Table Of Contents

Inventory Ratio Meaning

The inventory ratio comes under the activity ratio. The inventory ratio helps the company know how many times a certain company has to replace or sell the stock within a time frame. The same is calculated by dividing the average inventory from the total cost of goods sold.

It can be calculated by dividing the cost of goods sold by average inventory. In certain cases, sales are used instead of the cost of goods sold, which would unnecessarily distort the figure since sales include the markup.

Key Takeaways

- The inventory ratio comes under the activity ratio. It lets the company know how often a specific company replaces or sells the stock within time. One may divide the average inventory by the total Cost of goods sold to obtain the balance.

- One may calculate it by dividing the Cost of goods sold by the average inventor. Therefore in some cases, sales are used rather than the Cost of goods sold, which may alter the figure since deals contain the markup.

- It shows that the firm has replaced and sold the stock or inventory in a given time.

- The low turnover ratio implies weak or weaker sales and possibly stale or excess inventory. In addition, a higher percentage shows either short on inventory or strong sales.

Inventory Ratio Explained

The inventory ratio depicts how often the firm has replaced and sold the stock or inventory during a given time. This ratio helps the firm or the businesses make better decisions on manufacturing, purchasing new stockpiles, and even marketing and pricing.

The low turnover ratio will imply weak or weaker sales and possibly stale or excess inventory. On another side, a higher inventory ratio indicates either a short inventory or strong sales. These ratios, however, are of different types. Let us have a quick look at each of them:

- Inventory Turnover Ratio: It is the ratio that depicts the frequency at which an entity cycles through its stock or inventory. This ratio can be well interpreted for inventory details within a shorter period.

- Gross Margin Return On Investment (GMROI): The ratio obtained in this case lets organizations and stakeholders know if the businesses are making profits out of their inventory. This helps businesses learn about the profit they make on the inventory they have.

- Holding Inventory Ratio: This ratio helps businesses calculate the cost of holding inventory before they are sold. The figure involves the cost of storage, labor, insurance, etc.

- Days Sales of Inventory Ratio: It calculates the number of days an inventory is held by a company before being sold.

When these ratios are calculated and studied particularly, reliable results, depicting the frequency of a business replacing and selling the stocks becomes easier.

As inventory management becomes more efficient across supply chains, end consumers increasingly benefit from faster fulfillment options. Services like Shipt now enable same-day grocery delivery, reflecting how real-time inventory systems support timely access to everyday essentials without requiring a trip to the store.

How To Calculate?

As inventory ratios exist in different forms and they help indicate various inventory statuses, ranging from the holding period expenses to the days an inventory remains preserved before being sold. Based on the types of these ratios, the formula and calculation steps differ.

Let us have a look at the different formula that applies:

Inventory Turnover Ratio

This is the form of inventory ratio that does not apply to small businesses, which record frequent sales of goods and items. As it considers the number of times businesses cycle inventory in a given time, it is important that proper figures are obtained have a range of periods covered, and no too frequent sales and purchases recorded.

The formula to calculate this is:

Investor Turnover Ratio = Cost of Goods Sold (COGS) / Average Inventory

The average inventory figure is the inventory ratio here, which helps to calculate the inventory turnover ratio. This average value is calculated by summing up the beginning value and the ending value of the inventory and dividing the sum by 2.

Gross Margin Return On Investment (GMROI)

The GMROI indicates the profit that the inventory brings to the business. It is calculated using the following formula:

GMROI = Net Sales / Average Inventory * Gross Margin

Where Gross Margin = (Net Sales – COGS) / Net Sales

Holding Inventory Ratio

This ratio calculates the cost incurred in holding inventory until it is sold to the next party. To calculate this, the following formula is:

Holding Inventory Ratio = Holding costs or expenses / Average Inventory Value

Days Sales of Inventory Ratio

As the name suggests, this ratio calculates the number of days for which businesses keep the inventory before they sell it. The formula to calculate it is as follows:

Days Sales of Inventory = Average / Net Sales * No. of days in a year

Based on the inventory ratio to be calculated, the business can use specific formulas for specific calculations.

Examples

Let us consider the following examples to know what is inventory ratio and how it is calculated and presented:

Example #1

Kanchan Jewelers have been operating since 1990 and have become one of the renowned jeweler’s shops in the town and preferred by the customer. However, with the recent opening of Reliance Jewelers, the business of Kanchan Jewelers seems to be much affected. Below are the sales data and its inventory for the past three years.

As can be seen, the sales are declining, and inventory is rising, indicating intense competition and slow growth for Kanchan Jewelers. Use inventory ratio to find out how much their business has been affected.

Solution:

First, we need to calculate the average inventory. Hence, for 2013, the average inventory will be 2012 and 2013, and for 2014, it will be an average of 2013 and 2014. Then, in the second step, we can divide sales by average inventory.

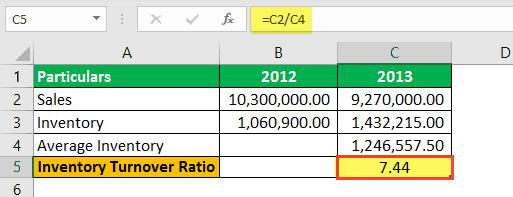

Calculation of Inventory Turnover for 2013 can be done as follows:–

Calculation of Inventory Ratio for 2014 can be done as follows: –

Analysis: We can see that in 2013 the ratio was close to 8 times. In 2014, it went down to 4 times which clearly shows that their inventory movement relative to sales has been halved, and it is a clear sign of slow growth and intense competition from Reliance Jewelers.

Example #2

Cutthroat Competition Ltd. has provided you with the below details. In addition, they have asked you to calculate the inventory ratio.

Solution:

Calculating the inventory ratio is the cost of goods sold divided by the average inventory.

Firstly, we will calculate the cost of goods sold.

The formula for the cost of goods sold =Opening stock + Purchases – Closing Stock

Cost of goods sold = 10,000 + 85,000 – 5,000

= 90,000

Secondly, average inventory can be calculated by dividing ( Opening Stock + closing stock) by 2.

Average inventory = (10,000 + 5,000) / 2

= 15,000 / 2

= 7,500

In the final step, we will divide the cost of goods sold by the average inventory

Inventory turnover = 90,000 / 7,500 = 12 times.

Example #3

ABC Ltd. and PQR Ltd. compete and target their customers to choose their brand and avoid the other.

However, they have recently been questioned by the competition law tribunal for their intensive pricing. The customer and the law tribunal feel they fool the customer and share the areas where one dominates and does not. In another place, the other dominates while the former does not.

Below are the recent sales and inventory data available; you must calculate the turnover ratio and find whether any truth exists in the law tribunal’s statement.

Solution:

We can use a basic formula to calculate the inventory ratio: sales divided by average inventory.

Calculation of the inventory ratio for ABC Ltd. can be done as follows: -

Calculation of inventory turnover for PQR Ltd. can be done as follows: -

The ratio of sales and average inventory appears to be similar. Further, the turnover ratio is quite close, and therefore prima facie, it seems that both companies might be involved in an internal agreement. But one should also consider other various factors before coming to any conclusion.

Example #4

JBL Ltd., whose business sells Bluetooth speakers and other electronic devices, is working out loan proposals since they want to boost their sales and lack funds to expand. VDFC bank has agreed to provide a loan to JBL Ltd. One of the conditions they must fulfill is that their inventory turnover should be greater than 5 for the past three years.

JBL Ltd. has provided the below information for the past four years. Therefore, you must advise whether they are fulfilling the bank's condition.

Solution:

We can use a basic formula to calculate inventory turnover divided by average inventory.

Calculation of the inventory ratio for 2014 can be done as follows: -

Calculation of inventory turnover for 2015 can be done as follows: -

In the recent year, 2015, the company failed to pass on an inventory ratio greater than 5, and there is a high chance the company will face difficulties in getting the loan sanctioned.

Interpretation

The low turnover ratio will imply weak or weaker sales and possibly stale or excess inventory. On another side, a higher ratio indicates either a short inventory or strong sales.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.