Table Of Contents

What Is An Intrinsic Value Formula?

The formula for Intrinsic value represents the net present value of all the future free cash flows to equity (FCFE) of a company during the entire course. It reflects the actual worth of the business underlying the stock, i.e., the amount of money that can receive if the whole business and all of its assets are sold off today.

Key Takeaways

- Intrinsic value formula calculates a company's worth by determining the present value of its future free cash flows to equity.

- It reflects the business's true worth and potential profit if all assets were sold at current market value.

- To find a stock's intrinsic value, divide the total business value by the number of outstanding shares. Compare this to the market price to see if it's overvalued, undervalued, or priced correctly.

- Value investors buy undervalued stocks with solid fundamentals, expecting the market to eventually correct and raise the stock price back to its fair value.

Intrinsic Value - Explained in Video

Explanation of the Intrinsic Value Formula

The calculation of the formula of the intrinsic value of a stock can be done by using the following steps:

Firstly, determine the future FCFE for all the projected years based on the available financial plan. The projected FCFEs can be computed by taking the latest FCFE and multiply it with the expected growth rate.

Now, the discount rate is determined based on the current market return from an investment with a similar risk profile. The discount rate is denoted by r.

Now, calculate the PV of all the FCF by discounting them using the discount rate.

Now, add up the PV of all the FCF calculated in step 3.

Next, the terminal value is computed by multiplying the FCFE of the last projected year by a factor in the range of 10 to 20 (required rate of return). The terminal value represents the value of the business beyond the projected period until the business is shut down.

Terminal value = FCFE n * Factor

To arrive at the value for the entire business, add up the value of step 4 and the discounted value of step 5 along with any cash cash equivalents (if available).

- Finally, the intrinsic value per share can be derived by dividing the value in step 6 by the number of shares outstanding of the company.

Example of Intrinsic Value Formula (with Excel Template)

Let us take an example of a company XYZ Limited which is currently trading in the stock market at $40 per share with 60 million shares outstanding. An analyst intends to predict the stock's intrinsic value based on the available market information. The prevailing required rate of return expected by the investors in the market is 5%. On the other hand, the company's free cash flow is expected to grow at 8%.

The following financial estimates are available for CY19 based on which the projections have to be made:

| All Amount in Millions | CY19 (E) |

|---|---|

| Net Profit After Tax | $200.00 |

| Depreciation & Amortisation | $15.00 |

| Increase in Working Capital | $20.00 |

| Capital Expenditure | $150.00 |

| Debt Repayment on Existing Debt | $50.00 |

| Fresh Debt Raised | $100.00 |

| Required Rate of Return | 5.00% |

| FCFE Growth Rate | 8.00% |

So, from the above-given data, we will first calculate the FCFE for CY19.

FCFE CY19 (in millions) = Net income + Depreciation & Amortisation - Increase in Working Capital - Increase in Capital Expenditure - Debt Repayment on existing debt + Fresh Debt raised

- FCFE CY19 (in millions) = $200.00 + $15.00 - $20.00 - $150.00 - $50.00 + $100.00

- = $95.00

Now, using this FCFE of CY19 and FCFE growth rate we will calculate the Projected FCFE for CY20 TO CY23.

Projected FCFE of CY20

- Projected FCFE CY20 = $95.00 Mn * (1 + 8%) = $102.60 Mn

Projected FCFE of CY21

- Projected FCFE CY21 = $95.00 Mn * (1 + 8%)2 = $110.81 Mn

Projected FCFE of CY22

- Projected FCFE CY22 = $95.00 Mn * (1 + 8%)3 = $119.67 Mn

Projected FCFE of CY23

- Projected FCFE CY23 = $95.00 Mn * (1 + 8%)4 = $129.25 Mn

Now we will calculate the Terminal Value.

- Terminal value = FCFE CY23 * (1 / Required rate of return)

- = $129.25 Mn * (1 / 5%)

- = $2,584.93 Mn

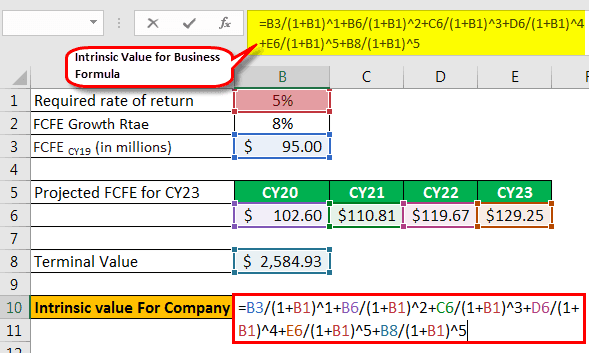

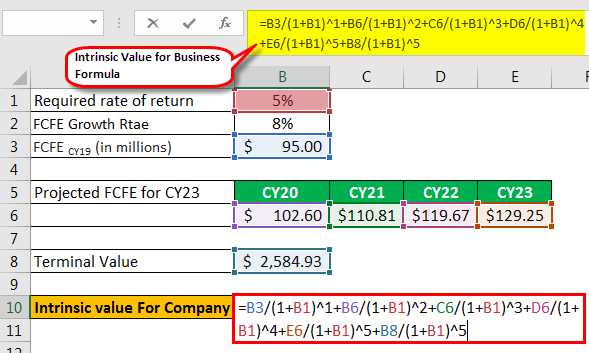

Therefore, the calculation of Intrinsic value for the company will be as follows -

Calculation of Intrinsic Value for the Company

- Value of the company = $2,504.34 Mn

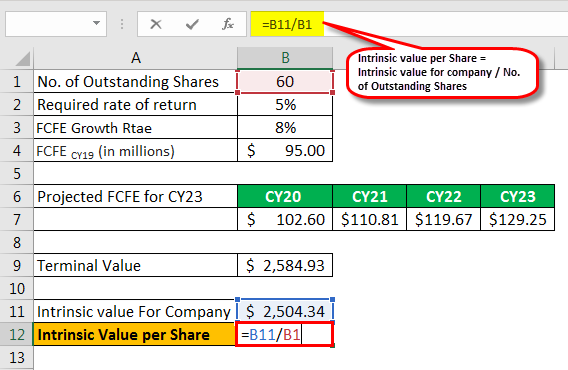

After this, we will do the calculation of Intrinsic value per share, which is as follows -

Calculation of Intrinsic value per share

- Intrinsic value formula = Value of the company / No. of outstanding shares

- = $2,504.34 Mn / 60 Mn

- = $41.74

Therefore, the stock is trading below its fair value, and as such, it is advisable to purchase the stock at present as it is likely to increase in the future to attain the fair value.

Relevance and Use of Intrinsic Value Formula

The value investors build wealth by purchasing fundamentally strong stocks at a price way below their fair value. The idea behind the formula of intrinsic value is that the market usually delivers irrational prices in the short term. Still, in the long run, the market correction will happen such that the stock price, on average, will return to its fair value.