Table Of Contents

What Is Investment Banking Job Description?

The investment banking job description refers to the responsibilities of analysts and associates in an investment banking firm. They are expected to study market trends along with conducting research and review financial information. They conduct a detailed analysis of financial models, deals, and other facets of their organization to determine the profitability and viability of their business.

An analyst or associate at an investment banking company is expected to portray exemplary research skills, and an innate ability to interpret market trends and current affairs into financial data. Moreover, since an investment banking job can be an intense role to play, the individual is required to absorb and work efficiently under pressure.

Table of contents

- The job of an investment banker involves various key responsibilities such as managing corporate finance, mergers and acquisitions, initial public offerings, capital financing, equity research, etc.

- Investment banking features long work hours and a hard-working individual to cope with the unending workload and upcoming innovative financial moderations and methodologies.

- The skills required for becoming an investment banker include MS excel, financial modeling, capital, and equity market research and analysis, valuations, etc.

- Technical skills are required to cope with the upcoming technical analysis and innovative financial tools. These include MS Excel, VBA Macros, and MATLAB.

Requirements

The following are the skills that make an effective Investment Banker:

- Excellent proficiency with MS Excel

- Develop financial models to perform forecasts on variables like credit growth default rates.

- Conceptually sound knowledge of concepts like Derivatives, Fixed Income Securities, and Corporate Finance is necessary.

- One is required to perform Valuations of companies for opportunities for mergers and acquisitions. Consequently, proficiency in doing Discounted Cash Flow Valuations and other valuation methods are expected.

Investment banking deals not only with simple investment instruments like equities and bonds but also with "Derivatives." Derivatives are financial products that derive their value (market value) from the underlying asset.

For example, equity derivative sees its market value as decided by how those equities perform in the stock market.

Qualifications

source: efinancialcareers.com

Below is the list of qualifications to become an investment banker:

- Masters or advanced level qualification in Finance and Statistics

- Candidates with MBA degrees, particularly in Finance, Quantitative Finance, have an upper edge in making it to the industry.

- A stronghold on Econometrics with knowledge of econometric modeling is required.

- Candidates with undergraduates in STEM courses in their curriculum or engineering background have an advantage in developing and handling quantitatively heavy valuation models and analysis.

Therefore, a career in investment banking requires dealing with data and numbers, and one needs computer-based software to perform such calculations. As a result, having appropriate technical skills is as essential as any of the above-mentioned points.

Roles & Responsibilities

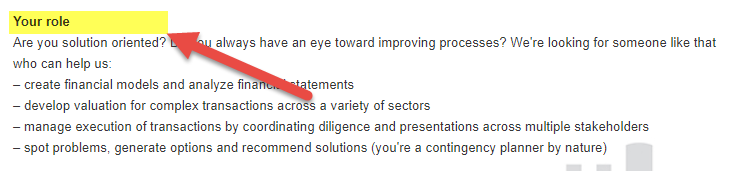

Below is the Investment Banking Job Description and the role taken from an actual opening.

Investment banking deals not only with simple investment instruments like equities and bonds but also with "Derivatives." Derivatives are financial products that derive their value (market value) from the underlying asset.

source: efinancialcareers.com

A few of the most sought after requirements of the job are as follows:

- Analyzing financial statements of companies with simultaneous evaluation of its peer companies.

- Should be well versed with Financial Modeling and should be able to create companies' financial models.

- The analyst must be able to perform valuations for complex transactions, and also the role may not be sector-specific.

- Through an understanding of accounting conventions to be competent in analyzing companies operating in different parts of the world.

- Build and manage Leveraged Buyout Models, M&A Consequence models for live transactions

- They are also required to advise their clients on local and global market conditions and forecast future performance expectations.

- They must be able to present investment options with a healthy return rate before his clients.

Technical Skills

This list of technical skills as a part of the IB job description has been compiled by studying various openings from top bulge bracket investment banks like JPMorgan, UBS, Gold Sachs, Morgan Stanley and others. Few of the most sought-after skills are as listed below:

- MS Excel – An expert level of proficiency is needed with this tool. This could be treated as the first step if one needed to develop a career in the Investment Banking industry.

- VBA macros: While Excel is the first step, one should analyze data via various programming languages like Python, R, and SAS to generate automated tasks such as report generation.

- MATLAB: is another important tool that is extensively used in the industry. While Python and R are freeware (available to use for free), MATLAB requires the purchase and licensing to use it. However, a good pick for beginners could be Python or R.

Since investment banking carries out a lot of mergers and acquisitions, it becomes critical to gauge the level of risks involved in the mergers or buyouts. Risk, in Finance, is defined in a very comprehensive mathematical way. Theories and models to calculate risk and incorporate them into decision-making are available. A few of these models and theories are discussed below:

- Using risk models to identify risk factors like default rate, NPA shares

- Candidates with internationally recognized certifications like CFA and FRM are preferred as they are adept in the quantitative aspect of risk calculations.

- Tools like stress testing, A/B Testing, Monte Carlo Simulations are few of the methods which are used by the industry in their calculations

As an IB analyst professional, one of the tasks is to fulfill the client's requirements. Naturally, one of the most important client demands is the swift and accurate availability of information.

Additional Skills

In addition to the financial and profitability analysis, an analyst or an associate would be expected to portray a range of hard and soft skills to cope with the high-pressure job. A few of the most prominent skill sets are as discussed below:

- The timely month-end news release and reporting along with other finance projects and duties

- Impeccable command of the English language and sharp communication skills

- A proactive approach towards coordinating amongst various departments and teams to ensure error-free and timely reporting to department heads and senior managers.

- Soft skills to handle clients' intense situations like a market downturn or unforeseen events before the closure of a deal.

A career in investment banking demands more than just a good combination of various skills. It comes with high-pressure working requirements and expects investment bankers to be on their toes all the time. Therefore, the remuneration and rewards are proportionately high and lucrative.

Frequently Asked Questions (FAQs)

The key responsibilities of an investment banker include financial analysis and corporate financial governance for corporations and institutions. In addition, they include financing through debt/equity, valuation, financial modeling, data analytics, underwriting and brokerage, initial public offerings, mergers, and acquisitions.

The requirements for the job of an investment banker are a bachelor’s degree in quantitative disciplines which is a basic requirement for an investment banker. Other requirements include a master’s degree in a quantitative disciplines, certifications such as CFA, analytical experience and skills, mergers and acquisitions skills, etc.

Analysts are an entry-level job position requiring a relevant bachelor's degree and perhaps, a few certifications. However, an associate is an upgraded level of position, usually requiring an MBA graduate.