Table Of Contents

Illiquidity Discount Definition

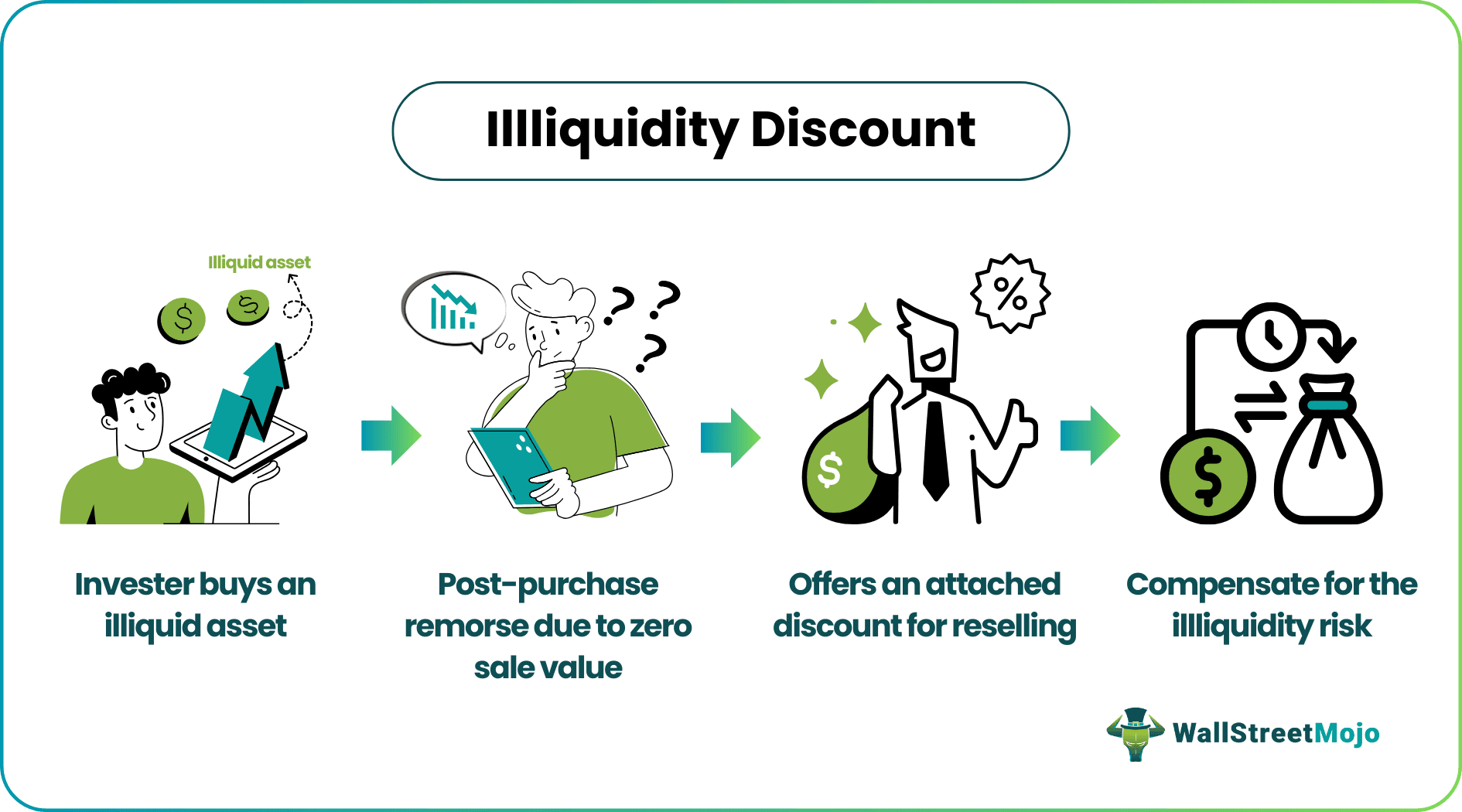

An Illiquidity Discount is the forced, unwanted reduction in an asset’s price or value due to its illiquid nature, i.e., it cannot be sold without expending considerable time, effort, and money. It is tough to sell such assets in open markets as it is difficult to find buyers for them. Hence, they cannot be liquidated and converted to hard cash easily. Therefore, a discount is offered to enable their sale, increase marketability, and attract buyers.

When an asset has zero resale value, the buyer of such an asset incurs an immediate loss, even without trying to sell it further. To sell it and make tangible earnings out of it, the asset owner offers a discount to compensate for its low marketability. The inability to reverse the original purchase also prompts this discount. If an asset has a liquidity risk, an illiquidity discount is allowed to initiate resale.

Key Takeaways

- An illiquidity discount refers to the discount applied on an illiquid asset’s price because it has zero resale value in open markets.

- Asset owners are willing to forego the earnings they could have booked without the discount since they prioritize the opportunity cost of potentially missed future opportunities. Hence, they offer illiquid assets at a discount to attract buyers.

- Depending on a buyer's subjective adjustment and the asset's profile, the illiquidity discount may be low or high. At times, it may be as low as 2% to 5% or go as high as 50%.

- Certain types of risky bonds, private company stocks, stocks with low trade volume, and real estate properties are some common examples of illiquid assets.

Illiquidity Discount Explained

An illiquidity discount is a reduction in an asset’s price due to its illiquidity. Asset holders offer such discounts during resale to nullify their illiquid nature. In the context of resale, there are two types of assets, namely, liquid and illiquid. Liquid assets are those that can be sold and easily converted to cash. In contrast, illiquid assets hardly attract buyers, making resale challenging.

Not everything an individual or a company buys or holds as an investment is liquid, meaning it may not have the desired resale value. It means that the asset holder is technically stuck with the investment. Such illiquid assets result in the locking of funds. Some examples of such assets are real estate, stock options, bonds, or any other financial instrument. In such cases, a discount on the illiquid asset's value is warranted, as it likely attracts buyers. This discount acts as compensation for negligible or no marketability.

The next question one may have is how to calculate this discount. Its computation depends on the data pertaining to the asset and prevailing market conditions. Asset type, existing valuation methods, data consistency, and comparability insights are important factors affecting the computation.

Various methods are employed to compute illiquidity discounts for private companies' assets, including the trading volume and bid-ask spread, market-based methods, and stochastic discount factor models. The model that will be used also depends on the valuation purpose. Every method is based on certain corresponding assumptions, factors affecting data reliability, and limitations. The next section discusses the computation strategy and methods in detail.

How To Estimate?

A single or common illiquidity discount formula cannot be employed in all scenarios where such computation is needed. Therefore, each asset follows a different method through which its illiquidity discount is calculated. The valuer's general preference and judgment also play a key role. When data reliability is low, model-based methods are generally used, or a survey-based approach may be employed when a model seems inefficient.

Many valuers employ multiple methods to cross-verify and authenticate the results. Some other computation methods that can be employed include restricted stock studies (where the value of stocks with restrictions on their sale are considered), expert valuation (which can be subjective), and direct negotiations between parties, among others.

The illiquidity discount determination is a complex process and demands precise data analysis, careful decision-making, and the ability to analyze and interpret market predictions. Some common mistakes must be avoided, such as using invalid historical data, incorrectly interpreting the current market conditions, disregarding the differences in different asset forms or types, or using a single model for every asset type. Also, it is imperative to avoid double-counting, making inaccurate assumptions, and ignoring important factors (if any).

While many factors affect the illiquidity discount computation, there are mainly two types of illiquidity discount approaches once the computation is available.

- Direct approach: Deduct the illiquidity discount from the asset's value as a percentage of the total amount.

- Indirect approach: The discount rate or cash flow is adjusted to reflect the asset's illiquidity.

Determinants

The determinants of illiquidity discount are:

- The holding period of the investor who owns the illiquid asset is considered.

- The opportunity cost is a key determinant because an investor loses potential opportunities to earn profits as time passes.

- The asset's type, nature, and structure can vary. The asset may be from various asset classes, including real estate, stocks, bonds, vehicles, or any other physical asset. The more illiquid it is, the more challenging it becomes to sell.

- The determinants of illiquidity discount for private companies are their financial health, the possibility of an IPO, physical cash, capital market conditions, and long-term economic vision.

- A lack of options is another significant determinant. It means when an investor wants to exit, the fewer the number of options available, the more the illiquidity discount they will incur upon resale eventually.

- Restricted stock units under employee stock compensation can also be factored in while computing illiquidity discounts.

Examples

Here are two hypothetical scenarios that explain illiquidity discounts.

Example #1

Suppose Penelope owns an illiquid asset that she wants to sell, but there are no buyers due to the lack of the asset’s marketability. Penelope calculates the asset's value, arriving at the $90,000 figure, and its illiquidity discount is set at 18% per the method she uses to compute it.

She takes the direct approach and subtracts the illiquidity discount percentage from the asset's absolute value.

So, 18% of $90,000 = $16,200

Therefore, the discounted value is $90,000 - $16,200 = $73,800

Penelope can sell her illiquid asset at $73,800.

Example #2

Assume Susan owns the same asset as Penelope. However, she decides to take the indirect approach to arrive at the amount of discount during its resale. She employs the discounted cash flow method to determine the illiquidity discount. The illiquidity discount of this asset is 18%. She can increase the discount rate by 18% or minimize her cash flow projections by 18%.