Table Of Contents

Investor Confidence Project (ICP) Meaning

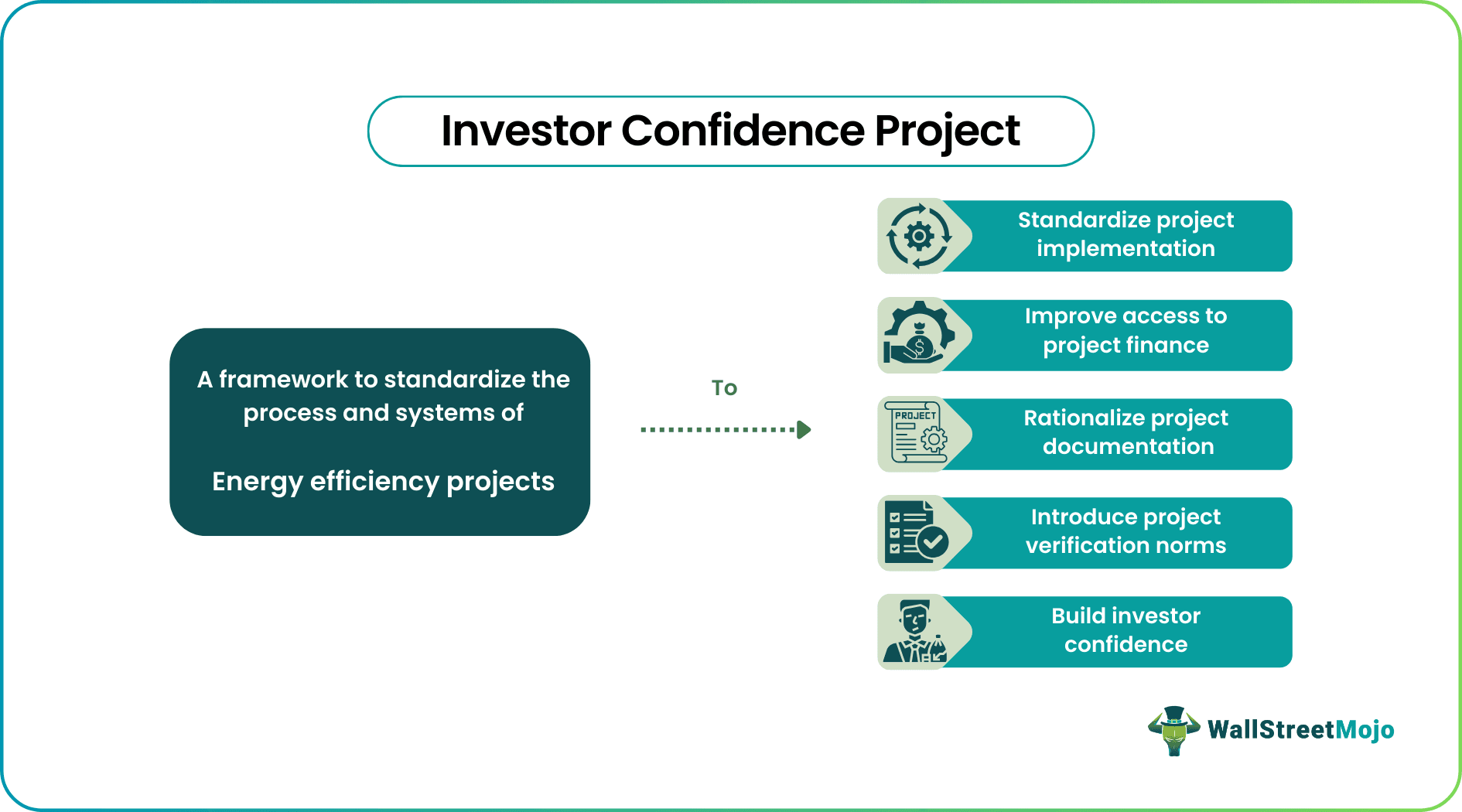

The Investor Confidence Project (ICP) defines protocols and certification guidelines that facilitate the financing, development, documentation, and certification of energy efficiency projects. By standardizing projects and introducing energy performance protocols, such as industry and building standards, to boost energy efficiency, this system helps reduce transaction costs and builds investor confidence.

ICP aims to address issues and complexities associated with energy efficiency projects. To this end, it promotes the establishment of consistent frameworks that simplify various planning, development, and implementation processes for project developers, building owners, and investors. These guidelines mobilize capital in energy efficiency markets by standardizing projects, improving documentation methods, and ensuring accurate measurement and verification.

Table of Contents

- Investor Confidence Project (ICP) Meaning

- The Investor Confidence Project (ICP) is a framework used to plan projects, forecast and measure energy savings, and execute projects for consistent results in terms of energy efficiency and cost reduction.

- ICP highlights and promotes market expansion of the energy efficiency industry, streamlines the project development process, and increases investor confidence.

- The standardized method offered by ICP boosts investments in the energy efficiency sector, results in energy savings, and produces financial gains for all the associated stakeholders.

- The platform also offers training sessions for contractors, energy service providers, project developers, and ICP Quality Assurance Assessors to enable them to master the ICP Protocols and Investor Ready Energy Efficiency (IREE) Certification.

Investor Confidence Project Explained

The Investor Confidence Project (ICP) is a framework that helps forecast and measure energy savings, offering consistent and accurate results and enabling action-oriented planning. It gives stakeholders and investors assurance about the efficacy, scalability, and reliability of project engineering methods, estimated energy savings, and anticipated financial returns of energy efficiency initiatives.

The Investor Ready Energy Efficiency (IREE) Certification Process and the ICP Protocols guarantee the quality of the projects undertaken in line with this framework and guidelines. They validate that certified developers have created and implemented energy-saving measures, and projects meet the defined requirements outlined by the ICP.

The platform also offers training for contractors, energy service providers, project developers, and ICP Quality Assurance Assessors to empower them to consistently apply the ICP Protocols and IREE Certification guidelines across projects. This is particularly beneficial for economies moving toward a carbon-neutral position.

The training offered via this program ensures uninterrupted compliance with the ICP Protocols and IREE Certification standards. Employing the intelligence and knowledge of industry experts and seasoned engineering firms that have joined the ICP and brought their recognized quality assurance suppliers lists further benefits the cause.

The ICP framework is designed to forecast, quantify, and improve energy efficiency. Green Business Certification Inc. (GBCI) manages it and assists businesses in funding initiatives that increase productivity, yield a positive return on investment, and lower operational expenses. The ICP framework helps decrease transaction costs for both sellers and buyers of energy efficiency and lowers risk for investors by approving projects that meet strict requirements.

In addition, standardization contributes to lower running costs, higher market value, and a much lower carbon footprint in buildings than under regular circumstances. It also enhances energy renovation transactions and increases the reliability of energy savings.

Residential, commercial, and industrial projects can benefit from these guidelines since the energy consumption across such projects is high. For example, energy usage on account of lighting and insulation can be reduced in residential and commercial buildings.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Objectives

In this section, let us discuss the objectives of the Investor Confidence Project (ICP).

- Standardization: ICP seeks to provide a standard method for project development and implementation to reduce complexity and promote consistency. This helps investors understand the project and its outcomes better.

- Investor Confidence: It aims to increase investor confidence and draw capital investments to the energy efficiency industry by offering clear norms and protocols. As the methodology improves reliability, risks and uncertainties are reduced significantly from an investor viewpoint.

- Streamlined Process: The goal of ICP is to simplify the work building owners and project developers put in as part of energy-efficiency projects by streamlining the project development process. It helps them save resources, both time and money.

- Measurement and Verification: ICP places a strong emphasis on measurement and verification procedures to guarantee that energy savings are precisely measured and recorded. Through this, it increases transparency and trust.

- Market Transformation: The ultimate goal of ICP is to encourage market expansion and the broad implementation of energy-saving initiatives, thereby giving the energy efficiency market a boost and accelerating capital generation for varied projects.

Examples

Let us look at a few examples to understand the concept further.

Example #1

Suppose Anne is the owner of a construction business. She owns a commercial building and wants to implement an energy-saving retrofit project. Anne wishes to secure funding from investors.

To ensure her project’s success, Anne decided to obtain a standardized framework to help her implement the ICP protocols. This entailed carrying out an energy audit, creating a project plan, obtaining funding, putting the retrofit measures into action, and confirming the energy savings that were realized.

Due to the ICP standardized methodology she implemented, investor confidence was bolstered, which facilitated capital acquisition and grew investor interest.

Example #2

According to an October 2021 report, the Canada Infrastructure Bank (CIB) set aside $2 billion for investment in commercial and public building projects to achieve significant carbon reductions. The bank embraced IREE accreditation, guaranteeing a standard development structure and quality control procedure for technical due diligence on all commercial projects.

Through standardization, real estate portfolios comprising Energy Service Companies (ESCO) and Super ESCOs can be merged to meet the bank's $25 million minimum investment mandate.

IREE certification offers an affordable yet scalable method of proving project quality by necessitating that projects adhere to industry-developed norms. The process is further strengthened through quality assessments that need to be conducted by an impartial Quality Assurance (QA) Assessor. This market-based method drives down the cost of quality assurance with its built-in scaling mechanism.

The growth plan of the CIB is to draw in institutional and private finance for infrastructure investments. The use of IREE accreditation for technical due diligence in commercial building investments is the foundation required to draw in further private funding for EE projects.

Importance

The importance of the Investor Confidence Project (ICP) can be seen in the points listed below.

- Increased Investment: ICP fosters investor trust and draws more capital into the energy efficiency sector by standardizing project development and offering precise standards.

- Streamlined Process: It streamlines the project development procedure, facilitating the implementation of energy efficiency projects for project developers and building owners.

- Energy Savings: ICP guarantees that energy savings are precisely measured and verified through the implementation of measurement and verification procedures. This results in discernible drops in energy consumption and related expenses.

- Market Growth: The standardized methodology of ICP helps create a more resilient and sustainable environment than that created for normal projects. It promotes the broad adoption of energy-efficient projects and stimulates market growth.

- Economic Benefits: Energy efficiency projects funded by ICP can result in cost savings, employment development, and economic growth by encouraging investments in such projects and enhancing building performance.

- Long-term Benefits: The program’s long-term goal is to establish a distinct asset class that will make it possible for capital markets to finance energy efficiency initiatives.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

ICP was created in 2015 by the Environmental Defense Fund (EDF) to increase investor trust in energy efficiency projects. EDF teamed up with the organization in 2016 to create a transparent underwriting standard for energy efficiency projects using Green Business Certification Inc. 's (GBCI) experience with Leadership in Energy and Environmental Design (LEED) implementation and rating systems.

Building owners gain from securitization, independent assessments, enhanced trust in project outcomes, and efficient procurement. Consistent projects, expedited approval processes, lower transaction costs, and links to utility, insurance, and financing programs are the many advantages project developers enjoy. Internationally accepted technical standards and ready-made provider recognition are advantageous to investors, reducing the burden of independent, investor-level due diligence.

Europe aims to reduce carbon emissions by 90% from buildings by 2050, with an estimated investment of 3.5 trillion or 95 billion Euros annually. This requires substantial financing from private sector institutions, who view building renovation projects as safe, reliable, and profitable investments. ICP helps in delivering it.

Recommended Articles

This article has been a guide to Investor Confidence Project (ICP) and its meaning. Here, we explain its objectives, examples, and importance. You may also find some useful articles here –