Table Of Contents

Independent Contractor Meaning

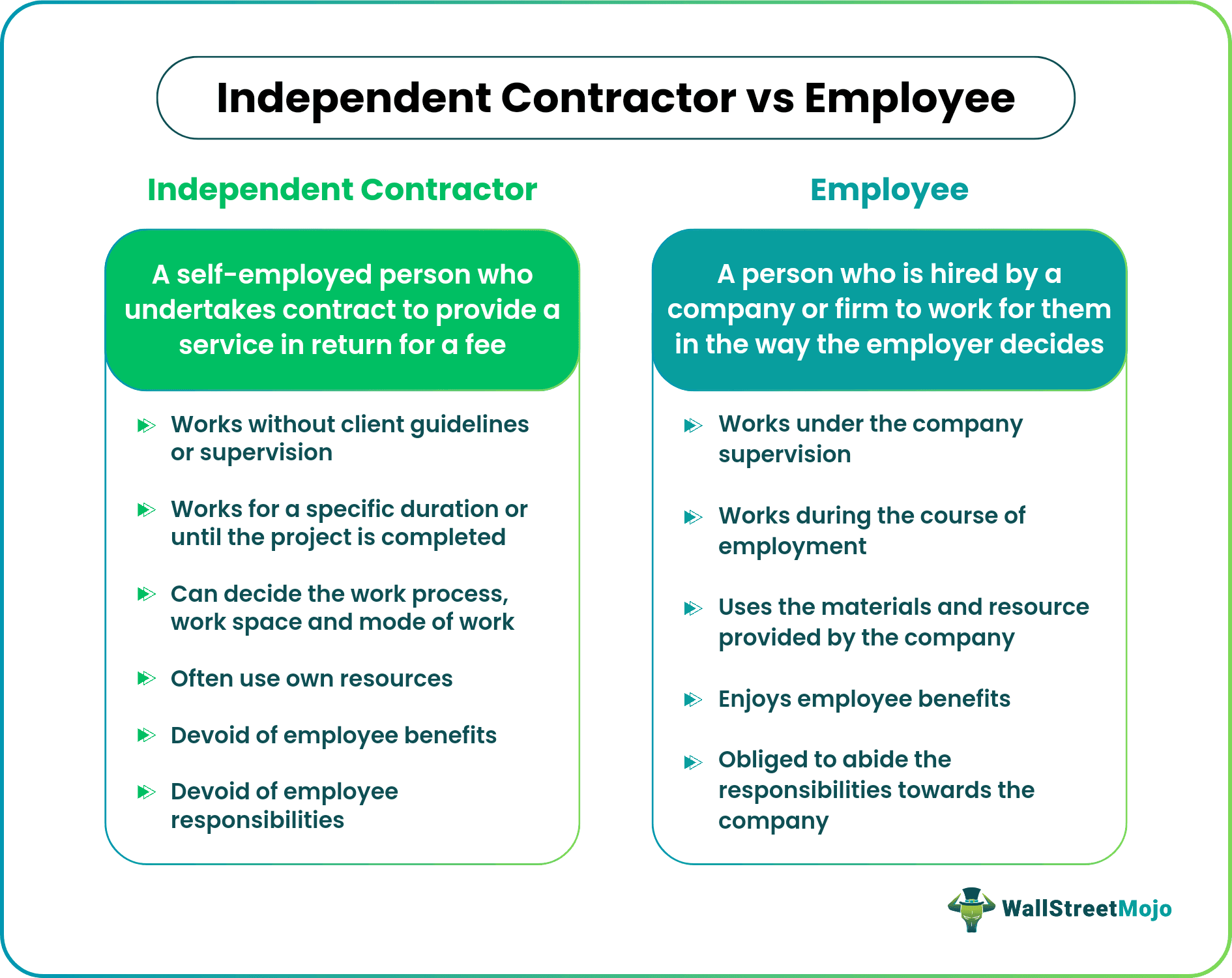

Independent contractors are people hired by companies, firms, and corporations to complete certain projects. They are self-employed individuals who work on a contractual basis for a certain duration. Independent contractors are paid with a fee dictated by the contract terms they sign when they agree to work for the client.

Rather than being obliged to meet the demands of the company they work for, independent contractors can be thought of as a separate business entity that provides a service for a fee. Therefore, they are not protected by employee benefits and often get the job done without any supervision or guidelines from the company.

Key Takeaways

- Independent Contractors are self-employed people who provide services to firms and companies without being fully employed by them.

- The terms of the partnership between individual contractors and their client firms are detailed in the agreement.

- The Independent contractor agreement provides details regarding the nature of the task, payment terms, and terms for dispute resolution and termination of the contract, etc.

- For paying taxes, independent contractors are treated as self-employed individuals by the IRS and must pay self-employment tax.

Understanding Independent Contractors

Independent contractors can include doctors, accountants, lawyers, contractors, real estate agents, or any other service providers who market their skills and talents for public service. Nowadays, people call independent contracts freelancers in layman terms.

A vast array of new skillsets has emerged to provide self-employment opportunities to individuals in recent times. The pandemic has boosted the demand for freelance professionals and skilled contract jobs.

Even though they work as self-employed individuals, independent contractors are classified depending on their working relationship with the entity who hired them. Generally, if the client controls the services delivered by a self-employed person, then the service provider is not an independent contractor. The freedom to control the details of the work is usually the single biggest difference between being an independent contractor and an employee.

The distinction of whether a certain individual is indeed a self-employed independent contractor or not is not necessarily relevant in terms of the work. However, it does gain significance when the tax authorities tax the income they gain through their work at the end of every financial year. The classification of a self-employed independent contractor in such instances may be different for different people based on certain facts.

Perks of independent contracts

The independent contractor can decide their work hours, mode of work, process, etc. They can decide when and how to complete the task, and they generally utilize their own resources and materials for the same. They can also earn as much as they want and often decide their own remuneration.

While the perks of being a freelancer seem quite interesting, one should also note that they are devoid of the safety net of permanent employees. The independent contractor has to find their own work and are constantly on the hunt for more projects as soon as they finish a contract. They are also responsible for running their self-employment business and have to keep track of everything from the money earned to the number of clients they can manage at a time. Managing agreements, schedules, and performance for multiple contractors can be challenging, but contractor management tool simplifies oversight, ensures compliance, and automates essential tasks.

Examples

Example #1

Let us consider a yoga instructor in a city who controls her own weekly schedules. She controls the running of the studio, the size of classes, course design, fees charged, décor, selection of music, etc. She also has the freedom to hire assistants to help her. This yoga instructor is, therefore, an independent contractor.

However, consider the case of a yoga instructor who works in a health club. The health club decides her schedule, the layout of the studio, fees charged from customers, etc. They also take care of the general maintenance and marketing of the club activities. In this scenario, the partnership between the club and the instructor is that of an employer and employee.

Example #2

An example of an independent contractor is an auto mechanic who owns or rents a workshop from a third party, sets his own hours, owns a resale license for auto parts, orders them on his own will, and sets his own timings.

On the other hand, a mechanic who works in someone else’s shop and receives a commission on the income generated every month by the shop, where the owner decides his hours and price paid by each customer is an example of an employee.

Example #3

A lawyer, who rents his own office, advertises his services in the local magazines and yellow pages, charges clients by the hour, and is at freedom to hire a substitute or assistant to work for him is an example of an independent contractor.

Suppose a lawyer handles the firm's legal affairs and represents them in business partnerships and meetings. The firm bills the clients for their services and pays a regular fee to the lawyer every month. In this case, the lawyer is an employee.

Independent Contractor Agreement

Before the employment of any individual for a project, work or task, it is imperative for the involved parties to have a formal, legally binding contract in place. Both the parties discuss the terms of the contract, and the delivery of the work commences after they consent to abide by the final agreement.

The agreement's purpose is to protect both parties from any legal issues or potential violations that may arise in the future after the work has started. Formally known as the Independent Contractor agreement, companies or firms regularly use it to hire professionals or freelancers from outside their organization to help with any job or task. For additional guidance, ZenBusiness explains how to hire independent contractors.

The independent contractor agreements are quite simple and either party can quickly draft and notarize them if required. A typical contractors’ agreement will include the details about the job, the terms of payment, the medium of resolution in case of any dispute between the parties, etc.

A more exhaustive list of elements found in independent contractor agreements are as follows:

- Introduction and identification details of the client and the freelancer

- Description of the rendered services

- Period the contract is valid for

- Responsibilities of both parties

- Payment terms

- Terms for termination of the contract

- Terms of resolution between parties in case of any dispute or breach of agreement

- List of laws and acts applicable

- Signature of both parties

Independent Contractor Tax Considerations

Paying the independent contractor does not come under wages. Hence, the paying company or firm does not withhold the tax liability for the income. This implies that they will not deduct payment for social security, Medicare, or federal income taxes. Hence, in most cases, the onus of declaring the income received as payment and fulfilling the tax obligations for delivering services as an independent contractor falls on the individual itself.

As of 2020, the paying firm has to send Form 1099-NEC to the freelancer or independent contractor. This document provides details of all payments over $600 made to the contractor during the year. If the individual works with multiple firms during the financial year, they will receive multiple copies of the form.

However, the IRS treats independent contractors as self-employed individuals, and hence they are made to follow a different set of taxation rules than regular employees.

The IRS requires all independent contractors to pay a self-employment tax if the net earnings generated from self-employment in a year exceed $400. Such an individual will need the help of Form-1040 or 1040 SR for tax payments and return filing. Contractors who are sole proprietors can use Schedule-C to calculate the pretax income or loss to the business.

For 2021, the Self-employment tax is at 15.3%, the tax rate as per the IRS website essentially consists of two parts:

- 12.4% for social security

- 2.9% for Medicare and an additional 0.9% Medicare surtax for high-income earners.

Also, in addition to the federal taxation laws, an individual may need to pay taxes on income at the state level. The regulations covering these taxes vary in every state and need to be in all tax calculations.

Deductions for Independent Contractors

As proprietors of small businesses, independent contractors often miss out on many benefits that employees of regular firms enjoy. They luckily have certain deductions that they can avail of while calculating the taxable income every year. Some of the deductions they can avail by independent contractors are as follows:

- Transit expenses while meeting a client.

- Purchases made for equipment required for work. Travel expenses as well.

- Any professional liability insurance.

- Retirement savings

- Several work-related expenses