This program is a collection of probably the best courses on investment banking. It is a 91+ hours of video tutorial which actually comprises multiple beginner to advanced courses on several finance topics that are directly and indirectly linked with investment banking tips. It is the same reason we named it a mastery program. This bundle course comes with 1-year unlimited access to the course content, links, study materials and downloadable templates. This is a completely online course with a self-paced learning option, which means you don't have to follow a schedule or attend a personal class. Everything is accessible with just a few taps on your device and a stable internet connection. One of the noteworthy features is that the course comes with case studies, real-world examples, industry references and professional experiences shared by the course instructors. What are you waiting for? Enroll in this program today and complete the certification courses for investment banking to enhance your career development.

Investment Banking Mastery Program (IBMP)!!

The Exact Training Used by Top Investment Banks | FM, DCF, LBO, M&A, Accounting, Derivatives & More | $2400+ in Exclusive Benefits | 100+ Wall Street-Level SkillsFLASH SALE!

Claim Your 60% + 20% OFF

FLASH SALE is here, and your chance to upskill has never been better.

💰 Get 60% +20% off (WSM20)

📈 Master financial modeling skills with expert-led training.

🕒 Learn anytime, anywhere, and boost your career prospects without breaking the bank.

🔥 Hurry - this FLASH SALE is live for a limited time only.

HIGHLIGHTS OF INVESTMENT BANKING MASTERY PROGRAM

Key Features & Highlights

Wall Street-Level Training

Wall Street-Level Training : Master FM, DCF, M&A, & LBO like investment banks.Financial Markets & Derivatives

Financial Markets & Derivatives : Understand markets & derivatives like top Wall Street firms.1,000+ 5-Star Ratings

1,000+ 5-Star Ratings : The most trusted investment banking program worldwide.100+ IB Skills

100+ IB Skills : Master skills used at J.P. Morgan, Blackstone, & McKinsey.Self-Paced & Job-Ready

Self-Paced & Job-Ready : Access expert-led, Wall Street-level training anytime.Certification

Certification : Earn a prestigious certificate to impress top recruiters.HURRY UP!

Unlock Premium Membership Benefits Worth $2400!

13+ Hours of Financial Modeling Mastery (Value: $298)

13+ Hours of Financial Modeling Mastery (Value: $298) :6+ Hours of Merger Modeling Training (Value: $248)

6+ Hours of Merger Modeling Training (Value: $248) :8+ Hours of LBO Modeling Training (Value: $248)

8+ Hours of LBO Modeling Training (Value: $248) :Comprehensive Derivatives Training (Value: $421)

Comprehensive Derivatives Training (Value: $421) :Access to 100+ Premium Excel Templates (Included)

Access to 100+ Premium Excel Templates (Included) :Career-Boosting Skills & Certification (Included)

Career-Boosting Skills & Certification (Included) :WHAT'S INCLUDED?

Introduction to Investment Banking

Enroll in this investment banking course free with a certificate to become aware of investment banking operations and improve your career prospects.

Our corporate finance course is designed for literally everyone. This corporate finance course can help you become good at managing your personal finance.

WHAT'S INCLUDED?

Excel for Finance

Master Excel for Finance and take your Financial Analysis skills to the next level!

WHAT'S INCLUDED?

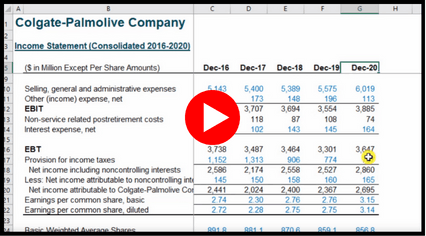

Accounting and Financial Statement Analysis

Join these basic accounting classes online to acquaint yourself with the role of revenue, expenses, assets, and liabilities in shaping the company's financial health.

With our 5+ hour high-quality video training on Ratio Analysis, you will embark on a transformative journey to uncover the mysteries hidden within financial statements.

In this comprehensive guide on "Accounting For Financial Analysts Course," learn the basic fundamental principles of accounting followed by financial analysts for financial reporting.

WHAT'S INCLUDED?

Financial Modeling and Valuation

In this comprehensive guide on "Financial Modeling Certification Online course," learn how to create a financial model and predict a company's performance for future years.

In this DCF Modeling Course, learn the dividend discount model, its types, sensitivity analysis, discounted cash flow (DCF), valuation ratios, and simplified approach for calculating terminal value as well. It gives you a deep understanding of various types of dividend discount models (DDM) and identifies companies for this model.

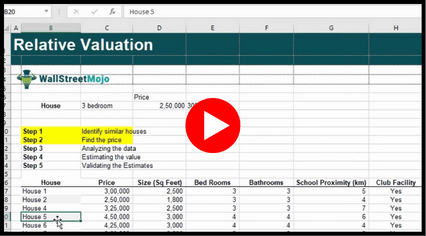

In this Trading Comps Valuation course, you get to explore the relative valuation model, its purpose, application, and relevance in the finance industry.

WHAT'S INCLUDED?

Merger Modeling

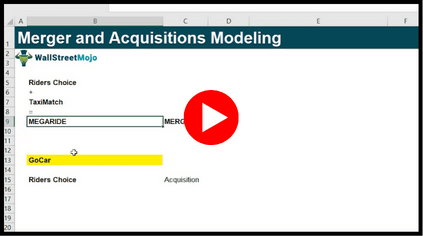

Learn how to easily develop a comprehensive mergers and acquisitions (M&A) model from start using MS Excel. This will entail preparing proforma income statements by merging the financials of both the target and the acquirer while ensuring that accounting principles are consistent.

WHAT'S INCLUDED?

LBO Modeling

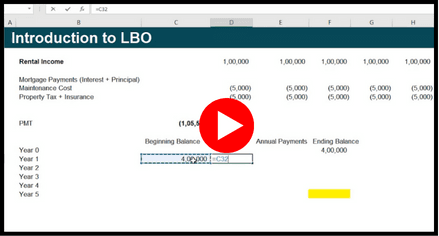

Take this LBO Modeling Course and learn to build an LBO model from scratch. Enroll now to enhance your financial modeling skills via LBO training.

WHAT'S INCLUDED?

Financial Markets and Instruments

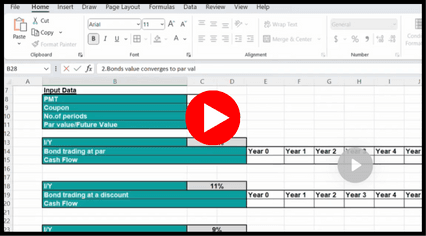

Break into the world of bonds and learn about its fundamentals, how to invest in it efficiently, and much more with our popular Crash Course in Bonds.

Learn bond valuation, yield curves, and more on your investments with our Fixed Income: Valuation, Return & Risk Measures Course.

Our Introduction to Currency Market course helps explore the modern forms of currency, identify its essential elements, and explore how it is traded.

Master the art of debunking bond risks with our Credit Analysis Course. Learn to perform Credit Analysis adjustment of fixed and zero-coupon bonds.

Explore the foreign exchange market with our Forex Trading course for beginners and learn to trade currencies using different indicators and patterns.

WHAT'S INCLUDED?

Derivatives and Risk Management

This basic derivatives course covers applications of derivatives and other advanced concepts. Enroll now to start learning and get certified.

Enroll in our Advanced Derivatives Course to explore the valuation and pricing of various derivatives and obtain Advanced Derivatives certification.

SKILLS COVERED

What Will You Learn?

This bundle course includes the best investment banking courses in India and around the world, in addition to a separate financial markets and instruments course. is designed to train you with future-proof skills and abilities that will turn the most complex tasks and operations into a piece of cake.

To start with, you will learn financial modeling and analysis, decipher credit analysis and Forex trading, and equip yourself with a series of currency market and derivatives techniques. Moreover, through this program, you will also explore mergers and acquisitions methods along with accounting and corporate finance.

There is so much more in this one bundle course that combines the best courses on investment banking that it is practically impossible to mention them all in just a few lines. We encourage you to take this course and become an investment banking wizard.

WHO ARE ELIGIBLE TO LEARN?

Who should attend the Investment Banking Elite Certification?

INVESTMENT BANKING ELITE CERTIFICATION COURSE PREVIEW

Sample Videos

PURSUE YOUR DREAM CAREER

Top Companies That Hire Professionals With Finance Certifications

COURSE INSTRUCTOR

Learn Directly From The Industry Expert!

Dheeraj Vaidya, CFA, FRM is the Co-Founder & Course Director of WallStreetMojo.

With an extensive background as a former J.P.Morgan and CLSA Equity Analyst, Dheeraj brings expertise in financial modeling, forecasting, and valuations. Over the course of his nearly two-decade career, he has trained and mentored more than 100,000 students and professionals across various topics, including investment banking, private equity, accounting, and more.

FEATURES OFFERED

Benefits Included For You

- Investment Banking Course

- Corporate Finance Course

- Excel for Finance Course

- Basic Accounting Course

- Ratio Analysis Course

- Accounting For Financial Analysts Course

- Financial Modeling Course

- DCF Modeling Course

- Trading Valuation Course

- Mergers and Acquisitions Modeling Course

LBO Modeling Course

- Bonds Crash Course

- Fixed Income: Valuation, Return & Risk Measures Course

- Introduction to Currency Market Course

- Fundamentals of Credit Analysis Course

- Forex Trading Fundamental Course

- Basic Derivatives Course

- Advanced Derivatives Course

CERTIFICATION

Earn 18 Certificates On Completion Of This Bundle Course!

There are hardly any online investment banking courses with certificates, but this investment banking mastery program offers you online certification. This certificate is highly recognized across industries and will dramatically increase your chances of grabbing a career opportunity in finance and investment banking jobs. This certification will validate your skills and will make you stand out from the crowd. With this certificate, you will pave the road to your career in investment banking.

ROLES FOR FINANCE

Careers With Investment Banking Certification

The careers that you can pursue with investment banking courses for beginners present in this bundle are as follows:

#1 - Intern:

Internships are a great opportunity to enter any field. After all, no one is expecting anything from you, yet you are introduced to real workplaces and offices with actual operations going on. You can pursue many investment banking short courses to get an internship. Most internships are paid and are offered by some of the best global companies. As per salary.com, in the US, finance and investment banking courses salaries for interns are around $62,911 annually as of October 01, 2024.

#2 - Analysts:

Analysts are the most common entry-level positions in any investment bank, financial institution or financial firm. They are responsible for studying long-form data, spotting patterns and trends and reporting them to senior management. This investment banking package includes financial analyst Excel training as well. Top firms such as Deloitte, PwC, Goldman Sachs, and Morgan Stanley provide these investment banking jobs, offering an average salary of $116,345 in the US annually.

#3 - Associate:

Associates work closely with managers and other department employees and are tasked with meetings, client visits, handling any form of error at their level, and reporting to managers with accurate results and figures. You will find many investment banking-related courses in this one bundle. In the US, the investment banking courses salary is approximately $37,681 for associates as of October 1, 2024, per salary.com, but yes, the figure varies depending on the firm size and the scope of their responsibilities.

#4 - Investment Banker:

‘Investment banker’ is a celebrated job profile. They are responsible for handling M&A clients’ investments, advising them in raising capital, financial modeling for investment banking and acting on their behalf. They are hired by top global firms and investment banking companies such as Bank of America, JP Morgan Chase, Morgan Stanley, and so on. In the US, investment banking salary goes up to $80,764 annually as of October 1, 2024, per salary.com data.

#5 - Vice President:

It is a top-level position, and only after gaining a certain level of expertise and experience can one reach this designation. In the finance industry, vice presidents enjoy a handsome salary of around $379,778 in the US as of October 1, 2024. This data is taken from salary.com.

#6 - Managing Director:

Lastly, this, again, is a top management position, and it takes a lot to become a managing director of an investment bank or finance firm. Companies such as JP Morgan, Barclays, or KPMG are often seeking people with unique skills to hire for such a job profile. Such investment banking professionals are given a salary package of around $328,797 as of October 1, 2024, in the US, per salary.com.

QUICK FACTS

Industry Trend

WHAT SHOULD YOU KNOW?

Prerequisites for Investment Banking Elite Certification

Individuals must meet certain requirements to enroll in the Investment Banking Elite Certification and ensure a hassle-free learning experience.

There are only minor requirements that one mus

- Any device that enables one to access the course content

- A stable internet connection

- MS Excel

BENEFITS AND FEATURES

Benefits & Features Of The Course

Here are some of the key benefits of one of the best investment banking courses online -

#1 - One-stop Solution:

This investment banking package is a is a combination of multiple training courses, which include financial modeling, accounting, mergers and acquisitions, and Excel for finance. Everything there is to learn about investment banking is included in this training program with a well-structured curriculum.

#2 - Become Certified:

This training program is one of the best investment banking certification courses that rewards you with an online certification that will not only validate your skills but will improve your reputation. You can link the certification to your professional portfolios and profiles like LinkedIn and attract recruiters and investment banking companies looking for fresh talent.

#3 - Equals a Master's Degree Knowledge:

Well, an investment banking master's degree is always a master's degree. Still, this investment banking package will make sure that even without taking a master's degree, you possess the same level of knowledge, skills and abilities that are required in an investment banking profession.

#4 - Career Development:

This training program will open opportunities for you. At the same time, you will learn what it really takes to become an investment banking professional. The modules developed by our highly experienced instructors will help you understand investment banking basics through their key experiences and professional insights with you.