Table Of Contents

Formula of Income Elasticity of Demand

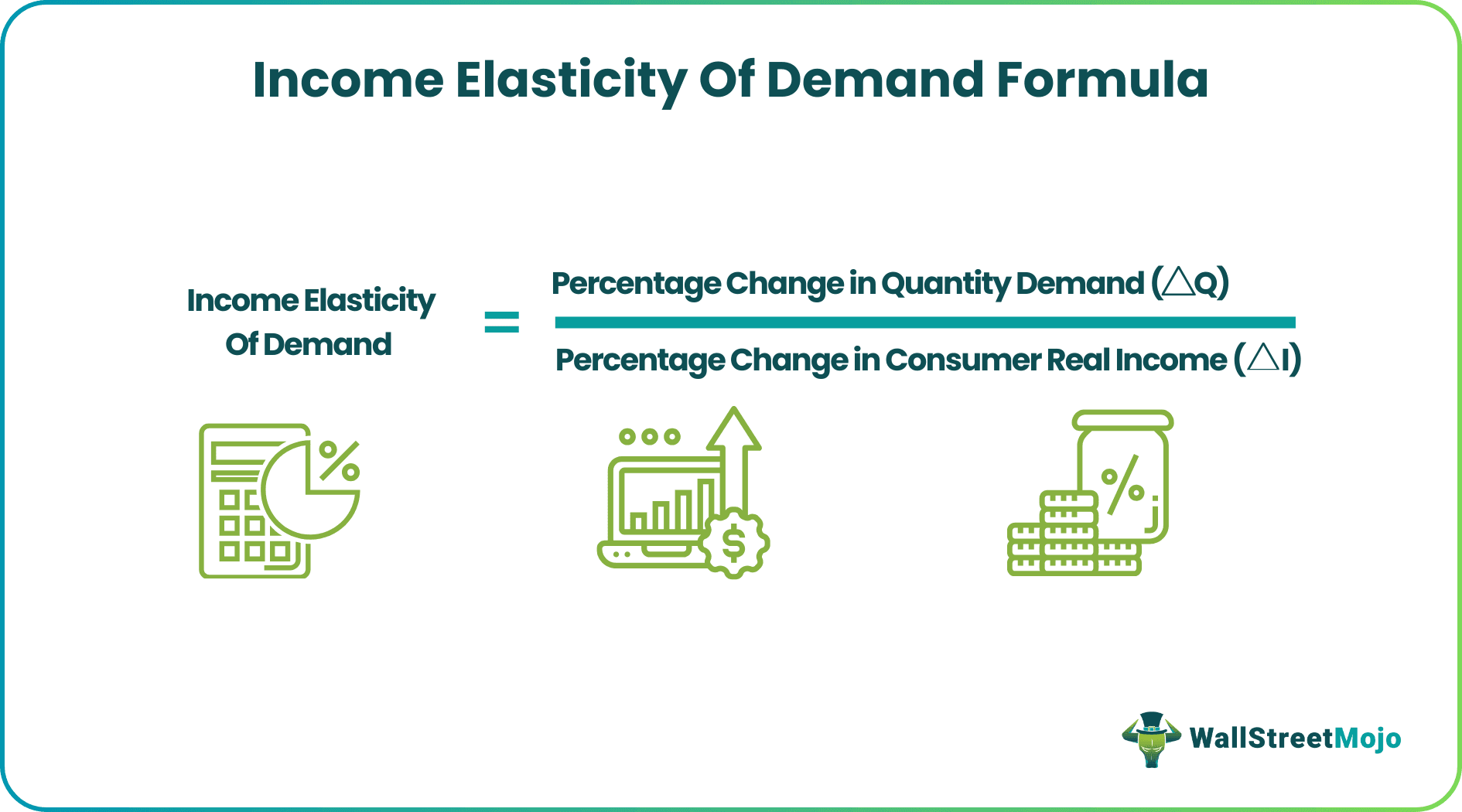

The income elasticity of demand formula determines the percentage change in the demand for goods or services with the fluctuation in consumers' real income. It measures the impact of change in consumers' real income on buying behavior and product demand.

So, below is the formula for the Income Elasticity of Demand.

Income Elasticity of Demand = Percentage Change in Quantity Demanded (ΔQ) / Percentage Change in Consumers Real Income (ΔI)

OR

Income Elasticity of Demand = ( (Q1 – Q0) / (Q1 + Q2) ) / ( (I1- I0) / (I1 + I2) )

The symbol Q0 in the above formula depicts the initial quantity that is demanded, which exists when the initial income equals I0.

When the Income changes to I1, it will be because of Q1, which symbolizes the new quantity demanded.

In the above formula, the income elasticity of demand can be either a non-positive number or positive number because of the relationship between the goods in question and the consumer's income, which again can be either positive or negative. As the income goes up, the quantity demanded shall either go down or up depending on the type of good. That is, when the income goes down, the quantity demanded shall again go in any direction depending upon the type of goods it is.

Key Takeaways

- The income elasticity of demand formula calculates the percentage change in the demand for goods or services in response to a shift in consumers' real income.

- It helps understand how changes in consumers' income impact their purchasing behavior and product demand.

- Income elasticity of demand can have either a negative or positive value, depending on the relationship between the goods and consumers' income.

- The sign of the elasticity is influenced by whether the goods are normal or inferior and whether the consumer's response to income changes is positive or negative.

Revenue vs Income Explained in Video

How to Calculate?

Example #1

Let’s take an example when the Income of the consumers falls by 6%, say from $4.62K to $4.90K. The demand for luxuries has decreased by 15%. Are you required to calculate the income elasticity of demand?

Solution:

Below is given data for the calculation of income elasticity of demand.

- Percentage Change in Quantity Demanded: -15%

- Percentage Change in Real Income: -6%

Now, the income elasticity of demand for luxuries goods can be calculated as per the above formula:

Income Elasticity of Demand = -15% / -6%

Income Elasticity of Demand will be -

Income Elasticity of Demand = 2.50

The Income Elasticity of Demand will be 2.50 which indicates a positive relationship between demand for luxuries good and real income.

Note:

The negative signage in the denominator of the formula indicates a decrease.

Example #2

OLA is an India-based mobile application where the customers use it to book rides of their choice, and they can take a ride anywhere, whether it's inter-city or intra-city. OLA has the concept of supply and demand wherein the price changes based on the booking requests. Suppose the bookings have exceeded the available cabs. In that case, it has the concept of contentious surge pricing feature that will make use of big troves of data on the supply of the cabs (i.e., of the divers available) and the booking request (i.e., by riders) and further to regulate the price in the real-time and to maintain the equilibrium for every real-time.

Further to this concept, they also surge the prices for a while, resulting in dampening the booking request. A recent study indicated that when a day's excess income is left more than 20 percent, then one would go for a price surge, then it was noticed that there was an increase in booking for about 28 percent.

You are required to estimate the income elasticity of demand based on the above data.

Solution:

Below is given data for the calculation of income elasticity of demand.

- Percentage Change in Quantity Demanded: 28%

- Percentage Change in Spare Income: 20%

As it can be noted that there is an increase in the bookings when the day’s spare income is left out with the consumer.

Now, the elasticity of demand for cabs can be calculated as per the above formula:

Income Elasticity of Demand = 28% / 20%

Income Elasticity of Demand will be -

Income Elasticity of Demand = 1.40

The Income Elasticity of Demand will be 1.40 which indicates a positive relationship between demand and spare income. hence, this depicts that riding in cabs is a luxury good.

Example #3

When the consumer's real income is $40,000, the quantity demanded economy seats in the flight are 400 seats. When the consumer's real income is increased to $45,000, the quantity demanded decreases to 350 seats. Mr. Newman wants to study this behavior as an economist student and wants to know why the seat demand decreased even though there was an increase in the consumer's real income.

You are required to calculate the Income Elasticity of Demand.

Solution:

Below is given data for the calculation of income elasticity of demand.

- Quantity at Beginning: 400.00

- Quantity at End: 350.00

- Income Level at Beginning: 40000.00

- Income Level at End: 35000.00

Now, the income elasticity of demand for economy seats can be calculated as per the above formula:

- Income Elasticity of Demand = (350 – 400) / (350 + 400) / (40000 – 40000) / (35000 + 40000)

- Income Elasticity of Demand = (-50 / 750) / ( 5000 / 75000 )

Income Elasticity of Demand will be -

Income Elasticity of Demand = -1

The Income Elasticity of Demand will be -1.00, which indicates a unitary inverse relationship between the quantity demanded economy seats of the flight and the consumer's real income.

It indicates that the economy class of the flights is inferior goods, and hence the demand for the same decreases when the income of the consumer increases.