Table Of Contents

What Is Interest Income Tax?

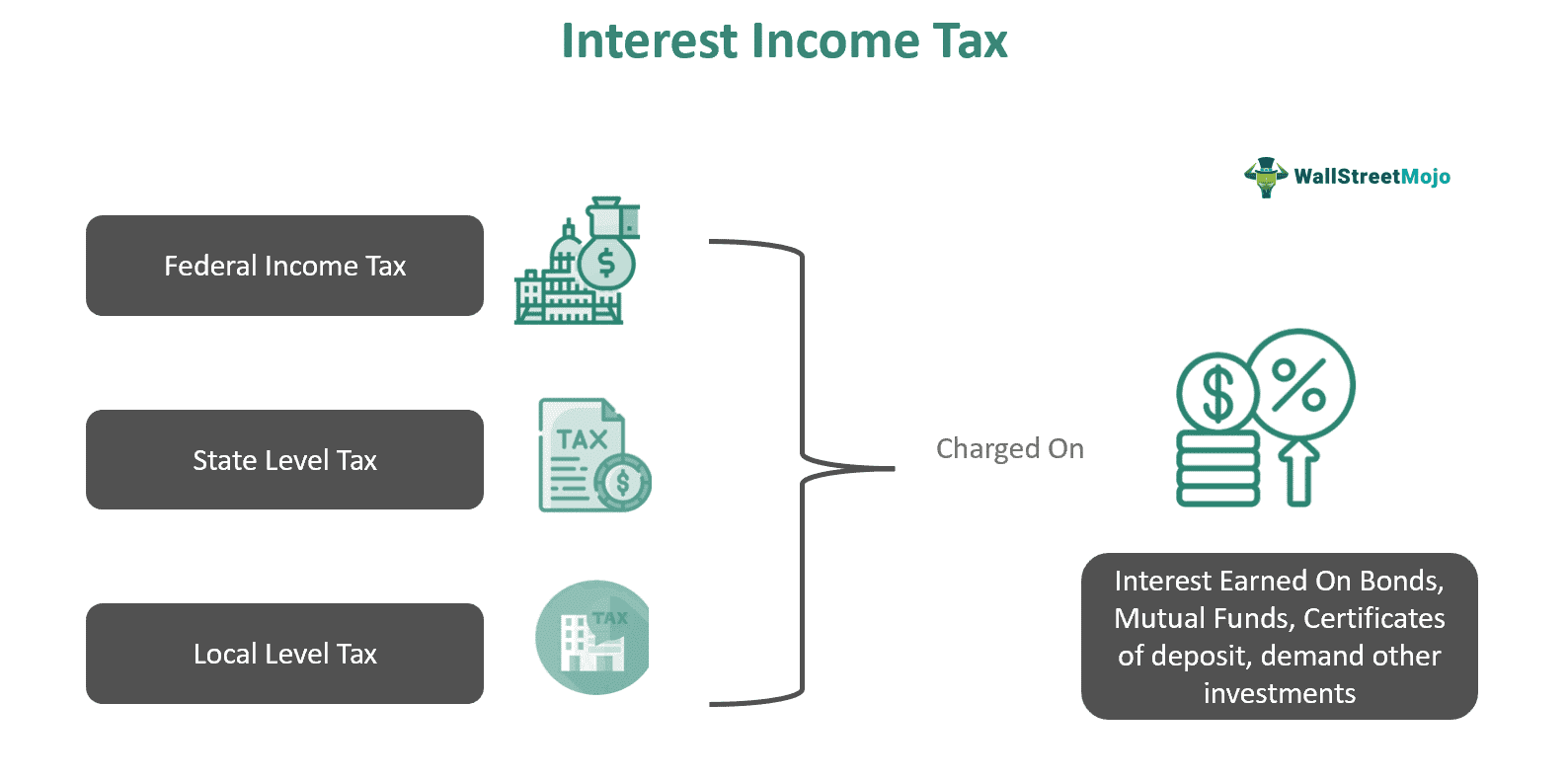

Interest income tax refers to the tax implications of earnings as interest during a given period, such as interest on demand deposit accounts, mutual funds, C.D.s, bonds, etc. Such an income is included in the ordinary income of an individual, I.e., salary, wages, business profits, and retirement plan distribution.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

Interest income from different sources alleviates an individual's taxable income and facilitates the determination of the marginal tax rate. However, all interest income is subject to taxes at local, federal, or both levels, except for exclusions, like interest on city, state, or county bonds. Also, specific kinds of interest income have partial tax implications.

Key Takeaways

- The interest income tax refers to the tax liability arising from the interest yielded by a taxpayer on various investments, including mutual funds, demand deposit accounts, certificates of deposit, bonds, etc.

- Such an obligation becomes due in the same year in which the taxpayer receives the amount.

- The issuer or bank serves a copy of Form 1099-INT each to the IRS and the client on disbursing an interest above $10 in a particular period, disclosing the interest paid to the customer.

- The taxpayer reports the same interest amount in the tax return under IRS Form 40's Section B.

Interest Income Tax Explained

Interest income tax is the amount of tax levied on the earnings made in the form of interest on investments, savings, and extended loans. It is usually summed up to the ordinary income of the taxpayers while filing federal tax returns. Therefore, it is accounted for during the evaluation of the marginal tax rate. Hence, the interest income tax rate is generally the same as the regular tax rate. However, the tax liability over the different types of interest income may have certain exemptions and may not be fully charged for the income tax by certain jurisdictions.

First, let us discuss the income received as interest from the following sources:

- Demand Deposit Accounts or Interest-Bearing Accounts: The demand deposit accounts, such as the savings and checking accounts opened with the banks, facilitate frequent deposits and withdrawal of funds. The bank provides interest to the accountholder to maintain cash balance in these accounts, which is subjected to income tax.

- Mutual Funds: The systematic investment plans taken by the investors are subjected to taxes; however, if the funds are invested into tax-deferred schemes like the individual retirement account (IRA) or 401k, then these are not charged for income tax until withdrawn.

- Certificates of Deposits: The interest the taxpayers yield on the certificates of deposits is taxable in the same tax year in which it is earned at the regular income tax rate.

- Bonds: Any interest earned on the corporate, savings, or U.S. treasury bonds is liable to federal income tax at the regular tax rates. However, the treasury bonds are not subjected to any local or state-level taxes.

- Others: The interest yielded by the other types of investments, such as government agency securities, treasury bills, and treasury notes, are all taxable at the federal tax level.

How To Pay?

Notably, when using the cash accounting method, the tax on interest income is charged in the same year when the taxpayer receives such earnings. However, taxpayers can use various ways of deferring the interest income tax, such as automatic withholding of such earnings, taking interest on the maturity of C.D.s, and reporting interest after the redemption of the savings bonds.

Investment brokerage firms, issuers, and banks send a copy of Form 1099-INT to the IRS and to clients who receive an interest income of more than $10 from their respective investments or accounts. The form states the annual interest paid by the issuer to the investors or account holders, which the latter uses to file tax returns. Such earnings are reported in the Internal Revenue Service (IRS) Form 1040's Schedule B (included in tax return) by the taxpayers.

The taxpayers are charged the same tax rate for their interest income as the marginal tax rate bracket in which they fall while computing the taxes on ordinary income.

How To Claim?

The interest income, in some instances, can be partially taxable or tax-free at the local, state, or federal levels, as per the regulations of the Internal Revenue Service (IRS). For instance, the interest yielded on municipal bonds is exempted from taxes at all three levels, while the capital gain on such assets is liable to state and federal taxes.

Simultaneously, savings bonds and U.S. treasury bonds are reported under the federal tax return but don't account for any local or state-level taxes. The interest on Series I and Series E.E. is exempted from any taxes. The amount of interest income subject to exclusion can be seen on Form 8815, and the claim for such exclusions is made on Schedule B of Form 1040.

Examples

Let us move ahead to the examples of how the interest becomes taxable and the bonds that save investors from the interest income tax liability:

Example #1

Suppose a taxpayer invests $10,000, yielding 6.5% annual interest. Now, the taxpayer is a salaried individual who, after considering the interest income of $650 (6.5% of $10,000) annually, falls in the federal income tax bracket of 22%. Therefore, the interest income tax payable by the individual in the given tax period is $143 (22% of $650). However, if the taxpayer had allocated 50% of this interest income as automatically withheld, then she would have only incurred an immediate interest income tax liability of $72.5.

Example #2

Investors widely acknowledge the importance of bonds in diversifying portfolios due to their stable income and lower volatility compared to stocks. However, understanding the tax implications is crucial. While U.S. stock dividends enjoy favorable tax rates, corporate bond interest is taxed as ordinary income. U.S. Treasury securities offer a slight tax advantage, exempt from state taxes but subject to federal taxes. Municipal bonds stand out for their tax efficiency, often exempt from federal and sometimes state taxes.

Investing in municipal bonds through funds adds transparency, liquidity, and convenience. Evaluating municipal bonds using the "taxable equivalent yield" helps gauge their actual benefits. Some top municipal bond funds include:

- Fidelity Municipal Bond Index Fund (FMBIX) - 0.07% expense ratio, 30-day yield: 3.4%

- Vanguard Tax-Exempt Bond ETF (VTEB) - 0.05% expense ratio, average yield: 3.6%

- Vanguard Short-Term Tax-Exempt Bond ETF (VTES) - 0.07% expense ratio, average yield: 3.2%

- Vanguard High-Yield Tax-Exempt Fund Investor Shares (VWAHX) - 0.17% expense ratio, yield to maturity: 4%

- iShares New York Muni Bond ETF (NYF) - 0.25% expense ratio, average yield: 3.6%

- iShares California Muni Bond ETF (CMF) - 0.08% expense ratio, average yield: 3.4%

- iShares National Muni Bond ETF (MUB) - 0.05% expense ratio, average yield: 3.6%

Source - https://money.usnews.com/investing/articles/best-tax-free-municipal-bond-funds