Table Of Contents

Illusion Of Control Bias Definition

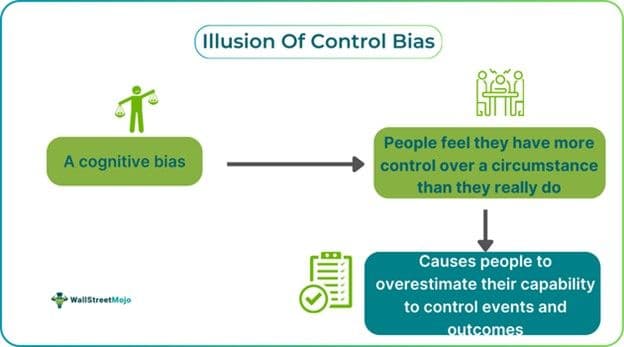

Illusion Of Control Bias is a type of cognitive bias that leads individuals to believe that they have more control over a situation than they actually do. It causes them to overestimate their power over occurrences and outcomes, which ultimately has an adverse influence on their decision-making abilities.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

The illusion of control can lead to overconfidence, which may result in poor judgment. If individuals think they have greater authority than they actually do, they could get a false sense of security. Those who overestimate their influence over a result may end up taking more risks than they should.

Key Takeaways

- Absolute risk reduction is the variation in event rates between two interventions. This calculation reveals the difference between the risks involved in an event in the control and treated groups in a study.

- The ARR analyzes the differences between two risks and helps determine the number needed to treat (NNT). It is otherwise known as the risk difference.

- It helps reflect the risk reduction related to the treatment and the underlying risk associated with access to the treatment. ARR is used to evaluate risk reduction along with relative risk reduction.

Illusion Of Control Bias Explained

The illusion of control bias is a cognitive bias in which individuals overestimate their capacity to influence or control events and outcomes, even when they have no actual control. The psychologist Ellen Langer initially proposed the idea of the illusion of control in 1975 when she conducted a number of tests showing individuals were inclined to think they have control over random events. Langer's study emphasized the difference between "chance-oriented" tasks, where results are decided mainly by coincidence or randomness, and "skill-oriented" tasks, where results are primarily determined by talent or skills.

When they apply skill-oriented thinking to chance-oriented situations, individuals feel an excessive sense of control and influence over the result. This is the core idea behind the illusion of control. Addressing the illusion of control can help individuals enhance their decision-making processes, evaluate risk more accurately, and eventually make more informed choices.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Causes

The causes of this bias are:

- When individuals actively participate in a process, even if their actions do not actually affect the outcome, they are more likely to feel that they have control over the results.

- Individuals who feel knowledgeable or confident in a situation may believe that they have more control over the result because of their apparent experience with it.

- When circumstances are luck-oriented, individuals who have faith in their abilities may overestimate their control because they will credit their own choices for results instead of the possibility of external forces.

- Individuals may mistakenly link their actions to outcomes even in cases when there is no related connection, which can lead to an illusion of control. This is because humans are naturally drawn to patterns and correlations.

Examples

Let us go through the following examples to understand this bias:

Example #1

Let us assume that Sam is an investor who believes that he is an expert in stock trading. Due to his confidence in this field, he invested a large amount of money in a particular stock instead of diversifying his portfolio across various companies and business sectors. Due to unfavorable market conditions, Sam experienced a significant loss in his investment. This is an illusion of control bias example.

Example #2

According to an email sent to the executive team that was posted on social media, Elon Musk insisted that every Tesla employee return to the office full-time. This top-down, authoritarian strategy is contrary to effective practices since it is based on distrust and incorrect assumptions. It hints at a control illusion that could be harmful to Tesla employees' engagement, productivity, creativity, retention, and hiring. One of Musk's false beliefs is that workers "pretend" to work from home. In contrast to other companies that have considerably more flexible work setups, Musk evidently lacks trust in his employees. This is another illusion of control bias example.

Impact On Investment Decisions

The impact of this bias on investment decisions is as follows:

- The illusion of control leads investors to invest in penny stocks. This is based on their belief that assuming the company's small size, they can utilize their resources to acquire a substantial stake in it so that they have control over the business's future. However, because of the nature of the industry in which they operate, many such penny stocks are risky. This false sense of control leads to further losses for investors.

- Investors who feel a false sense of control often consider themselves experts in their field. As a result, they center the majority of their portfolio on a single industry. Since the portfolio is not diversified, this leads to issues. If an unfavorable event occurs in the market, an undiversified portfolio will probably experience substantial price fluctuations.

- Investors with this bias fail to recognize opportunities when they are available. Since they have a false sense of control, they might overlook favorable entry and exit points in a specific stock.

How To Avoid?

Some ways to avoid this bias include the following:

- Individuals can use diversification in their holdings. Investors can lessen their exposure to specific risks and market swings by building a portfolio of diluted and unrelated assets distributed across different asset classes and industries.

- Individuals may consider trading for a more extended period instead of concentrating on short-term trading. By keeping a long-term perspective and emphasizing their investment objectives, investors may avoid market timing and overtrading, which can be harmful in the long run.

- A method of reducing this bias is creating and following an organized plan. By developing and implementing an action plan, precisely one that depends on solid investment ideas, individuals can avoid behaviors that give them a false sense of control over their financial outcomes.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Difference Between The Illusion Of Control And The Paradox Of Control

Illusion Of Control

- This bias is an inclination to overestimate the capacity to influence the result of unforeseen occurrences.

- Individuals often overestimate their control over events due to a mental bias.

- It may result in arrogant and risky, even disastrous, decisions.

The Paradox Of Control

- The paradox of control implies that managers may have to give up some control and give their workers more authority to obtain greater control.

- This paradox indicates that managers may actually lose control as they attempt to have more influence over the workers and the company.

- It is due to the likelihood of employee resistance or rebellion against an excessive amount of control, which could lower interest and performance.