Table Of Contents

What is an Inflationary Gap?

An inflationary gap is an output gap that signifies the difference between the actual GDP and the anticipated GDP at an assumption of full employment in any given economy.

Inflationary Gap = Real or Actual GDP – Anticipated GDP

There are two types of GDP gaps or output gaps. While the inflationary gap is one, the recessionary gap is the other. An inflationary gap can be understood as the measure of excess aggregate demand over aggregate potential demand during full employment. A recessionary gap is an economic state where the real GDP is out-weighted by the potential GDP under full employment.

John Maynard Keynes is regarded to have brought the modern definition of the inflationary gap.

Key Takeaways

- An inflationary gap is the output gap that denotes the difference between actual and expected GDP at complete employment assumption in any given economy.

- There are two GDP gaps or output gaps: the inflationary gap and the recessionary gap.

- A recessionary gap refers to an economic state where the real GDP is out-weighted by the potential GDP under full employment.

- The factors considered with short descriptions of their usage to identify the real GDP of an economy are government expenditure, consumption expenditure, net exports, and investments.

Components of the Inflationary Gap

It comprises real gross domestic product and anticipated gross domestic product.

If X is the real GDP and Y is the GDP with full employment, then X – Y denotes the inflationary gap. The following factors are taken into account with short descriptions of their usage to determine the real GDP of an economy: -

- Government Expenditure: It includes social benefit transfers, all public consumption, income transfers, etc.

- Consumption Expenditure: It has household licenses, permits, the output of unincorporated enterprises, etc.

- Net exports (exports – imports): Trade surplus if exports exceed imports, trade deficit if imports exceed exports.

- Investments: Commercial expenses (incl. equipment) exclude exchange of assets; purchase of financial assets.

One should note that any intermediate products and services are not counted toward GDP formation.

Examples of Inflationary Gap & its Graph

The following are examples of the inflationary gap: -

Example #1

The real gross domestic product (GDP) of an economy in Africa is $100 billion. The anticipated GDP is $92 billion. Determine the nature and magnitude of the output gap.

Solution

The real GDP exceeded the anticipated GDP. Hence, it is an inflationary gap. Also, it can calculate this gap by subtracting the expected GDP from the real GDP of the economy.

- = $100 billion - $92 billion

- = $8 billion

Thus, an inflationary gap of $8 billion can exist in the economy.

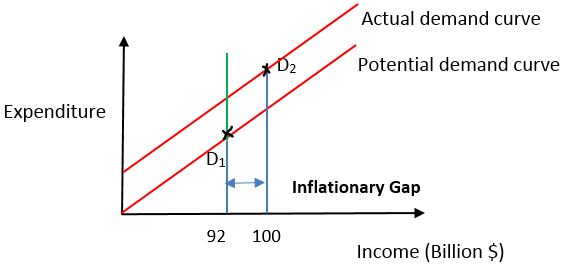

Inflationary Gap Graph

The X-axis represents national income, whereas the Y-axis signifies the expenditure.

The blue lines intersect the demand curve corresponding to the national incomes. Notice the red line sitting on the blue line (at $92 billion). That is the line of full employment. When the aggregate demand (in terms of national income) exceeds the demand under full employment conditions, the inflationary gap is caused; in this case, $8 billion.

Note that aggregate demand is the total demand for all final goods and services produced in an economy.

Example #2

A rice-producing economy gives an output of 500 tons of rice every day. Suppose that the aggregate demand for rice is 545 tons per day. What can be said about the inflationary gap in this economy?

Solution:

An inflationary gap in the given economy is,

545 tons – 500 tons = 45 tons of rice per day.

The economy utilizes its resources to generate an output of 500 tons per day. On the other hand, higher aggregate demand for rice creates an output gap of 45 tons per day. Therefore, it is possible to lower the aggregate demand by working on fiscal policy. However, it cannot improve rice production further if surplus aggregate demand is due to the full utilization of resources.

Advantages

Below are the advantages of the inflationary gap: -

- It is a good measure to decide economic policies. It is also useful in critically analyzing these economic policies (fiscal and monetary).

- If the resources of an economy are fully deployed in contribution to GDP, any signaling price rise is due to excess demand in the economy.

- It says it can control that inflation by checking aggregate demand.

Disadvantages

- The excess gap between the current income, current expenditure, and current consumption is taken, whereas corresponding factors already produced in the economy are ignored in the analysis.

- Inflation is not a static process. It keeps on changing with improbable and varying degrees. However, the inflationary gap study is founded on a fixed basis.

- The negligence of the factor market affecting the inflationary gap is a weakness of the concept.

Important Points to Note

- It can reduce by increasing savings such that aggregate demand is reduced.

- When the inflationary gap is in play, it is not easy to increase production because all resources have been utilized.

- If government spending, the tax generated, and securities issues are curbed, it might reduce the inflationary gap.

- As described in the diagram above, one should remember that the coincidence of actual income and full employment income gives rise to the absence of aggregate demand. Consequently, no significant unemployment can exist in this situation.

- Banks and financial institutions play their role in regulating the inflationary gap. They do this by checking the money supply in the economy.

Conclusion

The inflationary gap is an output gap, also termed the GDP gap, which functions on two indicators – real and anticipated GDP. There is an inflationary gap if the quantity of expenditure in any economy rises above national income due to full employment.

Deflationary fiscal policies prove helpful to the government in fighting the inflationary gap caused in an economy. It is achieved by raising taxes or reducing spending, or treasury spending. Thus, the currency in circulation is brought down to a controlled level. These types of measures are referred to as contractionary fiscal policies.

Government institutions and banks make amendments to the lending rates to affect money circulation in the economy.

To a certain extent, perhaps on the extreme side, economic policies also contain stringent provisions limiting wages and resources. However, it can be a revolutionary step that can affect the functioning of the economy in the long run. Therefore, it is essential to understand the underlying causes of inflation. Sometimes, it is good to increase domestic production; at other times, it is advisable to increase imports to satiate demand.