Table Of Contents

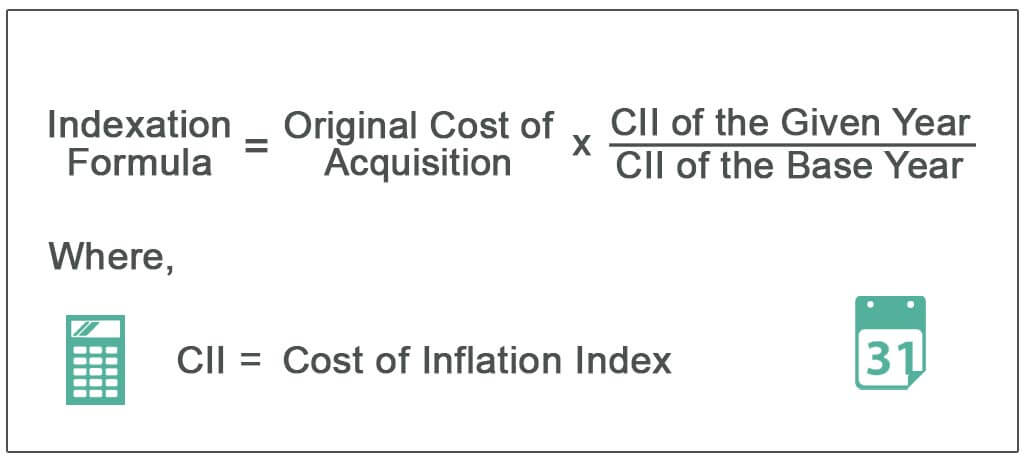

Formula to Calculate Indexation Cost

Indexation can be defined as a technique that can be used to adjust the amount byways of a price index to maintain the purchasing power after excluding the effect of inflation.

The formula to calculate indexation cost is represented below,

Indexation = Original cost of acquisition x CII of the given year / CII of the base year

Where,

- CII stands for Cost of Inflation Index

Step by Step Calculation of Indexation Cost

The steps to calculate the indexation cost are as below:

- Find out the original cost of acquisition, including the cost of the transaction which took place.

- Note down the Consumer Inflation Index for the year, which could be a year of the sale or any other year.

- Now, note down the base year’s Consumer Inflation Index.

- Multiply the original acquisition cost with CII noted in step 2 and divide the same by CII noted down in step 3. The resultant figure is the index value, which shall bring the value of an asset in the current period.

Examples

Example #1

You are required to compute the current price of X. The cost of X that was purchased in the year 2001 was $100,000. It is now 2019, and the prices of X have increased. What is the current X price provided that CII in the given year, i.e., 2019, is 214 and CII of the base year, which is 2001, is 190?

Solution

We are given here the cost of acquisition, the CII for 2019, and the CII for 2001. Hence, we can use the formula below to calculate the current X price.

Below is the given data for the calculation of the current price.

- Purchase Price: 100000.00

- CII for the given the year 2019: 214.00

- CII for the base year 2001: 190.00

Therefore, the calculation of the current price is as follows.

= $100,000 x 214 / 190

Current price will be -

- Current Price =$112,631.58

Hence, the current price of X is $112,631.58 per Indexation.

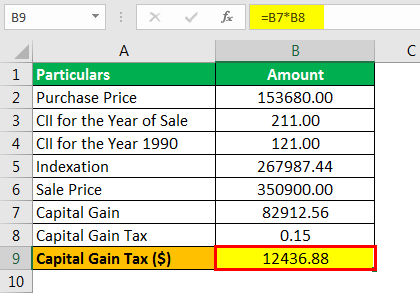

Example #2

Country X has a system of taxing individuals on the sale of an asset. It has also set up the policy when there is a sale of the asset, and if it's being sold in a long-term period, then there is a benefit of Indexation applicable. Mr. Kennedy’s resident of country X had purchased the land back in 1990 and has sold the land in the current year. He acquired that land for $153,680, including duties and other transaction costs. After almost a decade, he has sold this asset for $350,900. The capital gains are subject to 15%. Also, the CII for 1990 was 121, and the CII for the year of sale was 211. After applying for indexation benefit, you must compute capital gain on the asset's sale.

Solution

Mr. Kennedy purchased the asset back in the year 1990 and has sold it almost after a decade; hence, he would be subject to long-term capital gain tax. To compute the tax, we need first to find the capital gain, and for that, we need the index acquisition cost.

Below is given data for the calculation of Indexation

- Purchase Price: 153680.00

- CII for the Year of Sale: 211.00

- CII for the Year 1990: 121.00

Therefore, Indexation Cost can be calculated using the above formula,

= $153,680 x 211/121

Indexation will be -

- Indexation = $ 267,987.44

Capital Gain

- Capital Gain = 82912.56

Capital Gain Tax

- Capital Gain Tax = 12436.88

Now, we can calculate the gain, which would be sale less index cost of acquisition which is $350,900 less $267,987.44, which would be $82,912.56

The long-term capital gain tax is 15%, which would be applied to the gain we calculated above, i.e., $82,912.56, and 15% of the same would be $12,436.88.

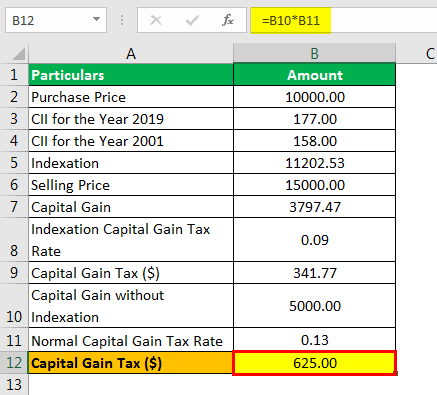

Example #3

Y is a developed nation. It has a policy of taxing long-term capital gain at 12.5% and short-term capital gain tax at 17%. Also, the country allows indexation benefits for long-term capital gain. Further, the country allows 9% long-term capital gain flat if no indexation benefit is taken. Mrs. Carmella sold an asset for $15,000, subject to long-term capital gain tax. When the asset was purchased for $10,000, the CII for the same was calculated as 158, and the CII for the year of sale was calculated as 177. You must evaluate whether Mrs. Carmella should opt for Indexation or pay long-term capital gain tax, flat at 9%?

Solution

It is an interesting question where govt. It is flexible with their taxpayers and allows them to pick up the best option where they need to pay less tax.

Mrs. Carmella purchased the asset and is liable for long-term capital gain tax. To calculate the tax, we need first to find out the capital gain, and again to calculate the gain, we need to index the acquisition cost.

Use the following data for the calculation of Indexation

- Purchase Price: 10000.00

- CII for the year 2019: 177.00

- CII for the year 2001: 158.00

Therefore, Indexation Cost can be calculated using the above formula,

= $10,000 x 177/158

Indexation will be -

Indexation =$ 11,202.53

Capital Gain will be -

- Capital Gain = 3797.47

Capital Gain Tax will be -

- Capital Gain Tax = 341.77

Hence, the gain would be $15,000 less $11,202.53, which would be $3,797.47, and capital gain tax on the same would be 9% of the same, which is $341.77 capital gain tax.

Option II

Capital Gain Tax will be -

Capital Gain Tax =625.00

Pay capital gain tax @ 12.50% straight on gain of $5,000 ($15,000 less $10,000) which shall be $625.

Hence, the tax outflow is more in option II; the taxpayer should opt for an option I with Indexation.

Relevance and Uses

Indexation is widely used in many countries for gauging economic conditions. As stated earlier, this is the most commonly used measure for valuing the assets to current prices and, by proxy, for knowing the effectiveness of the government's economic policy. The Indexation shall give the businesses, the government, and citizens a brief idea about the changes in the price of the assets in the economy and can act as a guide to making decisions about the whole economy. Indexation is used in the field of taxation and in other fields of finance to know the true value of the asset purchased from the base year to the current period.