Table Of Contents

IFRS Meaning

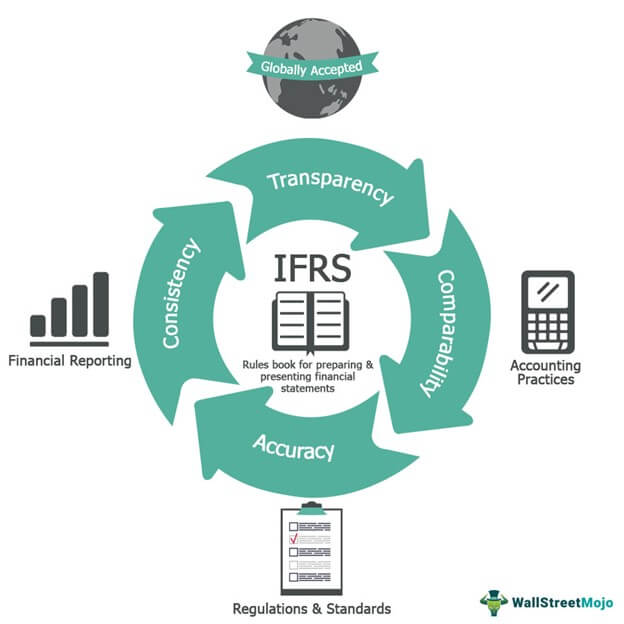

IFRS or International Financial Reporting Standards refers to a globally-accepted set of accounting and financial reporting guidelines for preparing and presenting financial statements. It ensures uniformity in accounting practice that makes financial records comparable across different reporting entities worldwide. Over the years, it has emerged as the new world standard in accounting.

It was first published in the year 2003. It was designed by the International Accounting Standards Board (IASB) and is adopted by more than 144 jurisdictions and countries worldwide, including the European Union. The U.S. government, however, uses the U.S. Generally Accepted Accounting Principles (GAAP) system of accounting rules. Before IFRS, the International Accounting Standards (IAS) were in regulation.

Table of contents

- IFRS Meaning

- The full form of IFRS is the International Financial Reporting Standards. It is a unique set of rules and regulations followed worldwide for recording financial transactions of a business entity. At present, it is adopted by 144 jurisdictions.

- In June 2003, its first copy was published by IASB. IASB is a board of finance and accounting experts with responsibility for designing and issuance of the standards.

- IFRS is often confused with IAS (International Accounting Standards), which were in practice before. IFRS superseded IAS.

- The U.S. government doesn’t follow IFRS and has its own rules and protocols called U.S. Generally Accepted Accounting Principles (GAAP). Both standards are effective and serve the same purpose. However, there is always a comparison of IFRS vs GAAP.

Understanding IFRS

The purpose of financial statements is to provide information on a company's financial performance and position to help current or prospective stakeholders make reliable financing decisions. It is a company’s primary means of communication with them.

So, the information presented in the records should be relevant, reliable, accurate, and comparable. To ensure it, companies started observing regionally accepted accounting standards. However, comparing different companies across countries became difficult due to a lack of uniformity in their accounting guidelines. As a result, companies had to prepare several sets of financial statements for different jurisdictions.

With the emergence of multinationals having a presence in multiple countries, the need for a global accounting framework gained momentum. It gave rise to the formation of IASB. The IASB is an independent group with hybrid experts in finances, auditing, accounting standards, and education. The task of board members is to issue and publish financial accounting standards.

The IASB was created with the sole purpose of designing an international financial reporting system that will ensure smooth processing, interpretation, and comprehension of financial statements, business transactions, and foreign investments. IASB introduced IAS and later IFRS that laid down a framework of universally recognized principles for accounting.

The IFRS establishes accounting standards and practices that every company adhering to it must observe. It is a rule book that must be followed while recording business transactions in the books of accounts. Also, as it yields transparency and consistency in financial reporting, governments use it to regulate direct and indirect foreign investments.

It is accepted worldwide as it facilitates the free flow of capital. In other words, any U.S. investor will be more confident to invest in, suppose, an Indian company after scrutinizing its financial records prepared in conformity with this accounting standard. This is because following the internationally-approved standards eliminate accounting risks associated with such investments.

However, note that the U.S. government enforces GAAP on their companies. Therefore, there is often a widespread debate on IFRS vs US GAAP when it comes to compliance. IFRS is lengthy and flexible compared to GAAP. As it is principle-based, its rules are open to multiple interpretations. However, both IFRS and GAAP serve a common objective of uniformity and openness in maintaining financial statements.

Objectives of IFRS

International Financial Reporting Standards represents an international financial reporting system and serves multiple purposes. Some of its significant goals in the financial world are as follows:

#1- Create a Common Law

One of its key objectives is to ensure that common law is introduced and adopted by as many jurisdictions and countries as possible to bring everyone on the same page. It ensures that everyone follows the same guidelines and adopts a universal way of reporting business activities.

#2 - Aid analysis

It helps stakeholders in analyzing a company’s performance and interpreting its financial position. For example, corporations and governments use these standards to make credible financial statements. It aids in categorizing and reporting financial data with accuracy and consistency. Such financial records promote better comprehension and help decision-making.

#3 - Assist in preparation of reliable financial records

By following International Financial Reporting Standards, the data presented in the books of accounts are likely to be accurate, reliable, uniform, and appropriate within the bounds of its rules. The high quality of financial records assists investors in making informed economic decisions.

#4 - Ensure comparability, transparency, and flexibility in reporting

The consistency in reporting accounting practices enables easy comparison of the financial records of compliant companies across nations. Such comparisons allow investors to identify risks and opportunities before investing. As a result, it promotes foreign trade and investment.

Also, it requires full disclosure of all relevant information to its stakeholders. However, being principle-based, the rules are not very rigid and allow companies to adapt to them in their own way.

Uses of IFRS

This standard is a multi-layer set of rules and guidelines prepared like a blueprint to follow in accounting. Its main uses are as follows:

#1 - Financial Tool

The International Financial Reporting Standards bring efficiency, accuracy, and data transparency to serve public interests for growth, trust, and sustainability of the world economy. For example, the International Organization of Securities Commissions (IOSCO) is working with the IFRS to set up a new body by November 2021 to postulate mandatory global standards on climate change in company disclosures. The IOSCO will also eliminate any errors or conflicts by going interoperable with the global baseline.

#2 - Principles and Guide

The companies run their whole business and represent their financial data and information as per the IFRS accounting principles. If they fail to do so, they may be penalized for it. Hence, it assures the trustworthiness of a company.

#3 - Promotes Decision Making

The standards help investors make wise decisions regarding their investment by providing a clear picture of company reports and financial statements. It is possible because of its singular and universal language, making it easy to comprehend.

#4 - Improves Economy

Globally, investors are more open to investing in companies with IFRS-compliant financial records. Again, it is because such reports are presumed to be authentic, easily understandable, and comparable. This credibility opens the economy to foreign investment and thereby paves the way for economic progress.

Importance of IFRS

It is treated as an international accounting standard and holds great importance for many countries and the world economy. Here is its significance:

#1 - Transparency

It encourages transparency and accountability of financial statements prepared by companies, small firms, and government agencies. As a result, it minimizes the margin of error and manipulation of any holdings and irregularities of funds, transactions, and balances. Besides, it also motivates consistency and clarity of work.

#2 - Uniformity and Comprehensive

The International Financial Reporting Standards are developed to set uniformity in the presentation and understandability of statements. When everyone follows and recognizes the standards, it becomes easy for companies and agencies to follow a common law that helps world economies compare their growth comprehensively. Also, it is easy to read for everyone.

#3 - Security and Flow

It helps track the flow of transactions, records funds information, and works towards attaining a security level for direct and indirect foreign investments across nations. This accounting standard is essential when we are dealing with significant assets or getting into heavy transactions.

#4 - Accountability

It strengthens accountability by bridging the gap of incompetent financial reporting. If not complied with it, the companies may face penalties. For example, last year, the Johannesburg Stock Exchange fined a sugar firm Tongaat Hulett Ltd. Its financial statements, account reports, and other information details did not comply with IFRS and were incorrect.

Frequently Asked Questions (FAQs)

When was IFRS introduced?

International Accounting Standards Board (IASB) is a body formed to create IFRS in 2001. In June 2003, its first principles were developed and issued by it.

The IFRS are based on what?

It is based on standard accounting principles and procedures accepted and adopted by 144 jurisdictions. It is a guide on reporting financial statements and data that is understandable and comparable with one another.

What are IFRS and its purpose?

IFRS full form is International Financial Reporting Standards. As the name suggests, its purpose is effective, efficient, and accurate reporting of financial statements using standard accounting principles to ensure transparency, consistency, growth, and interest of public services.