Table Of Contents

What is Incremental Cash Flow?

Incremental cash flow is the cash flow realized after a new project is accepted or a capital decision is taken. In other words, it is basically the resulting increase in cash flow from operations due to the acceptance of new capital investment or a project.

The new project can be anything from introducing a new product to opening a factory. If the project or investment results in positive incremental cash flow, then the company should invest in that project as it would increase the company’s existing cash flow.

But what if one project is to be chosen and multiple projects have positive incremental cash flows? Simple, the project with the highest cash flows should be selected. But ICF shouldn’t be the only criteria for choosing a project.

Incremental Cash Flow Formula

Components

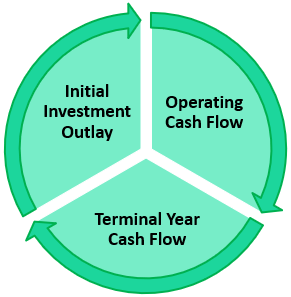

When considering a project or analyzing it through cash flows of that project, one must have a holistic approach rather than looking at only inflow from that project. Incremental cash flow thus has three components to it –

#1 - Initial Investment Outlay

It is the amount needed to set up or start a project or a business. E.g., a cement manufacturing company plans to set up a manufacturing plant at XYZ city. So all the investment from buying land and setting up a plant to manufacturing the first bag of cement will come under initial investment (remember, initial investment does not include sunk cost)

#2 - Operating Cash Flow

Operating cash flow refers to the amount of cash generated by that particular project, less operating, and raw material expense. If we consider the above example, the cash generated by selling cement bags less than the raw material and operating expenses like labor wages, selling and advertising, rent, repair, electricity, etc. is the operating cash flow.

#3 - Terminal Year Cash Flow

Terminal cash flow refers to net cash flow that occurs at the end of the project or business after disposing of all the assets of that particular project. Like in the above example, if the cement manufacturer company decides to shut down its operation and sell its plant, the resulting cash flow after brokerage and other costs is terminal cash flow.

- So, ICF is the net cash flow (cash inflow – cash outflow) over a specific time between two or more projects.

- NPV and IRR are other methods for making capital budgeting decisions. The only difference between NPV and ICF is that while calculating ICF, we do not discount the cash flows, whereas, in NPV, we discount it.

Video Explanation Of Cash Flow

Examples

- A US-based FMCG company XYZ Ltd. is looking to develop a new product. The company has to make a decision between soap and shampoo. Soap is expected to have a cash flow of $200000 and the shampoo of $300000 during the period. Looking only at the cash flow, one would go for shampoo.

- But after subtracting expense and initial cost, soap will have an incremental cash flow of $105000 and shampoo of $100000 as it has a greater expense and initial cost than soap. So going only by the incremental cash flows, the company would undertake the development and production of soap.

- One should also consider the negative effects of undertaking a project as accepting a new project may result in a reduction in the cash flow of other projects. This effect is known as Cannibalization. Like in our above example, if the company goes for the production of soap, then it should also consider the fall in cash flows of existing soap products.

XYZ Ltd

| Particular | Soap | Shampoo |

|---|---|---|

| Cash Flow | $200,000 | $300,000 |

| Less: Expense | $60,000 | $135,000 |

| Less: Initial Cash outflow | $35,000 | $65,000 |

| Incremental Cash Flow (ICF) | $105,000 | $100,000 |

Advantages

It helps in the decision of whether to invest in a project or which project among available ones would maximize the returns. Compared to other methods like Net present value (NPV) and Internal rate of return (IRR), Incremental cash flow is easier to calculate without any complications of the discount rate. ICF is calculated in the initial steps while using capital budgeting techniques like NPV.

Limitations

Practically incremental cash flows are complicated to forecast. It is as good as the inputs to the estimates. Also, the cannibalization effect, if any, is difficult to project.

Besides endogenous factors, there are many exogenous factors that may affect a project greatly but are challenging to forecast like government policies, market conditions, legal environment, natural disaster, etc. which may impact incremental cash flows in unpredictable and unexpected ways.

- For example - Tata steel acquired the Corus group for $12.9 billion in 2007 to tap and enter into the European market as Corus was one of the largest steelmakers in Europe that produced high-quality steel and Tata was a low quality steel producer. Tata forecasted the cash flows and benefits arising out of acquisition and also analyzed that the cost of acquisition was less than the setting up its plant in Europe.

- But many external and internal factors led to a slump in steel demand in Europe, and Tata’s were forced to shut down its acquired plant in Europe and are planning to sell some of its acquired business.

- So, even large companies like Tata steel couldn’t accurately predict or forecast market conditions and, as a result, suffered huge losses.

- It cannot be the sole technique for selecting a project. ICF in itself is not sufficient and needs to be validated or combined with other capital budgeting techniques that overcome its shortcomings like NPV, IRR, Payback period, etc. which, unlike ICF, considers the TVM.

Conclusion

This technique can be used as the initial tool for screening projects. But it would need other methods to corroborate its result. Despite its shortcomings, it gives an idea about the project’s viability, profitability, and its effect on the company.

Recommended Articles

This article has been a guide to What is Incremental Cash Flow and its definition. Here we discuss formula to calculate the incremental cash flow along with the example, components, advantages, and disadvantages. You can learn more about from the following articles –