreover, it helps mitigate risks and enhance financial control, leading to improved efficiency in billing operations and invoicing. Leveraging technological solutions and robust reconciliation processes further enhances these benefits.

Process

A straightforward method is required to cross-verify and rectify any errors, which can be achieved through the following steps:

Step 1: Gathering and reviewing invoices for correctness and checking for the accuracy of important details.

Step 2: Matching invoices with delivery orders or purchase orders. This step helps ascertain the receipt of the correct price and quantity of goods and services.

Step 3: Checking any mismatch or issue in prices, quantities and amounts as noted in the invoice received.

Step 4: If any discrepancies are identified, then investigate and resolve them using proper adjustments and communication channels.

Step 5: Note down all reconciled data in the accounting system while updating records of accounts payable.

Step 6: Get appropriate permission for reconciled invoices before making any payments.

Step 7: Start payments using the payment process as per the approved payment terms and invoices.

Step 8: All the above processes, like changes, adjustments, and findings of reconciliation, must be duly documented to facilitate auditing purposes.

Examples

Let us use a few examples to understand the topic.

Example #1

Let us consider Acme soap company, a soap manufacturer based in Old York state, as an example. It received an invoice from vendor XYZ of $10500 concerning a key soap manufacturing ingredient called lye. The said invoice had listed 50 drums at a price of $210 per drum. However, after an internal review, the company found that there was a discrepancy.

The purchase order clearly mentioned 55 drums at low prices of $200 each, which totaled $11000. However, after a thorough investigation, only 50 drums were received by the receiving department.

Consequently, a significant variance in both the quantity and price of the delivered order was uncovered. Thus, the reconciliation of the invoice facilitated the identification and resolution of this discrepancy.

Example #2

An online article published on 16 November 2020 discusses the hurdles of invoice reconciliation in different industries like telecommunication and supply chain. Issues in invoices and documentation break the automated processes, leading to the need for manual resolution efforts that consume time and resources. As a result, it affects the working capital of companies as they must allocate reserve capital and resources to address potential issues.

In response to these challenges, IBM has proposed a blockchain-derived solution for faster dispute resolution. Leveraging smart contracts and blockchain automation enables the swift identification and resolution of discrepancies, almost in real time. This approach enhances trust between parties and transparency in the system. Notably, case studies involving Home Depot and Syniverse have demonstrated significant reductions in disputes and expedited resolution processes, validating the efficacy of this solution.

Benefits

All industries and businesses require invoice reconciliation to maintain sound operations and financial stability. Key reasons include:

- Ensures financial accuracy for business by verifying invoices with receiving reports and purchase orders.

- Helps avoid excess payments and sudden liabilities by helping mange effective cash flow through reconciling invoices.

- Helps in regulatory adherence and readying for audits through accurate records using invoices reconciling.

- Enhances vendor relationships by quick discrepancies resolution and determining any discrepancies or illegal charges.

- Detection and prevention of frauds using conventional invoice reconciling and discovering discrepancies and illegal charges.

- Strengthening internal controls of firms through error detection and ensuring adherence to policies and approval procedures.

- Prompt dispute resolution through the reconciliation of discrepancies between other documents and invoices.

- Improving operational efficacy through data-driven decisions deriving from accurate financial information.

- Improving customer satisfaction due to inventory management and accurate pricing using invoices reconciling.

Best Practices

The following best practices aim to minimize inefficiencies and risks associated with this process:

- Set up clear procedures and policies while training everyone.

- Using a three-way method of matching to contrast invoices against receiving reports and purchase orders.

- Defining a proper escalation process to handle discrepancies effectively and promptly.

- Maintain a straightforward audit trail of every action undertaken while implementing the reconciliation process.

- Utilize software or Excel sheets to automate the process of reconciliation to reduce discrepancies and save time.

- Build an open communication channel with vendors to decrease misunderstandings and find weaknesses.