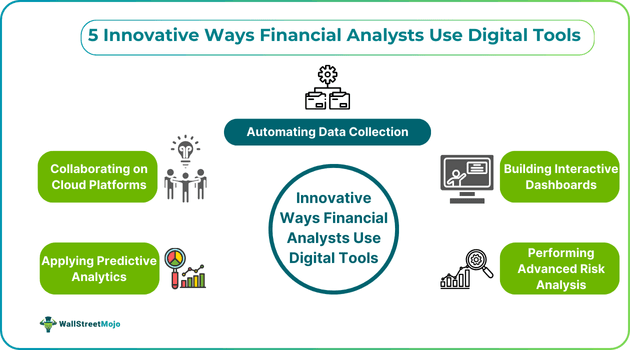

5 Innovative Ways Financial Analysts Use Digital Tools

Table of Contents

Introduction

In today's job market, no doubt the role of a ‘financial analyst’ is among the most demanding ones. They collect, analyze, and project data to detect any upcoming risks in the business. Now, imagine what if they had to do everything manually on paper. It would be time-consuming and certainly tough to process as well. Analysts often face the challenge of sitting with large sets of data to identify underlying trends. However, with recent technological advances, you, as an analyst, can use different digital tools to conduct innovative financial analysis.

Throughout this blog, learn about popular digital tools for finance professionals and how they are useful in financial analysis. Also, explore innovative ways to incorporate these tools and improve the analysis conducted.

5 Innovative Ways

For incorporating an innovative financial analysis process, there have to be the right tools picked by the analyst. The most common one is Excel, Power BI, Python, and SQL software. But, if we look closely, other financial technology tools, like predictive analytics software, can also help in forecasting the future performance of a company and ways to manage future expenses. However, there are many other ways to support data analysis for financial analysts with these tools. They can help improve financial operations and increase the productivity of a financial analyst. Let us look at them:

#1 - Automating Data Collection

Imagine you have to fetch data from annual reports manually. Every second, you have to switch tabs and update the details, which is tedious and time-consuming. Instead, how about using an application or tool that automates the data collection process? In other words, the application would collect the data for you from different websites and streamline automated workflows.

For instance, one can pull out financial information from financial statements (or annual reports) and then present it in a proper format. Just like scanning QR codes, the tool will scan the website and input the data in the Excel sheet. Later, the same data can be utilized to prepare financial models and valuation comps. Examples of such financial analysts digital tools include Docparser and Octoparse. These applications allow financial analysts to extract data from websites and streamline automated workflows.

#2 - Building Interactive Dashboards

The information in financial statements has varied purposes. For example, the financials further act as a base for preparing financial models and making future forecasts and budgets. However, preparing them and letting them lie idle in folders is not the ultimate aim. This information is then communicated to the key stakeholders in a simplified way through interactive dashboards that include charts and graphs. Such dashboards can help investors and management determine the ongoing trends in the market easily. For creating an interactive dashboard, one can use tools like Excel, Power BI, Qlik Sense, and Tableau.

Additionally, these financial analysts digital tools can assist in incorporating machine learning algorithms to update the dashboard dynamically when required. So, again, there is no hassle in referring to recent information and updating them in real time. It happens automatically.

#3 - Performing Advanced Risk Analysis

The use of digital tools for finance professionals is also common in risk management. If you see traditionally, risk assessment has been associated with limited assumptions. However, looking at a broader scale, various factors can impact the overall business of a company in the future years.

Hence, it is important to use the right tool to measure the risks. For instance, analysts can use tools like Monte Carlo simulations and software like Mitratech Alyne and Hyperproof to collect vast amounts of data. Furthermore, these financial analysts digital tools can uncover the hidden risk factors and possible correlations between them. Later, solutions to combat them can be implemented.

#4 - Collaborating on Cloud Platforms

Financial information and audit-related reports often hold a certain level of confidentiality. As a result, often, they have limited access unless made publicly available. At this point, cloud platforms help in achieving integrity among the stakeholders. Earlier, collaboration often limited sharing, but cloud-based platforms enable real-time co-authoring of documents, spreadsheets, and presentations. For instance, you can share the rough draft of financial statements prepared with the senior managers first. Later, the access could be updated to the board as well.

#5 - Applying Predictive Analytics

Predictive analytics is a crucial part of the entire finance, banking, and insurance industry. With the use of machine learning (ML) and artificial intelligence (AI), it is possible to forecast potential risks in the business. Moreover, you can also forecast future cash needs and market fluctuations and identify the potential shortfalls in the financials in a limited time with predictive analytics. This in turn, can help you protect your clients from emergencies and suggest investment and saving opportunities when in distress.

For instance, in the case of accounts receivable management, predictive analytics can help in identifying customers’ credit risk and payment patterns based on analysis of certain factors. A few examples of these factors are the financial strength of the client, past payment trends, etc. Moreover, advanced analytics algorithms can even estimate the day or date on which the customer might make the payment. Based on the probability of paying, the client can ask collectors to prioritize accounts and avoid spending too much time on those customers who are less likely to make payments.

Financial Analysts Can Use Digital Tools in Many Ways

Generally speaking, the financial arena is experiencing a huge shift in its operations. Analysts have now switched from a traditional routine to an advanced version. This acceptance of futuristic technology has allowed automation to a large extent, which has definitely helped businesses save costs and time as well. Also, this new wave of digital tools is transforming the way analysts work, thus empowering them to gain access to unexpected insights and boost their overall efficiency.

But, what really matters is how digital tools concerning data analysis for financial analysts are used in the market. If used efficiently, they can enhance their productivity and enhance the accuracy of your financial analysis. Indeed, financial analyst digital tools can help them gain a competitive edge in today's dynamic financial landscape and ultimately boost their careers. So, if you wish to improve your analysis quality, incorporate these innovative ways today!