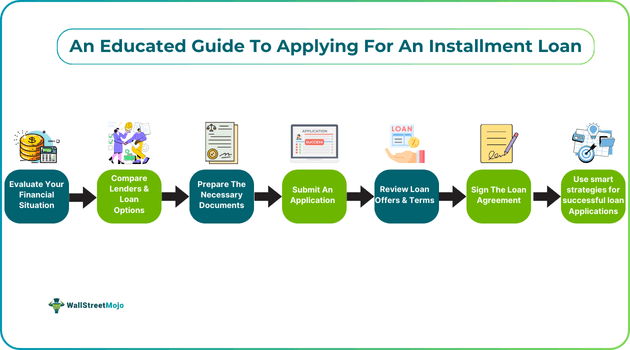

An Educated Guide To Applying For An Installment Loan

Table of Contents

Introduction

Considering the wide range of financial requirements that might materialize, being able to opt for financial assistance provides peace of mind. Indeed, suppose a medical emergency arises, and an individual does not have enough funds to meet the associated expenses. In that case, applying for an installment loan to cover the costs can be an ideal solution.

That said, there are certain requirements that one must follow to get the funds. We will discuss those criteria along with the list of documents required in this comprehensive installment loan guide. Besides the details of the application process, we will cover the key factors to consider when applying for such a loan.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

What Is an Installment Loan?

An installment loan refers to a type of debt that individuals pay off via periodic payments over a predetermined duration. The payments or installments consist of two components: principal and interest. A lender closes the loan account once the borrower pays all the predetermined installments.

Compared to open-ended credit, for example, credit cards, these loans have a lower cost of borrowing. Individuals take this kind of loan to fulfill an extensive range of financial needs, like funding a child’s college education and financing the purchase of a vehicle.

Factors To Consider

Let us look at the key factors that one must take into account when applying for an installment loan.

Evaluate Your Financial Situation

Individuals must assess their financial situation before opting for this form of financial assistance. They should only take the loan if they have the financial capacity to pay the installments on time and repay the loan in full. Individuals can utilize the installment payment formula to get an idea about how much to pay periodically toward loan repayment. Knowing what to pay beforehand can help one to plan their finances better.

Compare Lenders and Loan Options

There are various lenders offering installment loans. Hence, borrowers must ensure to compare different financial institutions and loan options to get the best terms and conditions. Note that some lenders may impose prepayment penalties and have hidden fees. Make sure to check these things before applying.

Also, make sure to consider a popular installment loan application tip, which is to avoid multiple applications. Submitting multiple applications indicates that the borrower is credit-hungry, which, in turn, has a negative effect on their credit score.

Prepare the Necessary Documents

When applying for an installment loan, for example, a personal loan, one needs to submit a list of documents, such as income proof, proof of identity, address proof, etc. So, individuals should have the necessary documents, like their passport, salary slip, driving license, etc., ready before initiating the personal loan approval process.

Submit an Application

One must submit an application to get financial assistance. Individuals submit the installment loan application online or offline. For the former route, one can download the lender’s mobile-based application, provide the required details, upload the necessary documents, and submit the application. On the other hand, if individuals want to submit the application offline, they can visit the bank’s branch, fill out the form, and submit the necessary documents to complete the application process.

Review Loan Offers and Terms

When applying for an installment loan, individuals must thoroughly check the loan offers and terms provided by lenders. As part of the review, it is vital to check the loan amount being offered, the interest rate, the processing fee, and other charges. If these elements are not in line with your financial capabilities or if any other lender is offering better terms, you may choose not to proceed with the application. Alternatively, you can try to negotiate better terms.

Loan and Repayment Administration Acceptance

Once the borrower accepts the lender’s terms and conditions concerning an installment loan, the borrower signs the loan agreement. The signature indicates that the borrower has agreed to the conditions set by the lender. The loan agreement includes all key details regarding the loan, for example, the loan amount, the rate of interest, the repayment schedule, and the loan tenure. Once the signing of the loan agreement is complete, the lender transfers the loan amount into the borrower’s bank account.

Smart Strategies for Successful Installment Loan Applications

Some effective strategies to ensure loan application approval are as follows:

- Assess your credit score before applying: If you have a high credit score, chances are that the lender will accept the application. You can even negotiate better loan terms if you have a strong credit profile.

- Check the eligibility criteria: If you check a financial institution’s eligibility requirements beforehand, you can know if you can get approval. You can also take measures to enhance your eligibility before applying for an installment loan if you don’t meet all the requirements.

- Avoid Multiple Applications: As noted above, a useful tip is to avoid applying for multiple installment loans. It will impact your chances of obtaining instant loan approval.

- Keep Documents Ready: Having all necessary documents in place can help ensure a hassle-free loan application process.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.