Table Of Contents

What is the Income Statement Formula?

The term “income statement” refers to one of the three primary financial statements the company uses to summarize its financial performance over the reporting period. The income statement is also referred to as the statement of earnings or profit and loss (P&L) statement. This income statement formula calculation is done by single or multiple steps.

In the case of a single step, the income statement formula is such that the net income is derived by deducting the expenses from the revenues. Mathematically, it is represented as,

Net Income = Revenues – Expenses

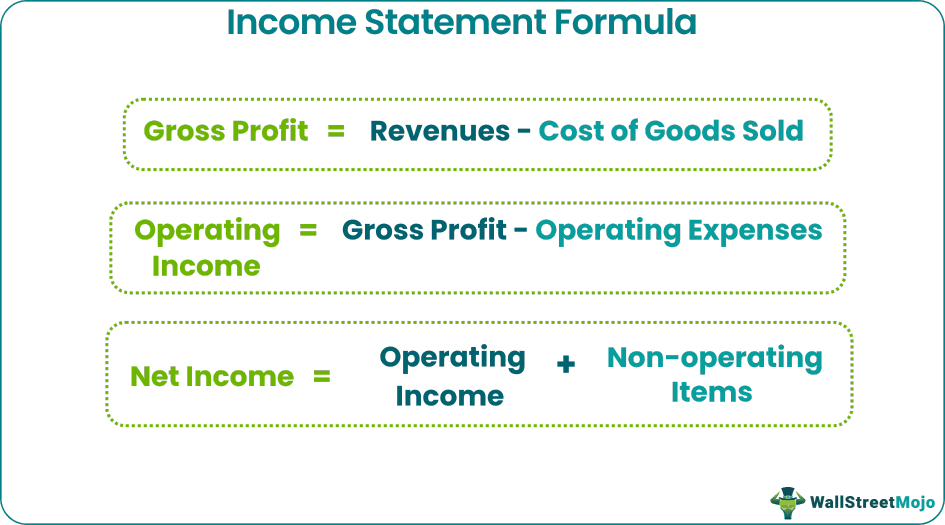

In the case of multiple steps, first, the gross profit is calculated by subtracting the cost of goods sold from revenues. Then the operating income is computed by deducting operating expenses from gross profit, and finally, the net income calculation is done by adding operating income and non-operating items.

Income Statement Formula is represented as,

- Gross Profit = Revenues – Cost of Goods Sold

- Operating Income = Gross Profit – Operating Expenses

- Net income = Operating Income + Non-operating Items

The income statement formula under the multiple-step method can be aggregated as below,

Net income = (Revenues + Non-operating items) - (Cost of goods sold + Operating expenses)

Explanation of the Income Statement Formula

Under the single-step method, the formula for income statement calculation is done by using the following steps:

Firstly, the profit and loss statement has to note the total of all the revenue-generating sources.

Next, determine the cost of goods sold from the profit and loss account. The cost of goods sold primarily includes raw material costs. In this step, the gross profit can be calculated by deducting the cost of goods sold from the revenues. It is as shown below:

Gross profit = Revenues - Cost of goods sold

Next, the operating expenses are also collected from the income statement. Operating expenses primarily include selling expenses, administrative expenses, etc. In this step, the operating income can be calculated by deducting operating expenses from the gross profit, as shown below.

Operating income = Gross profit - Operating expenses

Next, determine the non-operating items such as interest income, one-time settlements, etc. Finally, the net income calculation is done by adding the net of non-operating items (= non-operating income – non-operating expense) to the operating income, as shown below.

Net income = Operating income + Non-operating items

Revenue vs Income Explained in Video

Example of Income Statement Formula (with Excel Template)

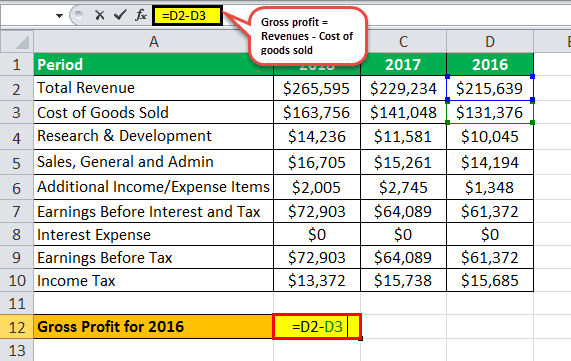

Let us take the real-life example of Apple Inc.'s annual report on September 29, 2018. First, fill up the blank spaces based on the following available information.

Below is data for the calculation of Apple Inc.'s annual report.

Gross Profit

Therefore, Gross Profit can be calculated as,

Gross profit = Net sales – Cost of goods sold

= $215,639 Mn - $131,376 Mn

Gross Profit for 2016 will be -

Gross Profit for 2016 =$84,263

Operating Income

Therefore, Operating Income can be calculated as,

Operating income = Gross profit – Operating expenses

= $84,263 Mn – $10,045 - $14,194

Operating Income for 2016 will be -

Operating Income for 2016 = $60,024

Net Income

Therefore, Net Income can be calculated as,

Net income = Operating income + Non-operating items

=$60,024 Mn + $1,348 - $15,685

Net Income for 2016 will be -

Net Income for 2016 =$45,687

Similarly, we can calculate gross profit, operating income, and net income for 2017 & 2018, and also, you can refer to the below given excel template for the same.

Relevance and Use of Income Statement Formula

Understanding the income statement formula is very important for people interested in actively trading in the stock market or analysts who investigate a particular company's financial performance. Therefore, they must know how to read financial statements, including the income statement.

One should note that net income is not the same as cash profit. Nevertheless, the ability of a company to generate healthy net income over a long period can be seen as a positive for its stock and bond prices because it is the net income that compensates the shareholders for the risks they have taken. Conversely, if a company cannot generate enough profit, then the value of the stock is likely to plummet. In short, a company with healthy earnings will have higher stock and bond prices.