Table of Contents

Interim Period Meaning

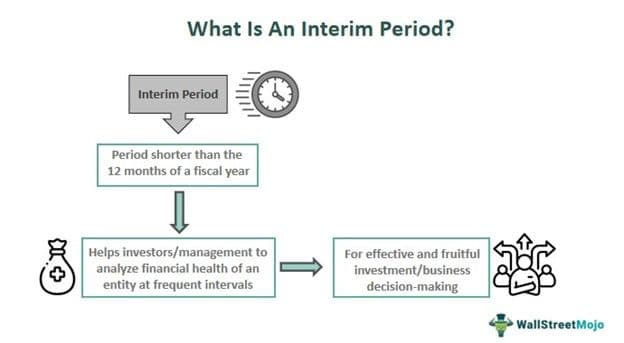

An Interim Period refers to a duration shorter than the 12 months of a fiscal year. This period could be segmented into quarters or on half-yearly basis. The interim range, however, is determined based on the reporting requirements or management needs, thereby helping provide insights into the overall economic performance of entities at frequent intervals or within shorter timeframes.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

The interim period in accounting serves as a critical checkpoint for annual financial reports, giving stakeholders access to insights right into a business enterprise's overall performance and financial health. By providing periodic updates, it allows informed choice-making, enhances transparency, and facilitates regulatory compliance.

Key Takeaways

- The interim period refers to a specific time frame within an economic year. This is when entities consider economic reporting and evaluate their progress evaluation before the annual reporting is conducted.

- The significance of this period lies in its role as a checkpoint for monetary reporting, ensuring effective decision-making and regulatory compliance.

- Interim financial reporting allows investors to be self-assured, leading to commercial corporations making plans and providing ordinary updates on an enterprise's economic performance.

- The interim period is essential for organizations as it allows them to evaluate monetary average overall performance, make strategic selections, look at policies, and plan for the future based on the evaluation of the economic information.

Interim Period Explained

The interim period is an essential phase of an employer's monetary reporting cycle as it provides stakeholders with snapshots of the performance of a business before the annual report for the year is prepared. It encourages reporting on transactions and other financial details quarterly or half-yearly, helping internal and external stakeholders to conduct more frequent evaluations of a commercial enterprise's operations. Interim financial statements, though unaudited, function as a vital tool for organizations when it comes to gauging an entity's monetary health and its adherence to accounting standards.

Auditors often review these details to ensure accuracy and transparency. It is also known as the stub period, given its role as an intermediary between two specific timeframes considered for financial reporting at regular, frequent intervals in a fiscal year. Besides providing overall financial information related to an entity, it also serves as a pivotal checkpoint for comparing financial performance and guiding strategic selection-making from time to time.

Furthermore, an in-between reporting guarantees regulatory compliance for publicly traded corporations, as they'll be obligated to reveal economic results periodically to regulatory authorities and make an investment public. Compliance with regulatory necessities, which include the ones stipulated with the useful resource of the Securities and Exchange Commission (SEC) in the United States, instills transparency and responsibility in corporate practices.

Additionally, timely and correct reporting complements investors' self-perception via regular updates on an organization's normal economic performance. Investors depend on those opinions to assess the business enterprise's development, risks, and investment alternatives. Consistent and obvious reporting sooner or later fosters credibility with shareholders as well as the market.

Lastly, an interim period in accounting acts as a foundational factor for organizations when making plans and forecasting. Companies utilize interim financial records to task destiny performance, set up practical desires, and allocate belongings correctly. This fact empowers management to make informed decisions relating to budgeting and investments and enhance techniques, thereby ensuring enhanced smooth and sustainable progress and productivity.

Examples

Let us now define an interim period using the instances below:

Example #1

Suppose there is a retail chain with an economic year starting in July and ending in June. The company chooses to file its monetary performance on a bi-annual basis, dividing its financial year into two interim periods in a year:

- Period 1: July 1 to December 31

- Period 2: January 1 to June 30

Following the perception of every in-between period, the retail chain prepares and publishes interim economic statements to update stakeholders on its monetary status.

For instance, after Period 1, the enterprise may disclose income of $50 million and include miscellaneous fees of $40 million and a net profit of $10 million, while for Period 2, it would document sales of $60 million, operating expenses of $45 million, and net earnings of $15 million. These semi-annual monetary statements provide stakeholders with normal insights into the organization's monetary performance at some point in the economic year.

Moreover, the retail chain compiles an annual economic record at the end of Period 2, providing for a comprehensive evaluation of its overall economic performance for the entire fiscal year. Unlike the interim reports, this annual file undergoes auditing to ensure accuracy and compliance with regulatory requirements.

Example #2

In November 2021, the Financial Accounting Standards Board (FASB) proposed an update to the existing accounting standards, mainly for entities that prepare interim financial statements and notes with respect to the generally accepted accounting principles (GAAP). This update modified the requirements that were expected earlier when organizations adopted interim financial reporting.

While the proposed requirements focused on various aspects of financial disclosures to be reflected in the financial statements and notes, its main concern was to continue with the previous SEC Regulation S-X whereby organizations made disclosures at interim periods whenever a particular transaction, which occurred before the fiscal year would end, would impose a material effect on the firm or entity.