Table Of Contents

What is Investment?

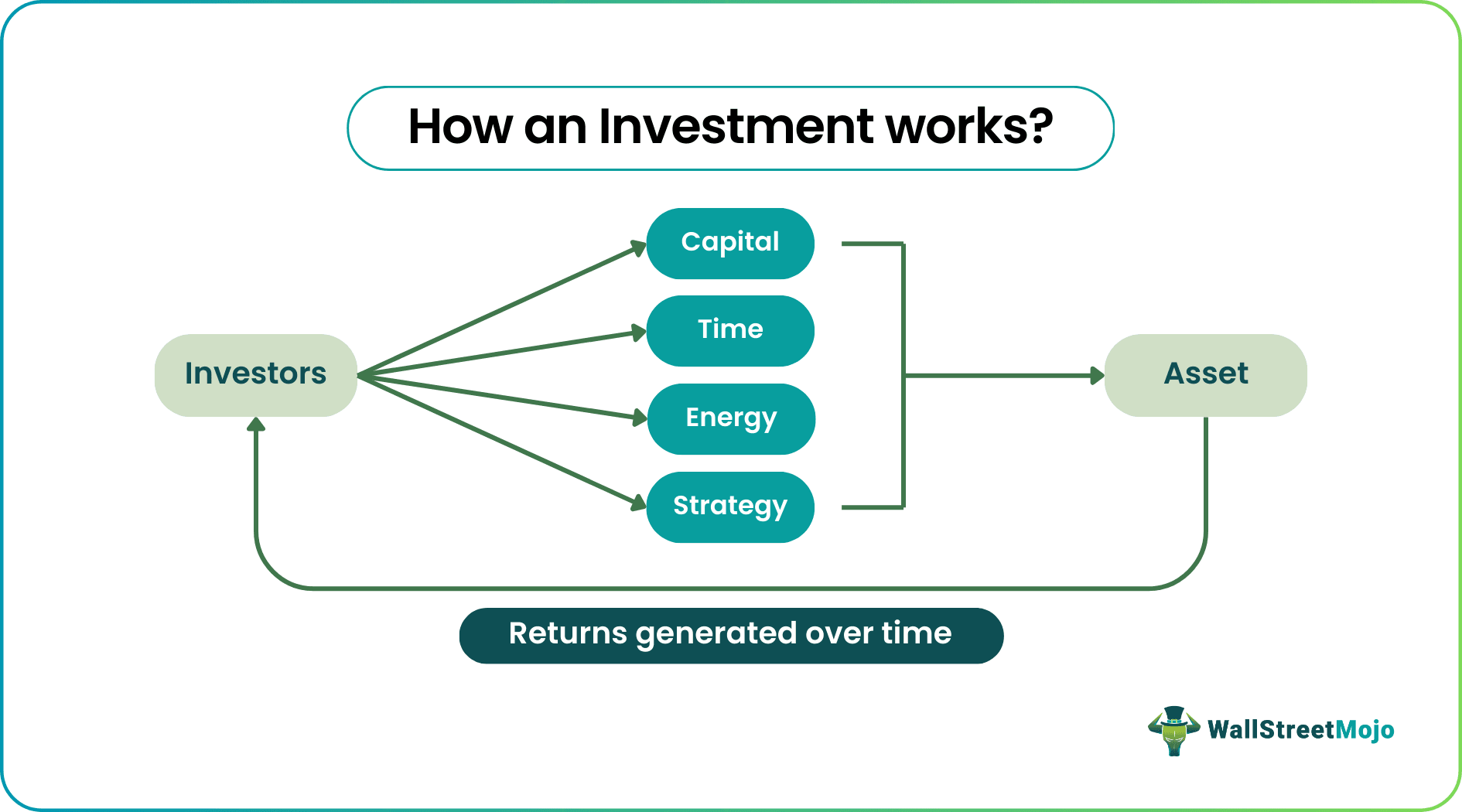

Investments are typically assets bought at present with the expectation of higher returns in the future. Its consumption is foregone now for benefits that investors can reap from it later. Generally accrued over a period, investments can generate either profits or losses. They can be made by individuals and entities alike.

The income generated can fulfill financial goals by meeting shortages in income, debt repayment, education or student loans, etc. Investors can use it to purchase further assets that generate additional income and further investment. It fulfills the aspirations of increasing revenue without working hard for the same.

Table of contents

- What is Investment?

- Investments are usually assets that one purchases now with the hopes of greater returns in the future. They postpone its consumption today for the sake of future rewards.

- The main purpose of investing is to earn profits. People can utilize it to satisfy financial objectives such as income inadequacies, debt repayments, education or student loan repayment, etc. Investors can also use it to buy more assets that generate more revenue.

- Smart investments can help investors earn more money, gain financial stability, and achieve financial goals. People can accomplish this through the compounding nature and inflation-beating returns.

Investment Explained

Investments are another form of savings, except that they generate an attractive rate of return. They can grow into more than what they were initially worth. Assets can be stock market investment, precious metals, land, real estate investment, etc. They generate income in two ways. One is through profit if it is in a saleable asset, and the other is through gain accrual if it is in a return-generating plan.

A person can invest for various reasons. The primary goal is, however, to gain high returns. It can be through yield plus capital appreciation (the difference between purchase and sale price). Dividends and interest received are examples of such yields. The returns are subject to various conditions, including the maturity period, the type of investment, and the risk involved. Investors also invest for liquidity since a liquid asset is easily convertible into cash within a short period. When liquidity is high, then returns may be less.

Saving and investing are related to each other even though, from an economic standpoint, investing and saving are distinct concepts. Savings refers to any income that is not spent on consumption, regardless of whether they are being invested for greater returns. As a result, individuals' investment, saving, and consumption values might differ during a given specific period.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Effects of Investment

It's not just the individuals who invest; companies also make investments. Corporate and capital investments enhance the economy's capacity to produce. They result in economic growth. If there is no investment activity in the economy, it can result in unemployment. But there are negative effects to over-investing too. If investing exceeds savings, inflation occurs. Investing has effects on both individuals and economies. It is not a good sign if an economy comes to depend on investments alone for its income generation.

There is always a certain degree of risk that comes with investments. Wrong investment decisions can make someone lose their hard-earned money. Therefore, the smart investment includes considering the safety factors too. Individuals who prefer to keep cash safe for adequate returns choose to invest in government bonds.

Types of Investment

Investments are broadly classified into:

#1 - Stock Market Investment

Commonly known as stocks or shares, equity securities represent an ownership interest in a company. A shareholder is an investor who owns a share/stock in a company. They usually receive payment last in liquidation or winding up of the company. After that, they receive whatever remains after paying creditors, the government, etc. Holding stocks pay dividends. Dividends are profits that companies distribute to their shareholders.

#2 - Investment in Debt securities

Debt securities are otherwise known as "fixed-income securities." They give periodic returns until the maturity date. Bonds belong to this category. A bond is a contractual obligation of the seller to repay the buyer a certain amount of interest plus the principal on the maturity date. Some instruments do not pay periodic interest, such as discounted bonds. Instead, people sell them at a discount and return their original value to investors. Other instruments include treasury bills, corporate and government bonds, etc.

#3 - Investments in Derivative Securities

It is otherwise known as "contingent claims." They derive their values from the underlying security or assets. Options and futures are two such securities. Options provide rights to traders to buy or sell, but there is no obligation to do so. Call options are to buy, and put options are to sell. A futures contract comes with an obligation to buy or sell the asset at a predetermined price and time.

Examples

Check out these examples for a better idea:

Example #1 - Return on Investment

Let's take the example of two friends, David and Daniel. David invested $10000 at the age of 25, and his friend Daniel started investing with the same $10000 at the age of 35. When they were fifty, David had $33,863.55, and Daniel had $20,789.28 with him. Even though both friends invested the same amount of money with the same interest rate, David had more money. This is because he had started investing long before Daniel. The amount carries the compounding interest difference of ten years between the friends. Compounding interest increased the profit, or otherwise the return on investment collected by David. This example demonstrates the power of investing for longer periods.

Example #2 - Smart Investment

Harry and Jerry wanted to invest their game-winning money. Both wanted these investments to serve emergency purposes. Harry invested in shares of a company, and Jerry chose to invest in the real estate sector, thinking it would give high returns. When an emergency struck, Harry sold his shares and received cash. Unfortunately for Jerry, selling real estate required a significant amount of time and paperwork, so he could not sell it in an emergency. This example demonstrates the essence of knowing the goal and the means to invest in it. Harry had chosen a high liquidity asset, which would be appropriate as the goal was "to serve in an emergency." After thorough research and analysis, investors should make similar decisions considering the purpose, risk involved, the factor of liquidity, etc.

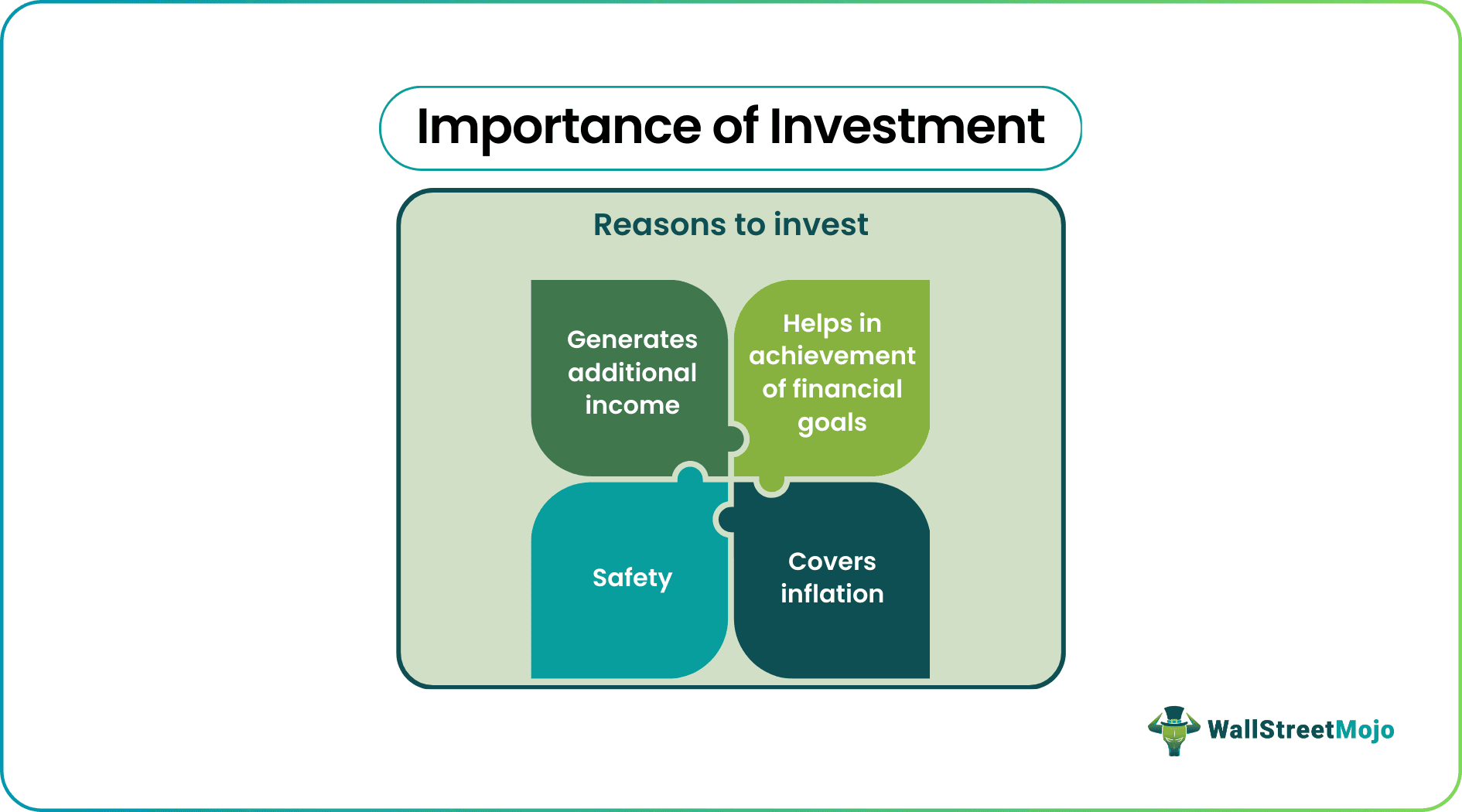

Importance of Investment

The importance of investing is more apparent when one examines the differences between saving and investing. Savings are cash that one puts in safe places such as savings accounts, certificates of deposit, etc. They allow access to an individual's money at any time. The security factor and availability pay less interest. If one leaves the money (with interest) in place for an extended period, they do not keep pace with inflation.

For example, suppose the savings can buy a bottle of water today for $1, and that one dollar, along with interest accrued, can only buy half a bottle of water after a few years. This is the effect of inflation. Here, the value of money decreases. Therefore, investing is a way out. Clearly, it can provide returns that cover inflation, saves tax, and much more. Investing can, thus, reward individuals (and entities) more for the risk involved, especially if the investment is long-term.

Investing provides individuals with financial security, and selling off assets can provide a getaway from a financial crisis. It provides financial independence. Reinvesting the existing dividends and interest can earn more and more returns. Reinvesting the returns is how a person can build wealth. Investing also helps individuals achieve their personal and financial goals. Smart investment choices can help investors achieve short-term, medium-term, and long-term goals.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Smart investments provide additional income, financial security, and the achievement of financial goals. It is achieved through inflation-beating returns and the compounding nature of these investments.

The liquidity concept refers to the ease at which a given asset can be converted into cash in terms of time and cost. For example, land and real estate investment are the least liquid as they take several months to years to be sold.

Interest, dividends, capital gains, rental and royalty income, and non-qualified annuities are all examples of net investment income. If the investor earns more than the threshold amount, individuals must report the net investment income tax in Form 8960. The form helps in calculating the amount of taxable investment income.

Assets are instruments that generate income or profit. Unless investments result in losses, they are considered assets as they accrue benefits over time.

Recommended Articles

This has been a guide to Investment and its Meaning. Here we learn the types of investments, their explanations, importance and examples. You can learn more from the following articles –