Although indirect and direct finance has the same participants, they operate in different markets. Therefore, it becomes necessary to understand the differences, so let us look at them:

Table Of Contents

What Is Indirect Finance?

Indirect finance is a method of raising capital for businesses and individuals with the assistance of financial intermediaries or third-party institutions. This approach is chosen primarily to secure funding while mitigating the risks associated with asymmetric information.

The significance of indirect finance extends to both households and organizations. Direct financing takes a back seat in this system as third-party intermediaries assume a pivotal role. This results in lower financing costs for consumers and provides access to specialized expertise. However, it is important to enhance the flexibility of indirect finance within secondary markets.

Key Takeaways

- Indirect finance refers to financing where participants (borrowers) obtain funds from a third party rather than directly approaching primary lenders.

- Borrowers in indirect finance can include both consumers and firms. Consumers typically use this financing to purchase products, while firms use it to fund their operations.

- These financial intermediaries include depository institutions, credit unions, contractual savings institutions, and investment intermediaries.

- Additionally, they provide financial services like denomination divisibility, liquidity, and flexibility in terms of maturity.

Indirect Finance Explained

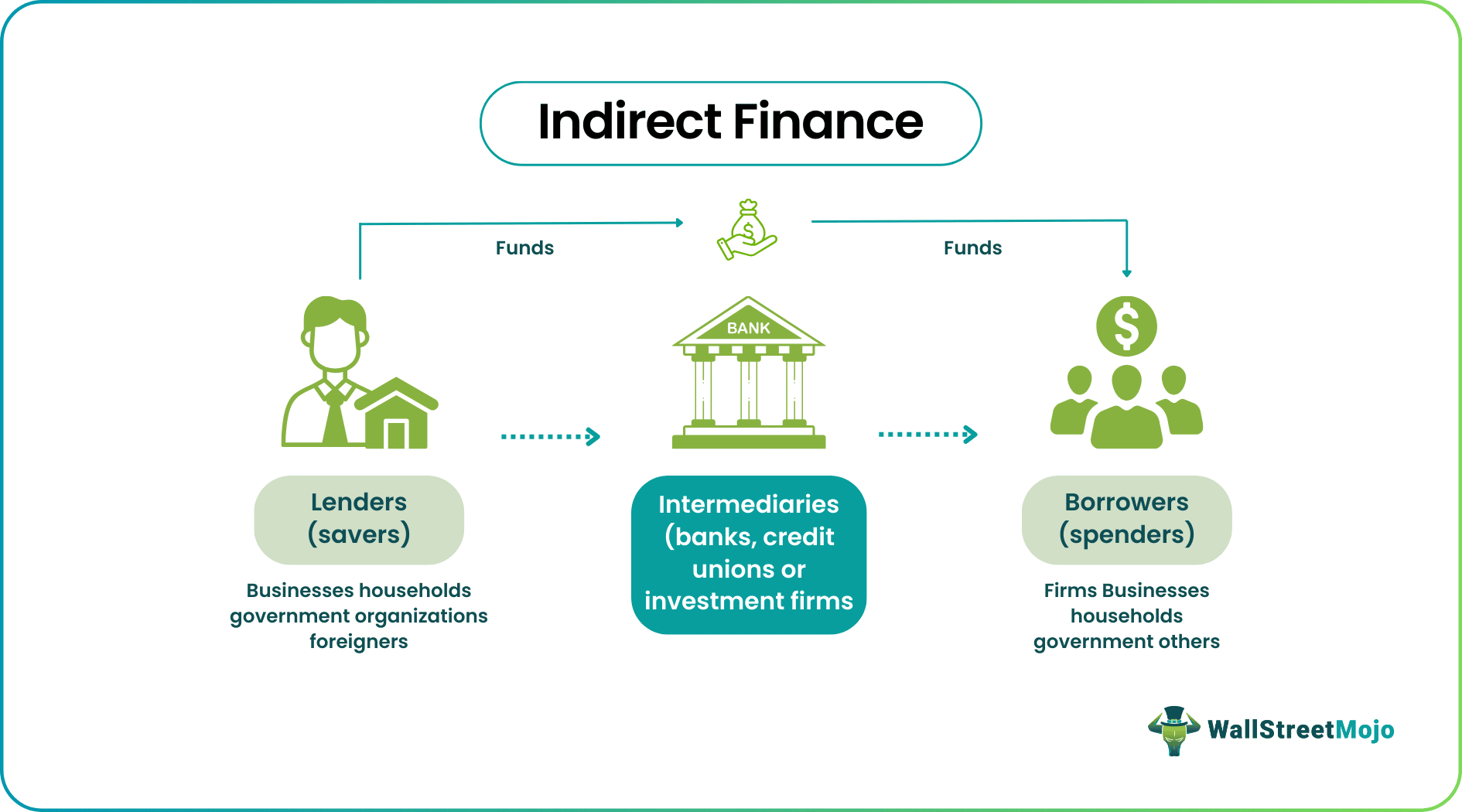

Indirect finance is a financing mechanism that enables businesses and households to access borrowed funds through intermediaries rather than dealing directly with investors. Intermediaries, such as banks, provide expertise and help eliminate the risks associated with information imbalances.

The process of indirect finance involves interactions between consumers and financial intermediaries. In this system, firms and households act as lenders and borrowers, while intermediaries encompass depository institutions, investment intermediaries, banks, etc. When businesses require capital, they turn to banks instead of seeking investments from individual investors. Similarly, households utilize channels like dealers to finance their expenditures.

Indirect financing is crucial for firms that cannot get public capital directly. Banks play a vital role in this process, enabling firms to secure capital through loans provided at competitive rates.

From the consumer's perspective, the process of indirect finance differs. Firms seek capital for various reasons, which banks are well aware of. As a result, banks bridge the gap between firms needing funds and consumers looking to invest. However, there's always the possibility that savers (depositors) may choose not to lend their money directly. In such cases, banks act as intermediaries, offering information about the benefits and guarantees associated with investment products. They gather funds through small deposits and then extend loans to companies in the form of debt.

Examples

Let us look at some examples of indirect finance to comprehend the concept better:

Example #1

Suppose Mr. James wants to buy a new model of Toyota car. As a result, he went to the nearby dealership showroom to find the best deal. However, he was short of funds. Thus, the dealer tried providing a loan facility with advantages like an extended warranty and discounted premiums. Therefore, James could easily avail of finance without approaching the bank directly.

Example #2

Consider Stamford & Co., a thriving technology startup with ambitious expansion plans. They find themselves in financial difficulty as a substantial portion of their capital has been invested in recent projects, leaving them in urgent need of additional funds to fuel their growth. However, due to various constraints, tapping into the primary market through a Follow-on-Public Offer (FPO) isn't viable.

In this critical juncture, Stamford & Co. strategically turns to a trusted financial intermediary, a well-established bank, to secure the required financing. The bank extends a debt arrangement offering a competitive interest rate of 12% over a 1.5-year term. This decision enables Stamford & Co. to access the necessary capital quickly, showcasing the practical application of indirect financing within the secondary market. It exemplifies how businesses, especially startups facing immediate financial demands, can effectively leverage intermediaries like banks to meet their funding needs and propel their expansion plans.

Example #3

In November 2022, the European Bank for Reconstruction and Development (EBRD) agreed to provide indirect financing to Bank al Etihad. This involves a $35 million loan from EBRD to Bank al Etihad, split into two parts: up to $25 million for supporting eligible businesses and individuals (Tranche A) and up to $10 million for lending to women-led SMEs (Tranche B).

The project's goals include aiding Bank al Etihad in lending to these groups, strengthening its financial structure, and aligning its practices with the Paris Agreement's objectives. The project aims to positively impact various aspects, including governance, resilience, inclusivity, and competitiveness. Bank al Etihad, a prominent banking group in Jordan, will use this indirect financing to improve its financial structure and expand its lending, specifically focusing on women-led SMEs.

The project also adheres to environmental and social requirements outlined in the EBRD's Performance Requirements. It includes technical cooperation funds supporting Bank al Etihad's transition plan and lending capabilities for women-led businesses.

Advantages And Disadvantages

Indirect finance plays a vital role in the capital development of the economy. However, there are certain advantages and limitations of indirect finance. So, let us look at them:

Advantages

- Indirect finance allows borrowers to access funds from various sources, including banks and financial intermediaries.

- Typically, the cost of borrowing through indirect finance is lower due to competition among intermediaries and economies of scale.

- Indirect finance often involves spreading risks among multiple investors and lenders, reducing the risk exposure for individual borrowers.

- Intermediaries can provide borrowers with valuable financial advice and guidance, helping them make informed decisions.

- Borrowers can choose from various loan products and terms offered by intermediaries.

- The involvement of intermediaries can expedite the loan approval and disbursement process, benefiting borrowers in urgent need of funds.

Disadvantages

- Borrowers may incur fees or charges for the services provided by intermediaries, increasing the overall cost of borrowing.

- While intermediaries facilitate access to funds, they cannot guarantee the absolute security of funds, and there may be risks associated with financial intermediation.

- Assessing the creditworthiness of borrowers can be challenging for intermediaries, leading to potential issues of non-performing loans.

- Borrowers might take on excessive risks, assuming that intermediaries or lenders will bear the consequences, potentially leading to adverse outcomes.

Indirect Finance vs Direct Finance

| Basis | Indirect Finance | Direct Finance |

|---|---|---|

| 1. Meaning | Borrowers raise capital from financial intermediaries. | Individuals or firms borrow directly from the public. |

| 2. Purpose | To raise capital without approaching investors directly. | To increase existing capital by approaching direct lenders. |

| 3. Market | Operates in the secondary market through intermediaries. | Operates in the primary market, dealing directly with the public. |

| 4. Example | Purchasing a car through a dealer with a dealer-facilitated loan. | A firm raises capital through an IPO directly from the public. |