Table Of Contents

What Is An Inverse ETF?

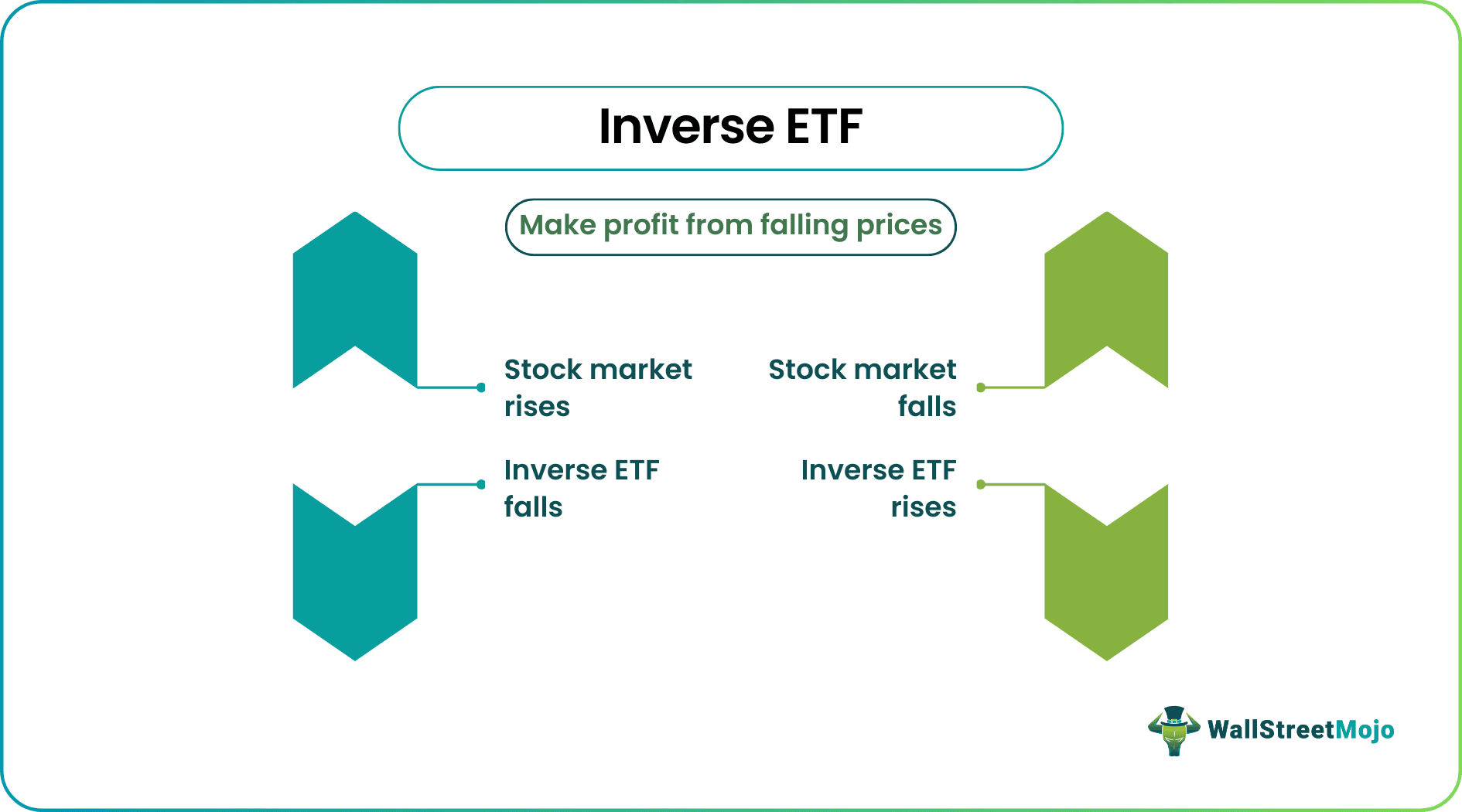

An inverse ETF is an exchange-traded fund (ETF) designed to generate returns when the value of the underlying asset or index falls. The product generally uses various financial derivatives, such as options and futures contracts, in their underlying constructs.

The ProShares Short QQQ is one of the examples which targets daily investment returns that are the inverse of the NASDAQ-100 Index's daily performance. Individuals and institutions will invest in this technique to protect or hedge positions and can also be used to speculate on a particular sector or index.

Table of contents

- What is an Inverse ETF?

- An inverse ETF generates profit when the market declines. Also, they commonly use options and futures contracts in their underlying construct.

- The optimum holding period is a single trading day, and if it crosses the set time, the fund managers subject inverse exchange-traded funds to rebalancing.

- In contrast to shorting, it aims to avoid the expense of borrowing but attracts interest charges and brokerage fees. Also, they come with a high expense ratio and compound risk.

- Leveraged Index ETFs will work similarly, but they multiply the results by double or triple the returns.

Inverse ETF Explained

Inverse ETFs share a complex relationship with indexes. They don't follow traditional ETFs buy-and-hold strategy where investors buy ETF's when speculating that the ETF value will increase in the future. An inverse exchange-traded fund, on the other hand, is used for the exact opposite reason. Its value is inversely proportional to the value of the target asset class or index. Also, they are commonly used by day traders than long-term investors, and holdings are rebalanced daily to maintain the specified allocation percentage of various components in the ETF.

When traders buy an inverse ETF, they expect the underlying benchmark to decrease in value. When the underlying measure decreases, the inverse exchange-traded fund will increase in value by the same amount, not including any fees or commissions included in the transaction. These short-term investment vehicles aim to achieve a multiple index return in a single trading day; however, returns for periods extended than that may be more or less than the single-day benchmark. It is the effect of compounding; gains and losses are compounded daily.

Many believe that inverse exchange-traded funds are more productive and less risky when the holding term does not exceed a single trading day. However, they tend to perform poorly over a long time as the underlying indexes have historically outperformed on a long-term basis. In addition, since the ETF's are managed daily, traders may also have to pay higher fees along with interest payments which will take away from investors' profits. Hence it produces a high expense ratio and compounding risk. According to research from etf.com, the average expense ratio for inverse ETFs is 1.02%.

Practical Example

One of the examples of aggressive inverse exchange-traded funds targeting the decline in value of the S&P 500 Index is ProShares UltraPro Short S&P 500 (SPXU) issued by ProShares on June 23, 2009, and listed on the NYSE Arca.

It seeks a yield that is three times the negative of the S&P 500 Index daily performance. If traders anticipate the S&P 500 stock index's value will decrease throughout the trading day, they may invest in the ProShares Short S&P500 inverse ETF. It achieves these outcomes essentially using futures contracts and swaps. The main assets of the fund include S&P 500 swaps from big banks like Bank of America, Goldman Sachs, Credit Suisse International, JP Morgan, and Morgan Stanley. SPXU has a relatively high expense ratio of 0.91 percent. The high expense ratio of the fund can be attributable to its daily rebalancing.

Leveraged Inverse ETF (2X and 3X)

In addition to having inverse ETF's, a leveraged ETF takes it a bit further by increasing the leverage by either double (2X) or triple (3X). Leveraged inverse exchange-traded funds use the same tactics to deliver results, utilizing derivatives to resemble an underlying index's returns. However, the difference with leveraged ETFs is they expand the returns by double or triple the amount. There are leveraged inverse exchange-traded funds for various sectors, industries, currencies, commodities, and countries. A few examples can include:

- Oil and Gas – ProShares Ultrashort Oil & Gas ETF 2X (DUG)

- Real Estate – ProShares Ultrashort Real Estate ETF 2X (SRS)

- Biotechnology – Direxion Daily S&P Biotech Bull and Bear 3X (LABD)

- Brazil – ProShares Ultrashort MSCI Brazil Capped ETF 2X (BZQ)

- Gold – ProShares Ultrashort Gold ETF 2X (GLL)

- Euro – ProShares Ultrashort Euro ETF 2X (EPV)

These financial instruments give individuals and institutions the ability to bet against a wide range of assets or sectors. As the underlying asset or index decreases in value, the leveraged inverse exchange-traded fund will increase by the leveraged amount. For example, if you buy into the gold leveraged inverse exchange-traded fund and gold drops in value by 2%, the 2X leveraged inverse exchange-traded fund will increase by 4%.

Fequently Asked Questions (FAQs)

Top inverse ETFs list:

• ProShares UltraPro Short QQQ (SQQQ): Example of NASDAQ inverse ETF targeting NASDAQ 100 index.

• ProShares Short UltraShort S&P500 (SDS): Example of S&P 500 inverse ETF targeting the S&P 500 index.

• Direxion Daily Semiconductor Bear 3x Shares (SOXS): Targets an index of companies involved in the production of semiconductors.

• Direxion Daily Small Cap Bear 3X Shares (TZA): Targets small-cap Russell 2000 index.

• ProShares UltraShort 20+ Year Treasury (TBT): Targets Barclays Capital U.S. 20+ Year Treasury Index.

An inverse ETF is an exchange-traded fund (ETF) crafted by using various derivatives like futures, options, and swaps to profit from the decline in the value of the underlying construct. It is a short-term investment vehicle used by prudent day traders.

Inverse exchange-traded fund with significant leverage levels, like the one yielding more than one time the inverse returns, eventually falls to zero over time.

Recommended Articles

This has been a Guide to what is Inverse ETF and its Meaning. Here we explain leveraged inverse ETF (2X and 3X) and practical examples along with benefits and disadvantages. You can learn more about financing from the following articles –