Table Of Contents

What is an Installment Sale Method?

Installment Sale is one of the revenue recognition methods in which the seller allows the buyer to pay in Installments over the specified period without fully transferring the risk and rewards at the time of sale. The seller recognizes the revenue and expense at the time of cash collection rather than at the time of sale.

Example of Installment Sale Method

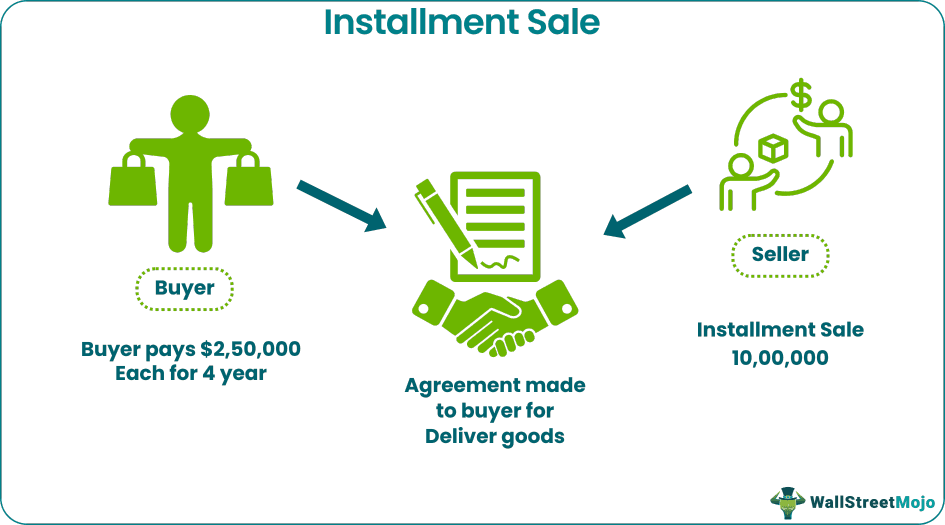

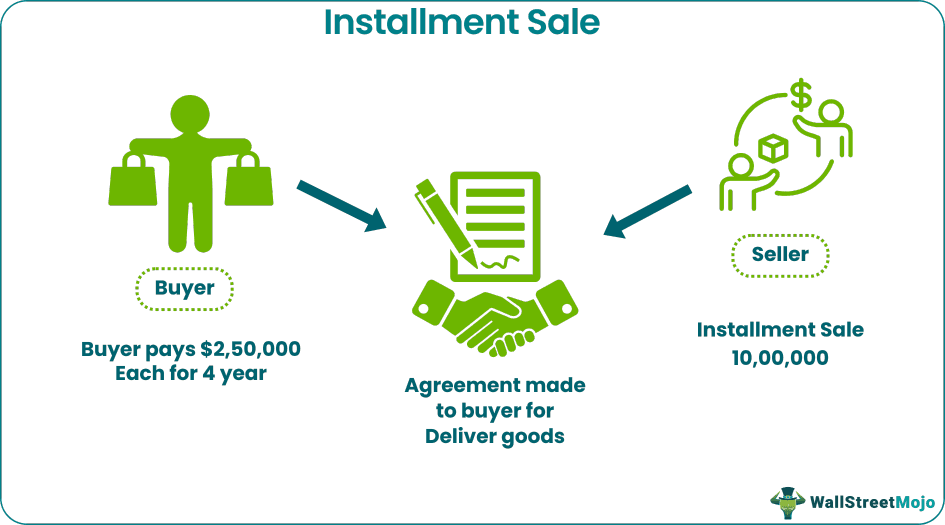

For example, Company Y ltd. Sells the goods on an installment sales basis on 01-August 2019. An agreement is made between the buyer and seller to deliver goods to the buyer at the start of the Installment. For this, the seller allows him to make payment in Installment over the specified period. The details of the transactions are as below:

- Installment Sales: $1,000,000

- Cost of installment goods sold: $800,000

- Gross profit percentage: 20%

It is decided that the buyer will pay the cash worth $ 250,000 each year for the four years starting from 2019 itself. How is the revenue to be recognized in the company's books of accounts for the year 2019?

Solution

In the above example Company Y ltd. Sales of the goods on the installment basis of $1,000,000, where it is decided that the buyer will pay the cash on installment sales worth $ 250,000 each year for the four years starting from 2019. Out of the sales Cost of installment goods sold is $800,000, and the gross profit percentage is 20%. So, total gross profit comes to $ 200,000 ($1,000,000 * 20%).

It is one of the revenue recognition methods under which the seller recognizes the revenue and expense at the time when the cash has been collected rather than recognizing it at the time when the sale is made. Now the income which will be recognized in the year 2019 will be calculated by multiplying the cash collection of the year with the profit percentage, which comes to $ 50,000 ($ 250,000 * 20%).

Apart from this, the deferred gross profit that will be carried forward to next year will be calculated by subtracting the recognized income from the company's total gross profit, i.e., $ 150,000 ($ 200,000 – $ 50,000).

Advantages

The different advantages are as follows:

- The buyer of the goods gets an extended period from the seller for the payment against the goods he purchased. So, the buyer needs not to arrange the whole amount of money in the starting and is allowed time to arrange the funds while getting the required goods delivered in the beginning.

- From the seller's perspective, revenue and expense under the installment sale revenue recognition method are recognized by the seller when the cash has been collected rather than recognized when the sale is made. It is useful when there exists uncertainty in the collection of the cash by the seller from the buyer against the goods he sold.

- This method for recognizing the revenue by the seller against the goods sold by him is the conservative method for the revenue recognition as, in this case, there is a deferral of the gross profit in the books of accounts of the seller because in the case of the uncertainty it is not appropriate to recognize the profits whose collection is not certain.

- Under the installment method, partial deferral of the capital gain, if any arises during the transaction of goods, is allowed to the taxation years in the coming future.

Disadvantages

- In case the person is a dealer in the real estate market. It is not allowed to follow the Installment Sale method for recognizing the revenue, and only the individual sellers and buyers can use this method of revenue recognition.

- Accounting for this method of revenue recognition is a tedious task and time-consuming, which leads to an increase in the cost to the company.

Important Points

- The installment sales method for recognizing the revenue is one of the conservative methods for revenue recognition as, in this case, there is a deferral of the gross profit in the books of accounts of the seller.

- In the case of the Installment, sales buyers are required to make the regular payments to the seller timely as decided between them in the agreement, along with the specified interest in case the Installment is payable by the buyer in the subsequent taxation years.

- It is very common and can be easily seen in the real estate market. Still, in case the person is a dealer in the real estate market. It is not allowed to follow the Installment Sale method for recognizing the revenue, and only the individual sellers and buyers can use this method of revenue recognition.

Conclusion

Installment Sale is one of the approaches of revenue recognition by the seller against the goods sold by him, where the seller recognizes the revenue and expenses at the time when the cash has been collected rather than recognizing them at the time when the sale of the goods is made. Under this method, partial deferral of the capital gain, if any arises during the transaction of goods, is allowed to the taxation years in the coming future.