Table Of Contents

Inflation Hedge Meaning

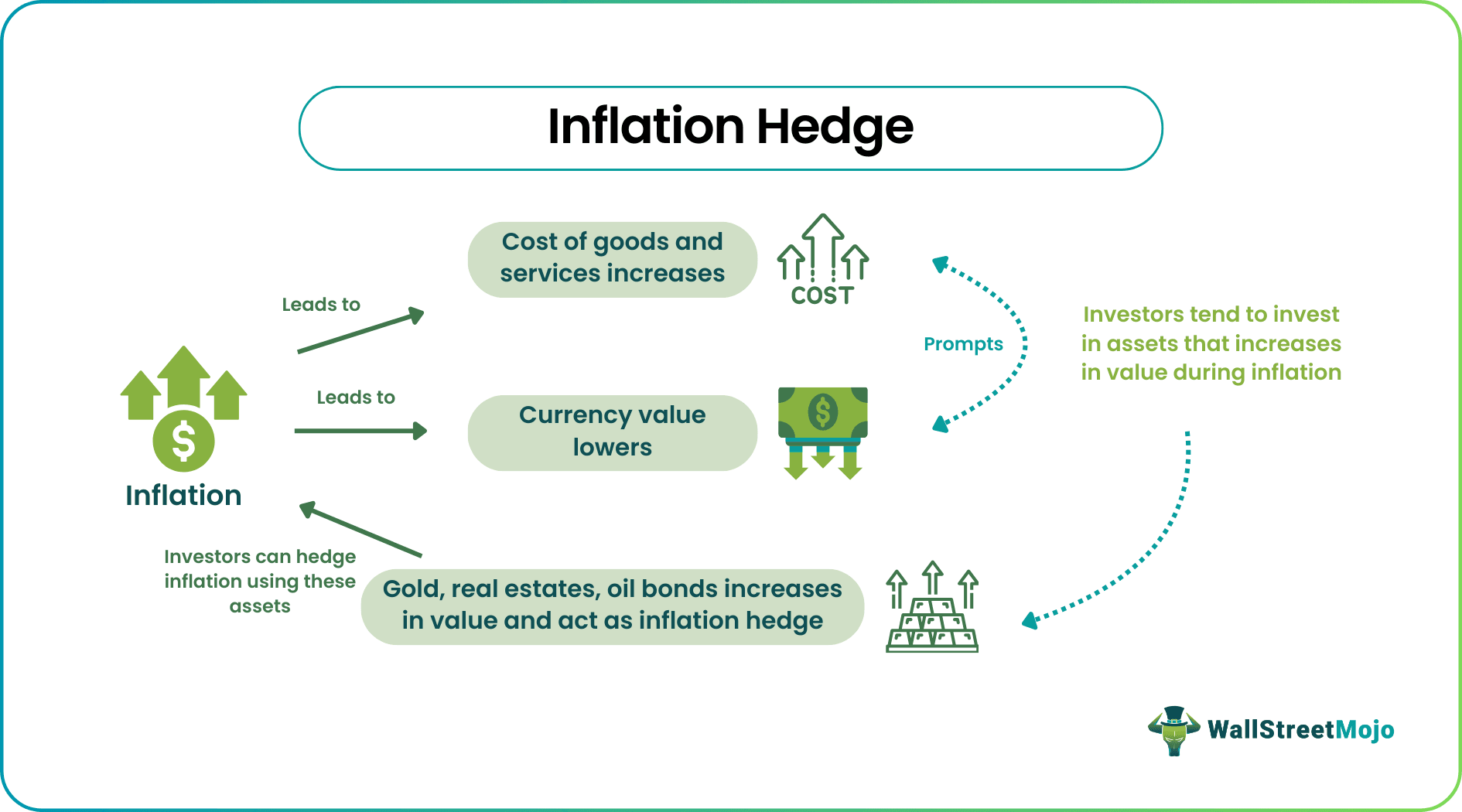

An inflation hedge refers to investments that provide protection to investors as the purchasing power of money diminishes due to rising inflation. These investments help stabilize or increase in value during periods of inflationary cycles in the economy.

Investors rely on their fundamental characteristics to safeguard their investments and minimize operational costs. Inflation hedging allows for assessing an asset's true strength regarding profitability during inflation. Gold, in particular, is often regarded as an inflation hedge asset due to its inverse relationship with the US dollar.

Table of contents

- Inflation Hedge Meaning

- An inflation hedge is a strategy used to mitigate the impact of inflation by investing in assets resistant to the depreciating currency and rising prices of goods and services.

- Inflation-resistant assets serve as effective tools to combat inflation and offer the potential for better returns on investment.

- Some commonly used inflation hedge assets include US Treasury inflation-protected securities (TIPS), UK index-linked gilts, physical real estate holdings, ETFs on REITs, real estate investment trusts (REITs), securities, gold, floating-rate bonds, real estate, and commodities.

Inflation Hedge Explained

An inflation hedge is a method to thwart the expected dip in the currency prices due to the inflationary effect of a rise in goods and services prices. It tends to decrease the currency's value and increase the prices of goods and services. Hence, it becomes important for investors to protect their investments against these dreaded situations.

Investors can hedge against inflation and decreasing currency value by investing in gold and real estate, besides some top-performing securities. Some investors also buy assets tied to inflation whose value increases with inflation. Moreover, some bonds have given a certain interest rate to investors on a partial basis during inflation.

Let us know the features of a good inflation hedge:

- Must quickly respond to increased inflation with higher returns

- Must be able to work efficiently across all countries, time durations, and inflation periods

- Must yield good long-term returns across the period

Let us look at some popular assets that provide investors with some protection against inflation:

- US treasury inflation-protected securities (TIPS), UK index-linked gilts

- Physical real estate holdings

- Exchanged traded funds (ETFs) on REITs

- Real estate investment trusts (REITs),

- Securities also correct some effects of inflation

- Gold

- Floating-Rate Bonds

- Real Estate

- Commodities

All these inflation hedge assets get discussed in the next section so that one can use them to fight inflation successfully.

How To Hedge Inflation With Investment?

One can hedge inflation with the following investments:

#1 - US Treasury Inflation-Protected Securities (TIPS)

They get issued by the US government in the form of government bonds created to hedge against inflation. Investors buy these and get interest in return. Their interest rate gets fixed and increases when inflation rises, giving more return to the investors.

#2 - Index-Linked Gilts

They get issued by the government and give out coupon payments every six months.

#3 - Physical Real Estate Holdings

It requires huge capital, so most investors cannot invest in it.

#4 - Exchanged Traded Funds (ETFs) On REITs

They get considered a low-cost investment opportunity for investors who want to expose themselves to REITs.

#5 - Real Estate Investment Trusts (REITs)

Real estate investment trusts remain linked to real estate rents and properties. Hence, even during inflation, real estate prices increase, giving investors a good yield in these investments.

#6 - Securities

They tend to be the best tool to hedge against inflation. During inflation, the Fed increases rates to handle inflation leading to profitability in banking and allied services sectors. Hence, if one invests in such sectors via securities, then one gets good returns even during inflation.

#7 - Gold

Gold inflation hedge or inflation hedge gold also acts as the best to counter the rising inflation and related price hike of products and services.

#8 - Floating-Rate Bonds

They get their interest rate hiked when inflation rises and decreases when inflation decreases. It happens because the central banks change the benchmark interest rates with regard to inflation changes. Hence, investors most often invest in floating-rate ETFs instead of buying bonds.

#9 - Real Estate

Real estate has been independent of the effects of inflation. Even during rising inflation, it has given good returns on investment in properties giving a shield and protection to investors' money.

#10 - Commodities

Commodities' price increases during inflation. Hence many investors like to invest in commodities like oil and corn in anticipation of giving good returns during inflation.

Examples

Let us look at some examples to understand the topic clearly.

Example #1

Let's consider an example where an individual invested $10,000 in real estate in an uptown area of New York in 2018. As inflation increased and made everything more expensive, the person decided to sell the property. They could sell it for $100,000, resulting in a profit of $90,000 or a 90% return on their initial investment.

Example # 2

In the current scenario, gold has emerged as a reliable asset for hedging against high inflation levels in the US. Despite a 10% decline in gold prices, it has allowed individuals to safeguard their purchasing power over extended periods. Gold's resilience as an inflation hedge has allowed investors to protect their wealth during times of significant inflation.

Quadratic Interest Rate Volatility And Inflation Hedge ETF

The main differences are as follows:

Quadratic Interest Rate Volatility ETF:

- Designed to provide exposure to the volatility of interest rates.

- Seeks to track the performance of an index that measures the implied volatility of interest rate swaps.

- Potentially allows investors to benefit from changes in interest rate volatility.

- It can be used as a tool for hedging against interest rate risk in a portfolio.

- Offers a diversified approach to capturing interest rate volatility across various maturities and instruments.

Inflation Hedge ETF:

- Aims to protect against inflation by investing in assets that have historically shown a positive correlation with inflation.

- Typically includes investments in commodities, real estate, inflation-linked bonds, and stocks of companies in sectors that perform well during inflationary periods.

- Offers potential for capital appreciation and preservation of purchasing power during inflationary environments.

- Allows investors to gain exposure to inflation without the need to hold physical assets or manage individual inflation-linked securities directly.

- It can serve as a diversification tool within a portfolio to hedge against the erosion of real value caused by inflation.

Frequently Asked Questions (FAQs)

Cash is not typically considered an inflation hedge. Holding cash during inflationary periods can erode purchasing power as the currency's value decreases due to rising prices. Investing in assets that have historically performed well during inflation, such as real estate, commodities, or inflation-protected securities, is generally considered a more effective way to hedge against inflation.

Some have considered Bitcoin a potential inflation hedge due to its decentralized nature and limited supply. Some investors view it as a digital store of value that may protect against inflation. However, the volatility and speculative nature of Bitcoin make its effectiveness as a reliable inflation hedge subject to debate and individual risk tolerance.

Stocks can be seen as a partial inflation hedge. While inflation can impact stocks in various ways, such as increased input costs for businesses, stocks also have the potential to provide long-term returns that outpace inflation. Companies that can adjust prices and generate profits in an inflationary environment may offer protection against the eroding effects of inflation. However, the relationship between stocks and inflation is complex, and other assets like real estate or commodities may provide more direct inflation hedging characteristics.

Recommended Articles

This article has been a guide to Inflation Hedge & its meaning. We explain hedging inflation with investment, & relation with quadratic interest rate volatility. You may also find some useful articles here -