Table Of Contents

Indemnification Meaning

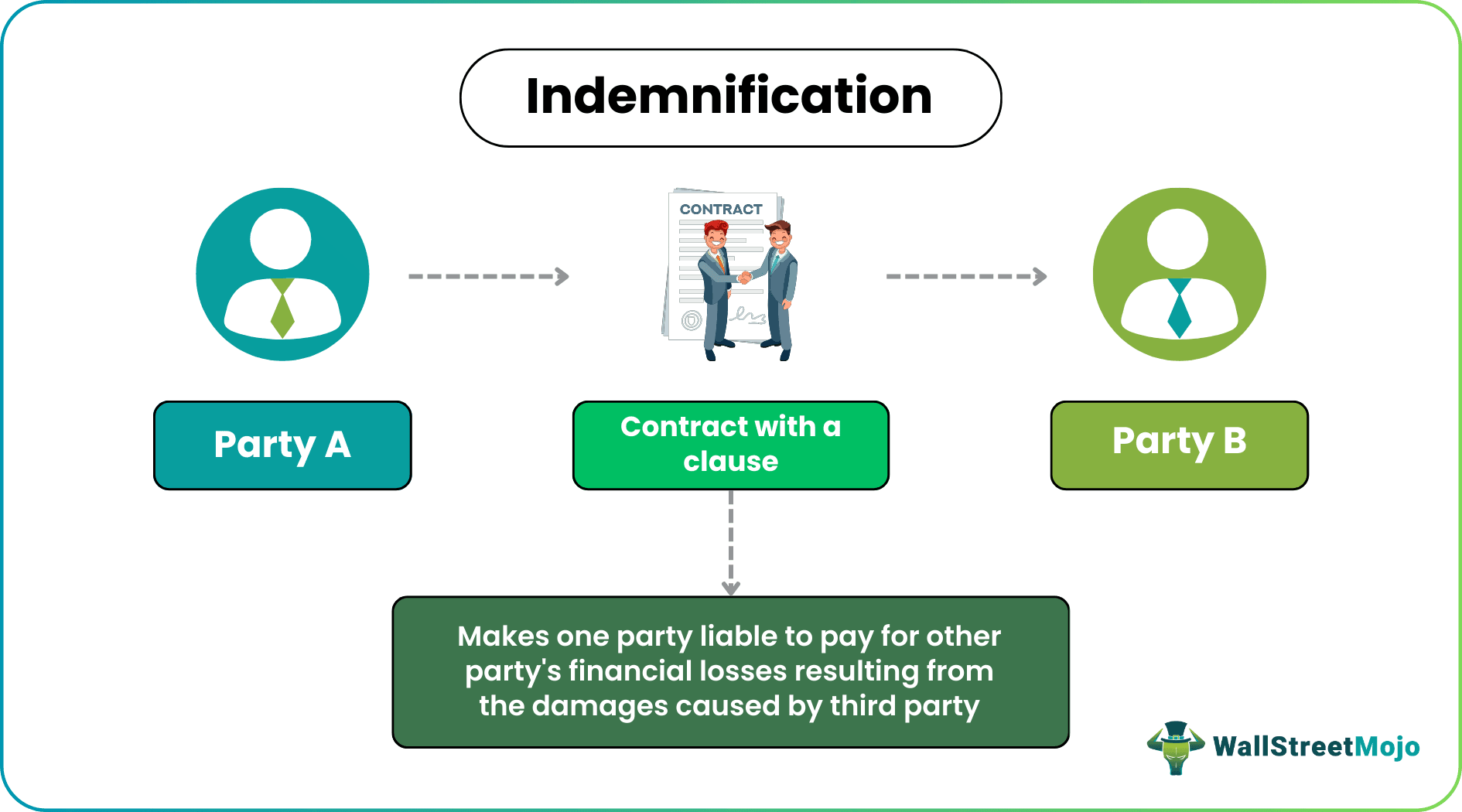

Indemnification is a legal obligation under a contract between two parties in which one party becomes liable to pay for any losses or litigation to the other caused due to a third party. It becomes an important shield of protection for one's business from financial losses involving costly litigation. It has become a standard industry practice to make indemnification a part of all business.

Also referred to as the indemnity clause, this obligation can be limited to the situation which could be controlled. Signing it saves two directly linked parties from shouldering higher liability risk, keeping a third party in between, which then becomes accountable for taking care of the potential risks. One can be special leverage to clinch the business deal through the sufficient risk mitigation provided by this indemnification clause.

Table of contents

- Indemnification Meaning

- An indemnification provision (also known as an indemnity clause) states that one party shall be responsible for covering any damages or legal costs the seller has to afford as a result of a third party within a legal agreement between two parties.

- It turns into a crucial barrier of defense for one's company against monetary losses or expensive lawsuits brought on by harms caused by or received from a third party. The majority of the time, an indemnification provision only applies to situations that one can manage.

- It transfers risks from one party to another without any insurance payment, whereas indemnity forms the backbone of insurance, and insurance transfers risks from one party to another based on the insurance payment.

- It tends to be an important document in all business contracts, like the limitation of risks to parties in case of third-party damages.

Indemnification Clause Explained

An indemnification clause can be stated as the most common legal element present in a contract for making one party absorb all the losses incurred by the other arising from third-party-caused events, accidents, and damages, either financial damage, physical injury, or physical damage to property. They can be either mutual or one-sided contracts. The indemnity contracts contain various terms like claims terms, recoverable damages, covered events, indemnity caps, and reimbursement terms. Furthermore, all courts, including federal, state, and local, can enforce indemnification but some states prohibit the insertion of the clause in indemnification agreements.

Every indemnity clause contains specific events, terms, and conditions that will make the other liable to compensate for the damage or loss the other suffers. That event is called the trigger event, which invokes the clause immediately. Such events fall under the following categories:

- Breach of agreement by any one of the party

- An action undertaken

- Negligence by any party

Both parties agree to include such trigger events in the contract, These will only invoke the clause. The conditions under which one can use an indemnification clause are:

- When one party agrees to provide a guarantee to another

- When one wants to protect oneself from any ambiguous liability

Indemnification working can be explained using the steps below:

- First of all, parties get into a legal contract.

- One of the parties decides to bear the burden of any damage or cost due to the third party, called an indemnifying party.

- Then, trigger events get recorded in the agreement as an indemnity clause.

- As soon as the trigger event occurs, the liable partner’s responsibility begins.

- Finally, the indemnifying party compensates all the costs, losses, or damages owing to the third party.

A letter of indemnification can be found in a variety of:

- Reasons like highly risky contracts in which a powerful party proposes the indemnity clause and projects high risks or damages or may suffer loss through any financial transaction.

- Sectors like the construction sector, partnership business, & insurance sectors.

Examples

Let us take the help of a few examples to understand the topic.

Example #1

Let us assume there is business XY corporation, which sells product A to various retailers. XY corporation has signed an indemnity clause with one of the retailers, Alex, regarding the sales of product A. If any third party raises concerns regarding the duplicity of the product on Alex, then Alex would not be responsible for the legal case. In such cases, a company like XY Corporation will be responsible for and bear the litigation cost and fight that case instead of the retailer or the user of the product.

Example #2

Another example relates to the injury of a customer. Suppose a shop owner remodeled the shop from a firm after signing the indemnity clause. Now, if a customer visited the shop and got injured by the breakage of the glass door, then such a case would be directed at the firm that remodeled the shop due to the indemnity clause. Hence, the shop owner can be protected from the litigation of the customer and is not liable to pay any damages to the customer or bear the cost of litigation.

Importance

One finds that an indemnification clause tends to be an important document in all business contracts because of the clarity it provides in terms of the following:

- Limitation of risks to parties in case of third-party damages

- The counterparty bears the losses and litigations arising out of the third party.

- If the indemnity is mutual, then its security to both the parties in the agreement from third-party damages or losses by collaboration with each other.

- Only the counterparty bears the risk if the indemnity clause is one way.

- It limits the scope of the damage claim by the third party.

- It increases the trust between a service provider and their clients.

Drawbacks

Businesses find it difficult to get the negotiation of the indemnity bond done all the time. Moreover, if a client insists on the execution of an indemnity bond, then the cost of services being offered may increase as the risk to cover the contract would also increase. Besides this, there are other limitations, which have been listed below:

- An indemnity bond makes a contract difficult to understand due to legal jargon.

- It becomes difficult to include unspoken huge impacting risk into the clause.

- It tends to make people make the clause too detailed, making the clause over-complicated.

Indemnification vs Indemnity vs Insurance

Let us use the table below to understand the difference between the three terms.

| Indemnification | Indemnity | Insurance |

|---|---|---|

| It transfers risks from one party to another without any insurance payment. | It forms the backbone of insurance. | Insurance transfers risks from one party to another based on the insurance payment. |

| It can dictate the behavior of insurance policy. | No indemnity means no insurance. | It comes from a part of indemnification. |

| It does not put a cap on the limit of the amount for damage or losses from the third party to be paid as compensation. | Indemnity may or may not involve the insurer and the insured. | It puts a cap on the limit for damage or losses from the third party to be paid as compensation by the insurer. |

| Active indemnification insurance is a precondition for the execution of indemnification. | It is a prerequisite for the indemnification process. | It facilitates the indemnification process. |

| Not applicable here. | No such things happen. | It may involve a one-time payment to the insured on their death. |

Frequently Asked Questions (FAQs)

Indemnification works by allowing one party to compensate for the losses suffered by the third party claims for specific situations or events and their related costs and expenses.

In insurance, insurers tend to make an agreement with the insured persons regarding coverage of damage, losses, or liabilities which may occur out of the insured event. It means that insurers have to pay the third party for the damage caused by any event covered under the clause of Indemnity in an insurance policy.

It requires property owners to sign the indemnity clause under the lease agreement by the tenant. It can be done to protect the leased property from any third-party losses or damages, as the tenant has to pay the full amount or disburse the amount partly to compensate the property owner under a liability situation. One should not sign the indemnity clause if one feels that the clause contains reimbursement for damages or loss from an uncontrollable situation.

Under this clause of Indemnity, both parties are equally and mutually responsible for the damages or losses caused by the third party. Both parties consider themselves innocent and harmless compared to the other for all liability or loss due to the activities mentioned in the contract.

Recommended Articles

This article has been a guide to Indemnification and its meaning. Here, we explain it with examples, compare it with indemnity & insurance, and its importance. You may also find some useful articles here -