Table Of Contents

Functions of Investment Banking

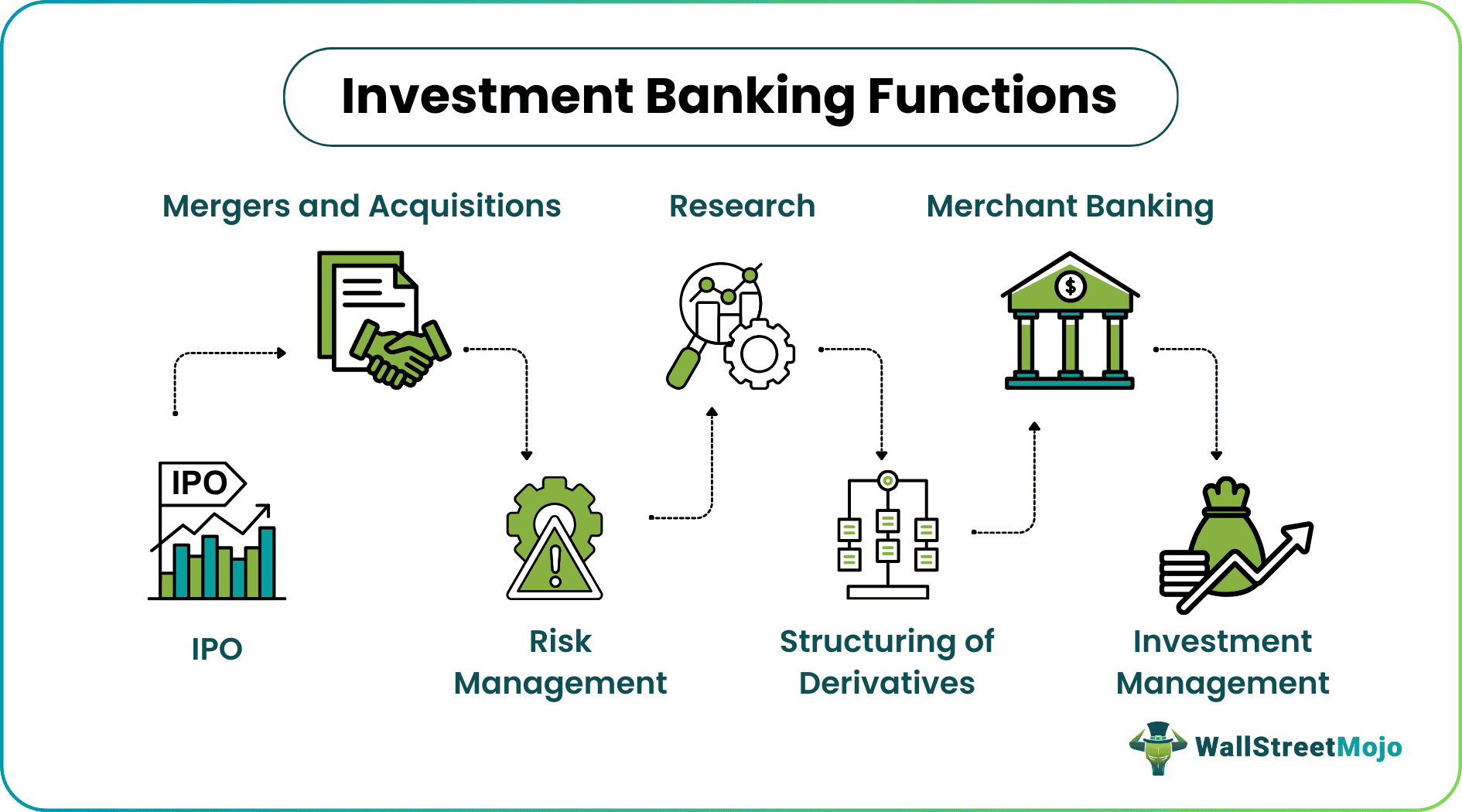

Investment Banks perform various economic functions by offering different financial services to their clients, such as helping the corporations find the investor for obtaining the debt finance, underwriting the stock issues, working as the financial advisor, handling the mergers and acquisitions, etc.

An investment bank is like a middleman between investor and issuer and helps clients raise money through debt and equity offering. Some investment banks are JP Morgan Chase, Goldman Sachs, Credit Suisse, Morgan Stanley, etc.

Key Takeaways

- Investment banking functions refer to the wide range of financial services provided by investment banks like Goldman Sachs, JPMorgan Chase, and Credit Suisse to their clients.

- Some of the core investment banking functions are the launch of initial public offerings, conducting thorough research related to financial markets, offering merchant banking services, and underwriting.

- Investment banks play a crucial role in helping companies mitigate or eliminate financial risks. Some of the risks that investment banks help minimize are operational risk, credit risk, and compliance risk.

- Merchant banking offered by investment banks includes various services, like portfolio management, leasing services, and fundraising.

#1 - IPOs

source: wsj.com

This investment banking function, i.e., IPO is an initial public offering wherein a company hires an investment bank to issue an IPO.

Below are the steps followed by a company for its IPO:-

- Before the issuance of an IPO , companies hire an investment bank. This bank is chosen based on different criteria like market reputation, industrial experience, quality of research and distribution channels, etc.

- Selected banks do underwriting where it acts as a broker between investors and issuing companies.

- The investment bank works out the financial details of the IPO in the underwriting agreement.

- Post that company files the registration statement along with the underwriting agreement with SEC.

- Post-approval of IPO by SEC underwriter and issuing company decide offer price and several shares be sold.

- After issuance, the bank carries out aftermarket stabilization in which that bank analyzes aftermarket stabilization and creates a market for the stock.

- The final stage is a transition to market competition. After 25 days, the bank provides an estimate regarding the valuation and earnings of the issuing company.

IPO is one of the major investment banking functions. Investment bank helps a company set everything and list an IPO in a stock exchange. This bank, in return, charges a commission from a company.

Video Explanation of Careers in Investment Banking

#2 - Merger and Acquisitions

source: businessinsider.in

Merger and Acquisitions are corporate finances, management, and strategy dealing with purchasing or joining other companies. An investment bank, in return, charges fees for M&A. M&A company hires a bank for mergers and acquisitions. The following steps are taken for M&A by investment banks.

- There are two types of roles in M & M&A of an investment bank: seller representation and buyer representation.

- A critical role in M&A is the valuation of a company. The bank calculates the actual value of a company.

- Investment bank builds its strategy for M&A of two companies.

- The investment bank also does financial provisioning for a company as M & M&A companies will need lots of funds. It helps a company in raising funds for M&A.

- The main role is to issue new securities to the market.

This investment banking function helps a small firm to project itself and design a merger once a suitable target is found. It helps in the merger's success, which is all done with the help of an investment bank.

#3 - Risk Management

From the name itself, Risk Management is clear that its risk management involves a continuous process as capital is involved. It set a limit to avoid loss in trade. Investment banks help a company in the following ways:-

- Investment banks help a company manage financial risk in terms of currency, loans, liquidity, etc.

- This bank helps a company to recognize the loss area.

- This credit risk-control credit risk investment spreads out counterparties, and banks choose stock exchanges for trading.

- There are different risks like business risk, investment risk, legal & compliance risk, and operational risk, internally controlled by an investment bank.

Investment banks do risk management at every level as it highlights the risks and how they can be handled.

#4 - Research

This equity research investment banking function is one of the most important investment banking functions. This research helps provide a rating to the company to help investors decide on investment. Research reports tell whether to buy, sell, or hold based on a company's rating. Through this, one can know the worthiness of the company. Research is done by analyzing and comparing various company reports and performance reports. Investment banks' primary work is research, and these researches are of multiple types like equity research, fixed income research, macroeconomic research, qualitative research, etc. Investment banks share these reports with clients, which helps an investor to generate profit through trading and sales.

#5 - Structuring of Derivatives

Derivatives products offer a high rate of return and a good margin; hence, many risks are involved. Investment banks prepare these derivatives with a strategy based on single and multiple securities.

For this Investment banking function, i.e., structuring derivatives, investment banks need a strong technical team working on such a complex structure of derivatives.

Investment banks design securities with different derivatives options. The main reason to design such a product is to attract investors and increase the profit margin.

This bank adds features to it, like in bonds. It provides future and options derivatives etc.

Another derivative is also available in the market; it helps generate a good return to investors.

#6 - Merchant Banking

This investment banking function is one of the personal activities of the investment bank where the bank also does consultancy for their clients. It acts as a financial engineer for business. They provide consultancy in financial, marketing, legal, and managerial matters.

Merchant banking has the below functions:-

- Raising finance for a client

- Broker in Stock exchange

- Project management

- Money market operations

- Leasing service

- Portfolio management

- Handling government consent for industrial projects

- Managing public issue of a company

- Special assistance to small companies and entrepreneurs

Investment banks provide multiple other services to their clients. This bank charges consultancy fees from investors.

Working in any division within an investment bank, be it research or merchant banking, requires individuals to have specialized skills. If you are wondering how to develop such skills, this Investment Banking Mastery Program (IBMP) can be your answer.

Led by an industry expert who has over 15 years of experience, this program covers all key techniques used by investment bankers step-by-step. The real-world examples and case studies, along with the detailed explanations in the program, will ensure that you develop the practical understanding required to build an illustrious career in investment banking.

#7 - Investment management

This investment banking function is a core job of an investment bank to guide the investor to purchase, manage his portfolio, and trade various securities. Investment banks prepare reports based on company performance, and through this investment bank decides on financial securities. Investment advice is based on the client's objective, risk appetite, investment amount, and period. Based on the customer segment, investment management is divided into Private clients, Private wealth management, wealth management. Here, an investment bank manages a portfolio of customers and provides tips to investors on whether to sell stocks, buy stocks, or hold stocks.