Table Of Contents

What Is An Interest Tax Shield?

An interest tax shield is a tool companies use to decrease income taxes made available due to the tax-deductible nature of interest payments. This particular tax shield protects the interest payments rather than the interest income, as they are deductible expenses for most companies. It can provide a financial advantage to companies that have significant debt obligations, as it can reduce their overall tax liability and increase their after-tax profits.

It helps both new and established companies raise capital efficiently. Interest payments are deductible expenses, and the deductible interest paid on debt obligations reduces the business's taxable income. However, it will hurt the company's interests if the debt goes above tolerable limits and become a hindrance leading to the pausing of active projects.

Table of contents

- What is an Interest tax shield?

- An interest tax shield is a tax-saving technique companies utilize to reduce the tax from their debt interest payments.

- Businesses can profit from the formulation of such activities. When money is saved from being taxable, businesses have an extra amount that can be utilized for expansion plans and other purposes.

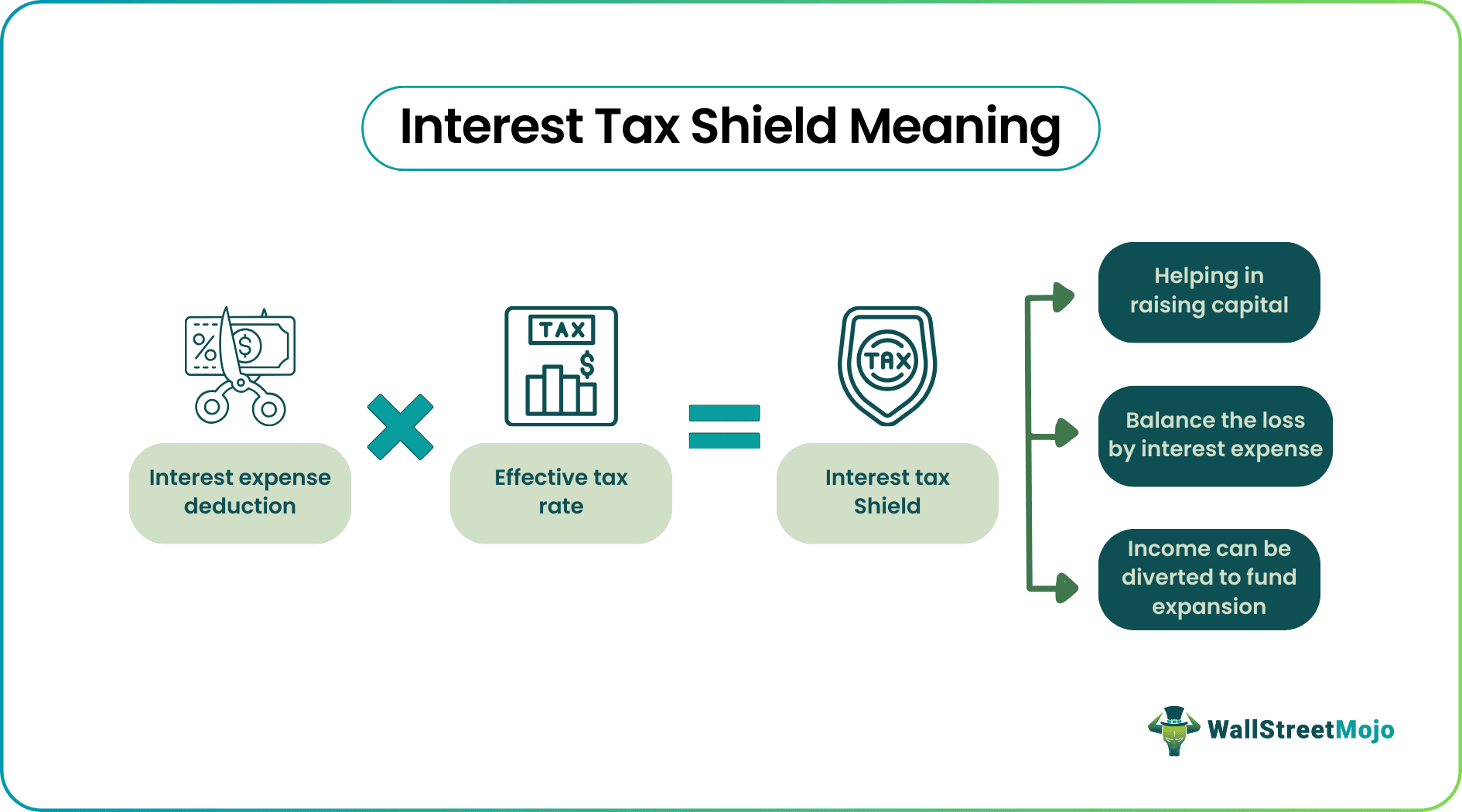

- The formula used for calculating is as follows: Deduction for Interest Expense x Effective Tax Rate.

- The interest pertains to the interest payments made and not the interest income, as interest payments are considered deductible expenses by most companies.

Interest Tax Shield Explained

An interest tax shield is a tax-saving technique company uses from their debt interest payments. It is one of the tax shielding options available to businesses and is also known as a corporate tax incentive for debt. However, the interest here pertains to the interest payments, not the interest income, as most companies consider interest payments deductible expenses.

A company's taxable income is decreased by the interest paid that is deductible on debt commitments. The overall amount of tax the company owes subsequently lowers as a result. However, only situations in which the company's earnings, specifically its earnings before interest and taxes (EBIT), exceed its actual interest expenses qualify for the tax shield. Therefore, a business must show profitability before it begins to make use of the interest tax shield.

When a business takes on a debt, the lender receives compensation through interest expenses. An example would be mortgage loans, which may come with a shield option for buyers as mortgage interests are deductible expenses against income. Companies need to examine this particular shield option as it is an opportunity to reduce their tax liability.

Debts are requirements for a business's operational ability. Therefore, many view debt finance as an initial source of money that is "cheaper." Businesses hence want to maximize the tax advantages of debt without facing the risk of default, such as failing to meet required interest expenses or missing the due date on principal repayment obligations. It, therefore, encourages businesses to fund projects with debt.

As other options, such as gathering investors, even though would bring in the money, the company has to pay dividends, and dividends paid to equity investors are not deductible for tax purposes. Since interest expenses are tax deductible, tax shields are crucial because businesses can profit from the formulation of such activities.

Tax Shield Video with Explanation

Formula

The formula for the interest tax shield is pretty straightforward. It is as follows:

Interest Tax Shield = Interest Expense Deduction x Effective Tax Rate.

So, the calculation involves multiplying the tax rate and interest expense. For example, if interest expense is $240000 and the tax rate is 20%, the interest tax shield would be = $48000. This $48000 is the amount of tax savings it can claim.

Calculation Example

Take a look at this example to understand the calculation. Shine Ltd is a top manufacturer of leather apparel. Suppose the company has an interest expense of $7 million and a 25% effective tax rate.

Let us calculate the tax shield of the company with the help of the formula:

Interest Tax Shield = Deduction for Interest Expense x Effective Tax Rate

As a result, Sunshine Company will benefit from an annual interest-tax shield of $7 * 25/100 = $17,500,000. Let EBIT (Earnings Before Interest and Taxes) measure an organization's operating profitability after deducting COGS (Cost of goods sold) and operating expenses, which are $50 million here. The interest expense is $7 million; hence, the taxable income will be 50-7 = $43 million.

Because of the tax advantages associated with interest expense, Shine Company would have more cash sourced from its debt financing, which it could use to fund any future expansion plans.

Benefits

There are a few benefits of interest tax shields, and they are as follows:

- It decreases the taxable income and, thereby, the amount of taxes that a business must pay

- Businesses pay special attention to it when taking on more debt since it helps to balance the loss brought on by the interest expense related to debt.

- When they can save the taxable money, businesses can utilize an extra amount for expansion plans and other purposes.

Frequently Asked Questions (FAQs)

Yes, the interest tax shield can be viewed as a form of debt subsidy that lowers the effective interest rate on debt for companies by providing a tax benefit. This can incentivize companies to take on more debt, as the tax benefit from this shield can make borrowing cheaper and more attractive.

When a business saves money on taxes directly from paying interest on debt, this is referred to as an interest tax shield. In light of this, the debt is subsidized by tax shielding of interest. Doing so prevents taxes from being levied on interest and debt.

Yes, it can be seen as a debt subsidy because it reduces the cost of debt for companies by providing a tax benefit that lowers the effective interest rate on debt. This can make borrowing more attractive for companies and encourage them to take on more debt than they might otherwise. However, it is important to note that the tax benefit of the interest tax shield can vary based on a company's tax rate, making it more or less advantageous for different companies.

Recommended Articles

This has been a guide to what is Interest Tax Shield. Here, we explain the topic in detail with its formula, calculation, example, and benefits. You can learn more about it from the following articles –