Table Of Contents

What is Inflation Risk?

Inflation Risk commonly refers to how the prices of goods and services increase more than expected. Inversely, such a situation results in the same amount of money, resulting in less purchasing power. Inflation Risk is also known as Purchasing Power Risk. An inflation risk premium is a subtle yet impactful force that can sway the stability of an individual's or organization's financial portfolio.

An example of Inflation Risk is Bond Markets. When the expected inflation increases, it increases the Nominal rates (Nominal Rate is simple Real Rate plus Inflation), thereby decreasing the price of Fixed Income Securities. The rationale for such a behavior is that bonds pay fixed coupons, and an increasing price level decreases the number of real goods and services that such Bond coupon payments will purchase.

Key Takeaways

- Inflation risk refers to the situation where the costs of goods and services rise at a faster rate than predicted, leading to a decrease in the purchasing power of the same quantity of money.

- Inflation risk can result in purchasing power risk, which means that savings may not be sufficient to fulfill their intended purposes due to the erosion of purchasing power over time.

- Companies face increased borrowing costs due to inflation risk.

- Lenders require higher interest rates to compensate for the risk associated with lending money and the additional risk of a future decline in the value of money compared to the present.

Inflation Risk Explained

Inflation risk refers to the potential loss of purchasing power due to the steady rise in the general price level of goods and services within an economy. This phenomenon diminishes the real value of money over time, compelling investors to be vigilant and strategic in their financial planning.

Imagine a scenario where an inflation risk bond is outpacing the returns on one's investments. The real impact becomes evident when the hard-earned money saved or invested fails to keep pace with the rising cost of living. This discrepancy can erode the value of savings and investments, leading to a decrease in overall wealth.

Investors, therefore, need to be cognizant of inflation risk when crafting their financial strategies. Traditional savings accounts and low-yield investments may offer apparent security, but they often falter in the face of inflation's relentless march. To combat this risk, individuals are advised to diversify their portfolios by including assets that historically exhibit resilience against inflation, such as real estate or commodities.

This risk holds more relevance while making long-term investing decisions. Further, a high inflation risk poses a more significant threat to a nation and can lead to economic distress as well. It has serious ramifications as it reduces the value of people's savings on account of the falling purchasing power of money. A country with a high inflation risk also becomes less competitive against its competing nations, and as such, this risk needs to be well managed and is usually taken care of by the Central Bank of each Country. Hence, understanding inflation risk is paramount for any astute investor. By acknowledging its potential impact and adopting a diversified investment approach, individuals can navigate the financial landscape with a greater sense of resilience and ensure their wealth remains shielded from the erosive effects of inflation.

Examples

Now that we understand the basics of the concept and a certain degree of its intricacies, let us also understand the practical application of inflation risk premium through the examples.

Example #1

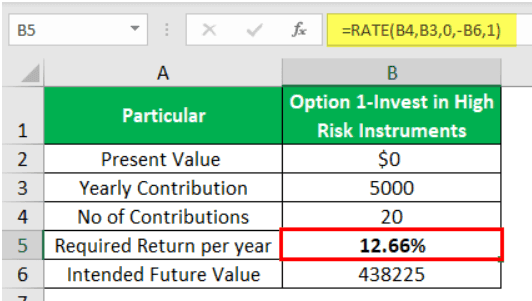

Mr. A working in a Law firm, intends to retire at the age of 50 years. He is currently 30 years of age and has 20 more years before the age at which he wants to retire. He is now saving $5000 every year and wants to save $200000 to buy a house by the end of 20 years.

The same objective can be achieved by investing in a low-risk investment strategy delivering a 6% -7% return.

- Present Value: $0

- Yearly Contribution: 5000

- No of Contributions: 20

- Required Return per year: 6.22%

- Intended Future Value: 200000

Now let's assume the Inflation rate is 4%, which means the purchasing power of money gets reduced each year by 4% or in other words, the House he intends to purchase gets the appreciation of 4% each year.

Due to this Risk, the House, which Mr. A intends to purchase at the end of 20 years, will cost $438225.

However, due to this, Mr. A will not meet the objective using the same strategy. Now to achieve his stated purpose, he will have two options, which are enumerated below:

- Invest his money in high-risk instruments

- Invest more money to achieve the same objective

Let's take one more example to understand the impact of this risk.

Ryan is working with an Investment Bank, which pays him $100000 every year. He expects the company to increase his pay every year by 10%. In such a scenario, his Projected Income for the next five years is as follows:

Now let's assume the Inflation is at 3% due to the Inflation Risk. The Increase in Ryan Income will be adjusted for Inflation, and the Real Increase of Income will be as follows:

Example #2

In December, 2023, Lawrence Summers, the ex-Treasury Secretary, expressed a concern that investors might be downplaying the risk of inflation as markets swiftly adjust their expectations for Federal Reserve easing. In an interview on Bloomberg Television's Wall Street Week with David Westin, Summers conveyed his view that there is a potential underestimation in the market regarding the progress on inflation.

According to him, there is a risk that the anticipated advancements in inflation may not materialize as much as people are hopeful, and correspondingly, the scope for Federal Reserve easing might not be as extensive as anticipated. This cautionary sentiment from Summers suggests a need for investors to carefully assess and recalibrate their expectations in the face of evolving economic dynamics.

How To Mitigate?

Let us now discuss a few ways through which inflation risk bonds can be mitigated through the detailed discussion below.

- Spread investments across various asset classes, such as stocks, bonds, real estate, and commodities. Diversification helps minimize the impact of inflation on any single asset.

- Treasury Inflation-Protected Securities (TIPS) are specifically designed to safeguard against inflation. These bonds adjust their principal value based on changes in the Consumer Price Index (CPI).

- Allocate a portion of the portfolio to real assets like real estate and commodities, which have historically shown resilience against inflation. These tangible assets tend to retain or increase in value as prices rise.

- Regularly review and reassess your investment strategy in response to economic conditions and inflation trends. Being proactive in adjusting your portfolio can help mitigate potential risks.

- Companies with a history of stable dividends can act as a hedge against inflation, providing a source of income that may keep pace with rising living costs.

- Seek advice from financial experts or advisors who can offer insights and strategies tailored to current economic conditions, helping navigate the complexities of inflation risk.

Advantages

The advantages of an inflation risk premium is as listen below.

- The significant advantage of Inflation Risk is that it results in more spending by the people when prices are increasing, and people prefer to spend more in the present on goods and services, which in the future will increase otherwise.

- A moderate rise in Inflation risk enables the business to increase prices commensurate with the increase in their input costs, such as Raw materials, Wages, etc.

Disadvantages

Despite the advantages mentioned above, there are a few factors from the other end of the spectrum as well. Let us understand the disadvantages of inflation risk bonds through the points below.

- First and foremost is the Price Risk that stems from Inflation Risk; prices of goods and services increase due to an increase in output cost, which is either passed on to customers, resulting in fewer units purchased for the same price, or a reduced quantity at the same price. In cases where cost can’t be passed, it results in downward pressure on the business's profit margins.

- Another type of risk is Purchasing Power. Inflation Risk results in Purchasing power risk and results in savings not sufficient enough to meet the goals for which they are intended to be. In other words, they are leading to the falling real income levels.

- Inflation Risk results in higher borrowing costs for businesses as lenders need to be compensated not just for the risk of lending but also for the additional that stems from falling real value of money in the future compared to the present.

- Inflation risk also results in a competitive disadvantage for one country over another as its exports will be less, leading to reduced foreign cash inflows.