Table Of Contents

What is the Investment Horizon?

The investment horizon describes the time limit of the investment portfolio or security that the investor is likely to hold before selling it. The investor may invest in the securities from a few days or hours to a few years to a few decades, depending upon the need for funds and the risk capability of the investor.

Explanation

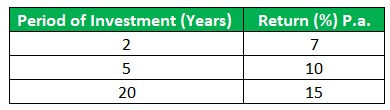

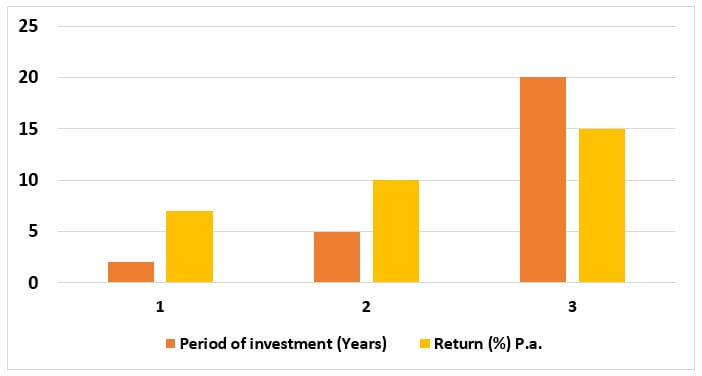

Investment is also on the analysis and research about the securities. It is also probable that the investor wants to invest for a longer time, but the time limit of the portfolio is shorter. Investors can also liquidate the investment in the middle due to continuous loss by the portfolio. It is called a break in the investment horizon. Pension plans, provident funds, and other similar investments are examples of investment plans. The higher the time of investment, the higher the risk and return. In contrast, shorter investment time determines lower risk and returns from the investment, which is reflected and understood in the chart and the example given below.

Types

There are three types of investment horizons: short-term, medium-term, and long-term:

#1 - Short Term

On this horizon, the time limit of holding the investment is shorter; it may range from a few hours to a few months. The period is lower than the three years. The risk involved in this horizon is generally low. In this, the securities of investment include a certificate of deposit, bank deposit, fixed income securities, and other safe securities.

#2 - Medium-Term

The time limit in the medium-term investment horizon ranges from three to ten years, and the risk is moderate; sometimes, the risk factor is also high. The investment includes investment in shares, derivatives, commodity market, medium-term bank deposits, mutual funds, etc. the securities hold a moderate risk and moderate returns.

#3 - Long Term

In this horizon, the risk is very high, and returns are also very high. The time limit of investment ranges from 10 years or more. The nature of securities involves investment in real estate sectors, high-risk securities, pension funds, provident funds, etc. the people willing to take more risks generally invest in long-term investment horizons.

Example of Investment Horizon

Mr. M, a retired person, gets the heavy amount on retirement, and he invests the whole amount in long-term fixed income securities and for buying a new home. Hence, the time limit is high, i.e., more than 20 years and returns are also high as the real estate industry is continuously rising, and the return on long-term fixed income securities is also very high. So, it is considered a long-term investment horizon.

Mr. A, a state government employee, started investing in 457 plans offered by state governments, so the type of investment is considered a medium-term investment, and the return is also moderate. So, the plan is considered a medium-term plan.

Mr. Y, an investor, has had excess funds for a few years, so he invested in a fixed deposit for two years. The plan is considered a short-term investment plan as the risk, return, and investment period is low.

Mr. A, a Government Employee, invest in the pension fund to save for retirement. The type of investment is considered a long-term investment horizon as the risk is moderate and the investment period is long, so the chances of higher returns are there.

How Does it Affect Mutual Funds?

The period and risk factors affect the investment by the mutual fund. It generally invests in mutual funds according to the customers' needs; they invest in short-term, medium-term, and long-term plans. Like investment plans, a mutual fund is also classified as a short-term and long-term plan. Therefore, the persons who want to invest in mutual funds can also invest through the investment horizons as they are considered secured for investment.

The mutual fund companies also approach the managers of this horizon for investment in mutual funds. So, it gives business to mutual fund companies.

Conclusion

Investment horizon is the term used to describe the time limit of investment. It is also called a time horizon. In this horizon, if the time of deposit is low, the funds are invested in safe securities, and the returns are also less. If the time of deposit is medium, the funds are invested in mutual funds, shares, derivatives, etc. the returns are also moderate. Suppose the period of holding the investment is higher. In that case, the funds are invested in risk-based securities like foreign exchange, hedge funds, real estate sector, etc. the returns are also higher in the long-term investment horizon.

Recommended Articles

This article has been a guide to What Investment Horizon is and its meaning. Here, we discuss types, importance, and how investment horizon affects mutual funds, along with an example. You can learn more about financing from the following articles: -