Table Of Contents

What Is Inventoriable Cost?

Inventoriable cost is the total direct expense incurred by a firm in manufacturing or producing goods or products. These include cost related to the purchase of inventory (raw material, WIP, finished goods) as well as cost that is incurred to manufacture the goods till the point of sale.

Also known as product costs, inventoriable costs differ hugely, depending on various factors, including the type of industry it is being applied in, the supplier it is passing through, etc. These costs are determined to be added to the price the manufactured products will finally be sold at.

Inventoriable Cost Explained

Inventoriable cost, as the name suggests, is the cost associated with the production of manufacturing of items that are inventoriable or ready to sell. These business costs involve expenses from direct labor to direct materials to everything that helps in the making of the items and preparing them for sale as finished products.

When it comes to accounting for these costs, it acquires a position in the expense account when it is sold to customers or leaves the warehouse and disposed of. Prior to being sold, this inventory goes to the balance sheet and is recorded as an asset. This is because these costs are added to the cost of product, which are then borne by the customers who buy them. In short, these expenses come back to the manufacturer.

The inventoriable cost, however, is the amount that does not necessarily remain the same. Firstly, it is different for different businesses, given the nature of activities being carried out and the type of product being manufactured. Secondly, the time becomes an important factor. Such costs are different at different point in time.

It is different from the non-inventoriable cost, which only includes the cost of running businesses, but anything directly related to the production or manufacturing process.

How To Calculate?

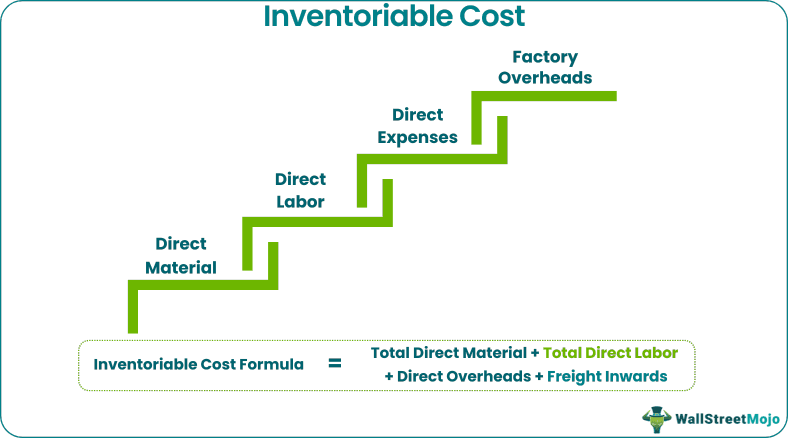

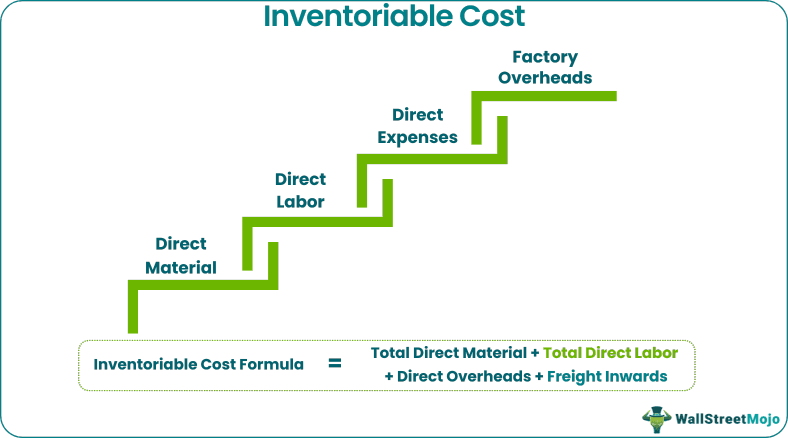

To calculate the inventoriable cost, the first thing that one must know is the formula. The mathematical equation to follow for obtaining accurate value of such costs is mentioned below:

Inventoriable Cost = Total Direct Material + Total Direct Labor + Direct Overheads + Freight Inwards

Where,

- Direct material involves cost of raw materials and components used to manufacture a product.

- Direct labor expenses include the amount tha is paid to the human resources used for manufacturing a product and making it ready for sale.

- Direct overheads is the cost that are fixed and do not change with the change in the volume of output to be produced. These include the factory rent, utilities, property tax, etc.

- Freight inwards is the transportation cost involved in moving the required items from suppliers to manufacturers to be used by the latter in the production process.

To calculate inventoriable cost per unit, however, the result obtain from the above equation can be divided by the total number of units as shown below:

Inventoriable Cost = (Total Direct Material + Total Direct Labor + Direct Overheads + Freight Inwards) / Total Number of Units

Examples

Let us take some examples to understand the inventoriable cost definition better and also check how it is determined or computed:

Example #1

ABC limited provides data related to manufacturing for March’19.

- Raw Materials: $180,000

- Direct Wages: $90,000

- Machine Hours Worked (hour): $10,000

- Machine Hour Rate (per hour): $8

- Administration OH: $35,000

- Selling Overheads per Unit: $5

- Units Produced: 4000

- Units Sold: 3600

- Selling Price Per Unit: $125

Calculate the inventoriable cost and value of the closing stock from the above data.

Solution:

Step 1: Calculation

= 180000 + 90000 + 80000 = 350000

Step 2: Calculation showing the deriving value of the closing stock.

Total Value of Closing Stock = 400 * 87.5 = 35000

Thus, the total inventoriable value of ABC limited for March’19 is $ 3 50,000.

Note: Cost related to administration overhead and selling overhead are in nature of period cost, and hence the same is ignored during the calculation of inventoriable cost.

Example #2

Below is the data related to the manufacturing of pencils in XYZ Corporation :

Calculate the following:

- Raw material consumed

- Prime cost

- Inventoriable cost

Solution:

Step 1: Calculation of Raw material consumed

Raw Material Consumed = 60000 + 480000 + (-50000) = 490000

Step 2: Calculation of Prime cost.

Prime Cost = Raw material Consumed + Direct Labor + Direct Expenses

Prime Cost = 490000 + 240000 = 730000

Step 3: Calculation

= 730000 + 100000 + 12000 + (-15000) + 90000 + (-110000) = 807000

Advantages

Inventoriable costs are costs that help businesses know how much the expenses incurred should be added to the cost of product to ensure they do not face losses. Such costs have their own sets of advantages, which the firms must know of.

Let us have a look at a few of them below:

- Total Cost Control - cost control is the key aim of all business persons. With the calculation, the business person will understand what type of costs are incurred and how to control the same.

- Cost Comparison - They will help identify the total cost for the given period. This will help compare the cost of the given period with another period. Cost comparison gives a push to benchmarking and cost optimization.

- Bidding Price for Tenders - For the businessman, bidding the tender is the principal task for bringing new business. In this task, inventoriable cost calculation plays a pivot role as this will only help determine the tender price.

- Operational Efficiency - It will help verify the optimum output received from the given input. Also, operational efficiency and effectiveness can be easily checked with the help of this cost.

Difference between Inventoriable Cost and Period Cost

There are two types of business costs involved in carrying out a business properly and ensuring proper pricing of the product based on the costs incurred. These are inventoriable cost, which is also known as the product cost, and period costs.

Let us have a look at the differences between the two to understand which cost belongs to what category and when and why they need to be considered:

| Points | Inventoriable Cost | Period Cost |

|---|---|---|

| Year of recognition | It is incurred in this year and will be recognized in another year. | It is incurred and recognized in the same year. |

| Forming part of the inventory | It will form part of the cost of inventory. | This cost will not form part of the cost of inventory. |

| Income statement Vs. Balance sheet | They will be capitalized as inventory. As a result, the same will be disclosed in a balance sheet. | The period cost will never form part of a balance sheet. It will always be disclosed in the income statement. |

| Cost forms part of which entity. | Such costs can be found only in manufacturing entities. | Such costs can be found in all types of entities. |