Table Of Contents

What Is The Interest Expense Formula?

The Interest Expense Formula refers to the mathematical equation that helps the calculate interest expense. An interest expense is related to the cost of loans or financial aid offered to borrowers with a repayment expectation. The loan amount can be associated with any financial instrument, including loans, bonds, lines of credit, etc.

There are of two types of interest expense that needs to be calculated given the nature of loan borrowed. One is the simple interest and the other is the compound interest, which is defined as interest over interest. There are different formulas to calculate these two interest expense types.

Interest Expense Formula Explained

The interest expense formula is the equation that makes it easier for lenders to calculate the amount they would ask borrowers to pay in addition to the principal amount they have lent. This expense is the income that businesses generate from offering monetary aid to those in need. The process of charging an interest on financing is considered an income-generating measure given the profit it stores for the lenders.

Interest expenses are of two types and so does the methods of calculation.

The first method is called as simple interest method, in which interest expense is calculated by multiplying principal outstanding, rate of interest, and the total number of years.

On the other hand, the second method is called as compound interest method. This is where interest amount is calculated by way of multiplying principal by one plus the annual rate of interest raised to a number of the compound period less one and lastly resultant value is deducted from the total initial amount.

Once this expense is calculated using the interest expense formula in accounting, it is recorded as an accrued liability for the borrower. It is a debit entry to the expense account and a credit entry to the liabilities account.

As soon as the lender send the invoice for collection of the interest expense from the borrower, the credit entry shifts to the accounts payable section and when the same is paid by the borrower, the amount gets a credit entry, thereby crediting the cash account.

How To Calculate?

When it comes to calculating the interest payable using the total or net interest expense formula, there is a series of steps that must be followed for accurate calculations. But before that, it is important to explore how these formulas for simple interest and compound interest is efficiently derived and used for further calculation.

Let us have a look at the detailed calculation of both types of interest expenses:

#1 - Simple Interest Method

In the case of a simple interest method, the interest expense can be calculated by multiplying the outstanding principal, the annualized interest rate, and the number of years. Mathematically, it is represented as,

Interest Expense SI = P * t * r

where,

- P = Outstanding principal

- t = Number of years

- r = Annualized rate of interest

For the simple interest method, the interest expense can be determined by using the following steps:

Firstly, determine the annualized rate of interest for the given debt level. The annualized interest rate is denoted by 'r,' which is clearly stated in the loan agreement.

Next, determine the outstanding principal of the loan, i.e., the opening balance of the loan principal at the beginning of the year. It is denoted by 'P,' and can be confirmed from the company's accounts department or the loan schedule.

Next, figure out the tenure of the loan, i.e., no. of years remaining till maturity. The tenure of the loan is denoted by 't' and is available in the loan agreement.

Finally, in the case of the simple interest method, the interest expense during a period can be calculated using the formula, Interest expenseSI = P * t * r

#2 - Compound Interest Method

In the case of the compound interest method, the interest expense can be calculated based on the outstanding principal, the annualized interest rate, the number of years, and the no. of compounding per year. Mathematically, it is represented as,

Interest Expense CI = P *

where,

- P = Outstanding principal

- t = Number of years

- n = No. of compounding per year

- r = Annualized rate of interest

For the compound interest, the interest expense can be determined by using the following steps:

- Step 1 to Step 3: Same as above.

- Step 4: Next, the no. of compounding periods per year is determined. Usually, the no. of compounding periods in a year can be 1 (annually), 2 (half-yearly), 4 (quarterly), etc. The number of compounding periods per year is denoted by 'n.'

- Step 5: Finally, in the case of the simple interest method, the interest expense during a period can be calculated using the formula,

Interest expense CI = P *

Examples

Let us consider the following instances to understand how the interest expense formula in accounting works:

Example #1

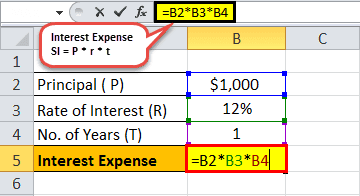

Let us take an example where the interest expense is calculated on a sum of $1,000 for one year with a simple interest of 12%.

- Given, Principal, P = $1,000

- The rate of interest, r = 12%

- No. of years, t = 1 year

As per simple interest method, the calculation using interest expense formula in excel will be,

= P * r * t

= $1,000 * 12% * 1

Example #2

Let us take an example where the interest expense is to be calculated on a sum of $1,000 for one year with an interest rate of 12% on the compounding method basis. The compounding is done:

- Daily

- Monthly

- Quarterly

- Half-yearly

- Annual

Given, Principal, P = $1,000

Rate of interest, r = 12%

No. of years, t = 1 year

#1 - Daily Compounding

Since daily compounding, therefore n = 365

As per compound interest method, the interest expense can be calculated as,

= P *

= $1,000 *

= $127.47

#2 - Monthly Compounding

Since monthly compounding, therefore n = 12

As per the compound interest method, the interest expense can be calculated as,

= P *

= $1,000 *

= $126.83

#3 - Quarterly Compounding

Since quarterly compounding, therefore n = 4

As per the compound interest method, calculation of interest expense will be,

= P *

= $1,000 *

= $125.51

#4 - Half Yearly Compounding

Since half yearly compounding, therefore n = 2

As per the compound interest method, calculation of interest expense will be,

= P *

= $1,000 *

= $123.60

#5 - Annual Compounding

Since annual compounding, therefore n = 1,

As per the compound interest method, calculation of interest expense will be,

= P *

= $1,000 *

= $120.00

From the above results, it can be inferred that all other factors being equal, the simple interest method and compound interest method yield equal interest expense if the no. of compounding per year is one. Further, under the compound interest method, the interest expense increases with the increase in the number of compounding per year.

The Below table provides the detailed calculation of the interest expense for various compounding periods.

The below graph shows the Interest Expense for various compounding periods.

Relevance and Uses

From a borrower's point of view, it is important to understand the concept of interest expense since it is the cost incurred by the entity for borrowed funds. Listed below are the points that indicate the usefulness of this formula:

- The interest expense is a line item captured in the income statement as a non-operating expense.

- It denotes the interest paid on the borrowings – which may include corporate loans, bonds, convertible debt, or other similar lines of credit.

- The significance of interest expense further increases because it is tax-deductible for companies and individuals in most countries.

- Therefore, it is vital to understand the interest expense as it would help in understanding its capital structure and financial performance.