Table Of Contents

Idiosyncratic Risk Meaning

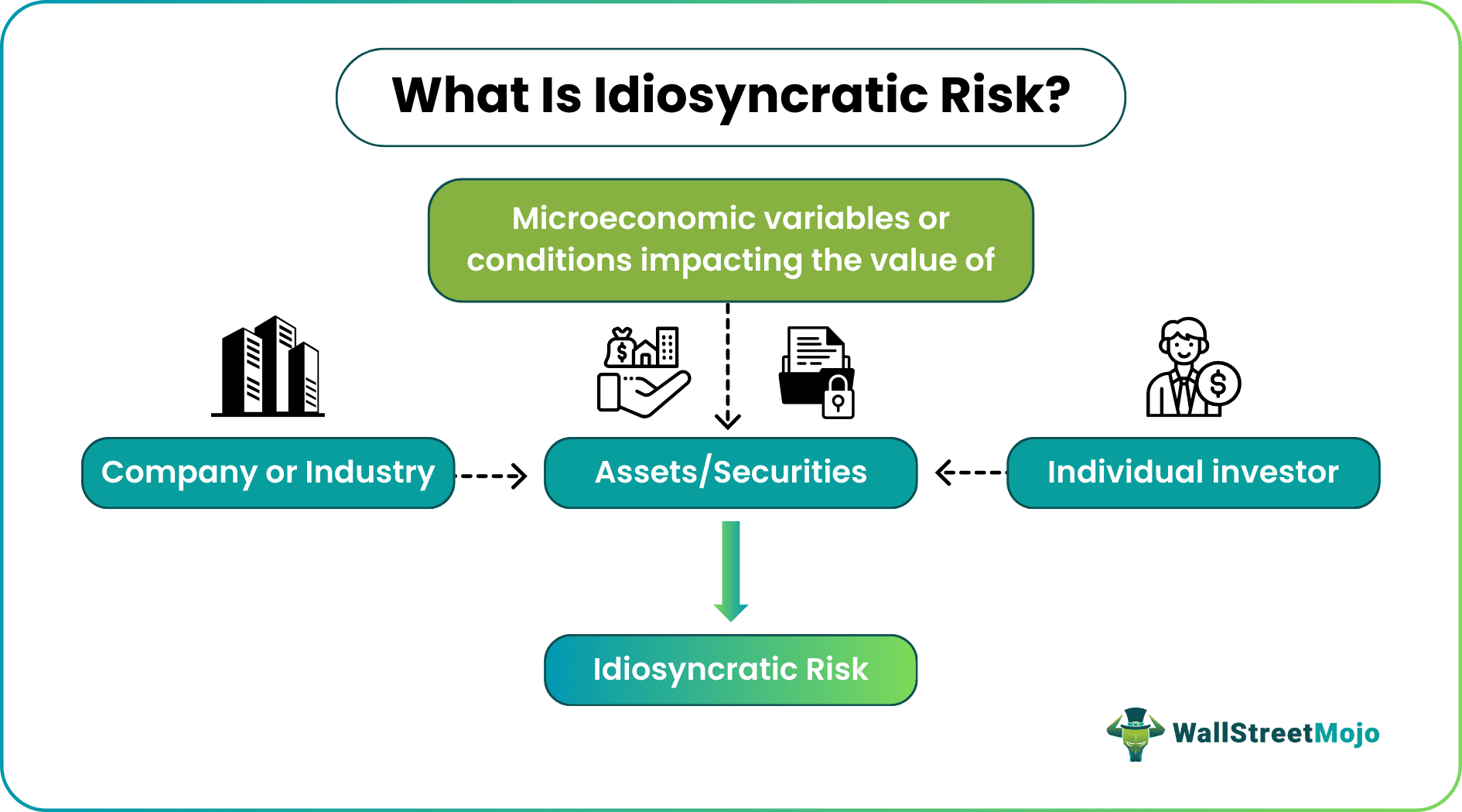

Idiosyncratic risk arises from variables or conditions that impact the value of a single, multiple, or rare asset of a particular company or sector over time rather than market risk. It is inherent with individual investment and does not affect the total investment portfolio of an investor.

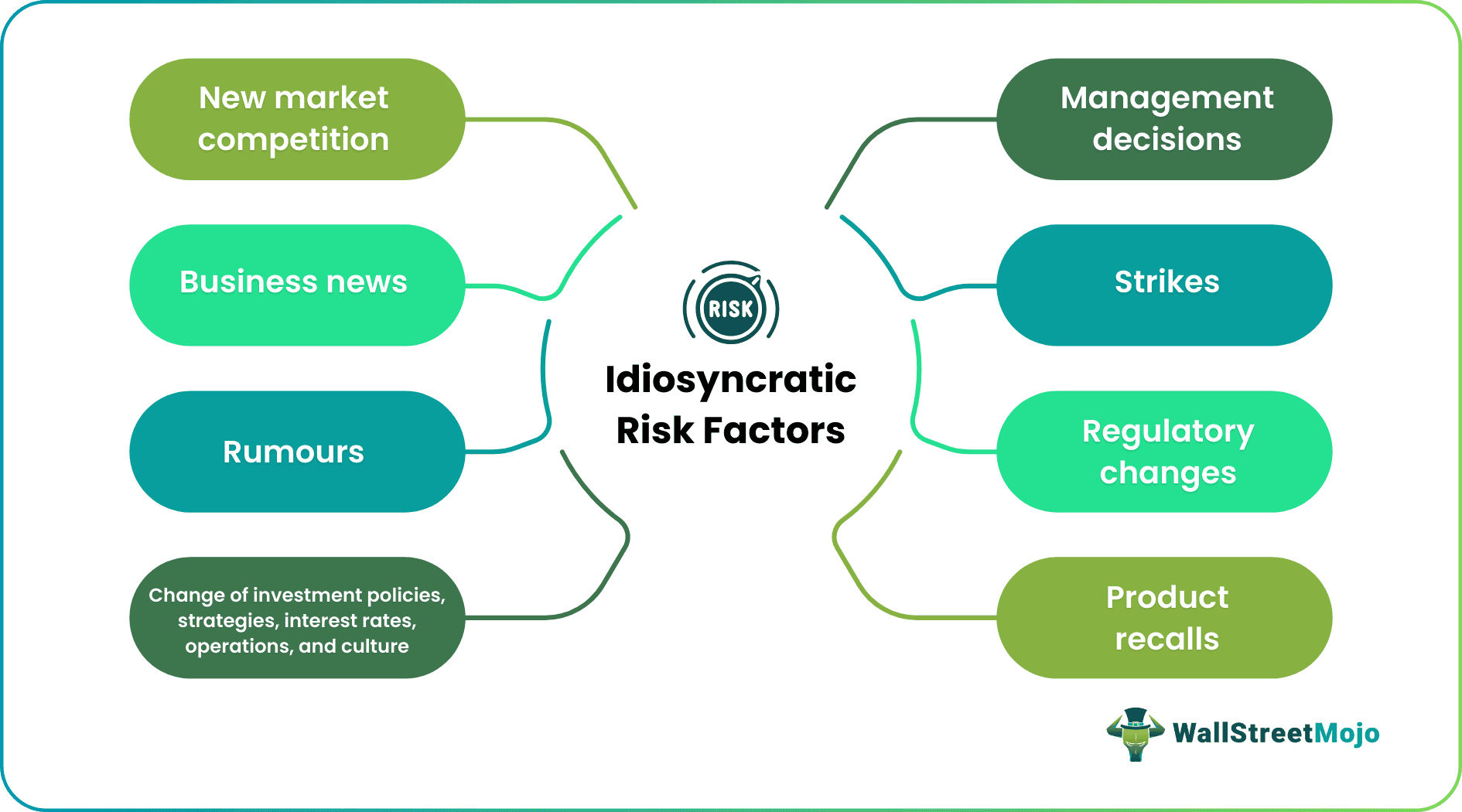

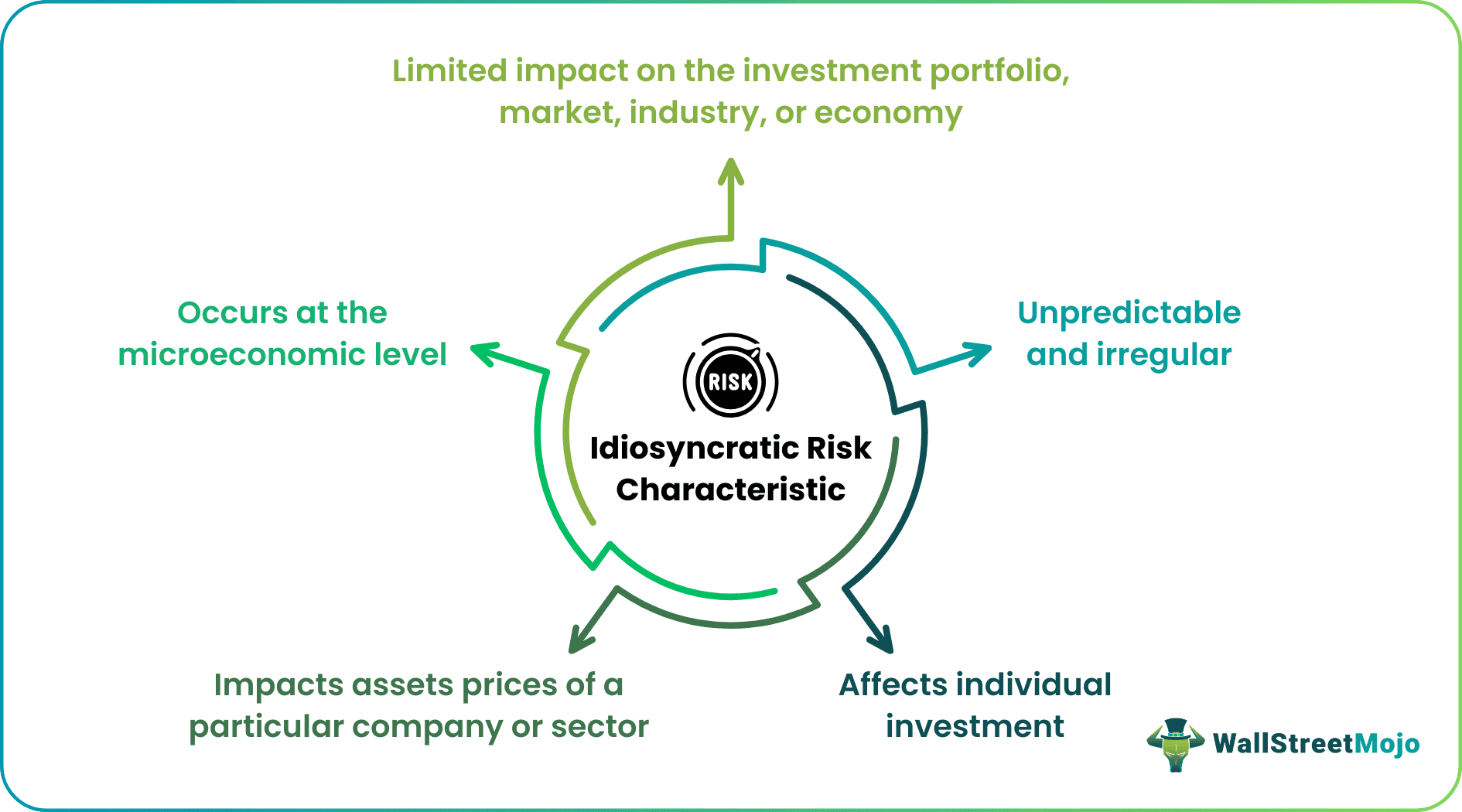

Idiosyncratic risk, also known as unsystematic risk or diversifiable risk, is highly unexpected and irregular. Examples include management decisions, legislative changes, competition, product recalls, etc. Investments strategies like portfolio diversification and hedging can help mitigate the risk. It differs from systematic risk, which impacts all assets and the overall market or sector.

Key Takeaways

- Idiosyncratic risk emerges from variables or events that impact the value of a single, multiple, or rare asset of a company or industry over time.

- It is highly unpredictable, irregular, and inherent in individual investments, with little bearing on an investor's overall portfolio.

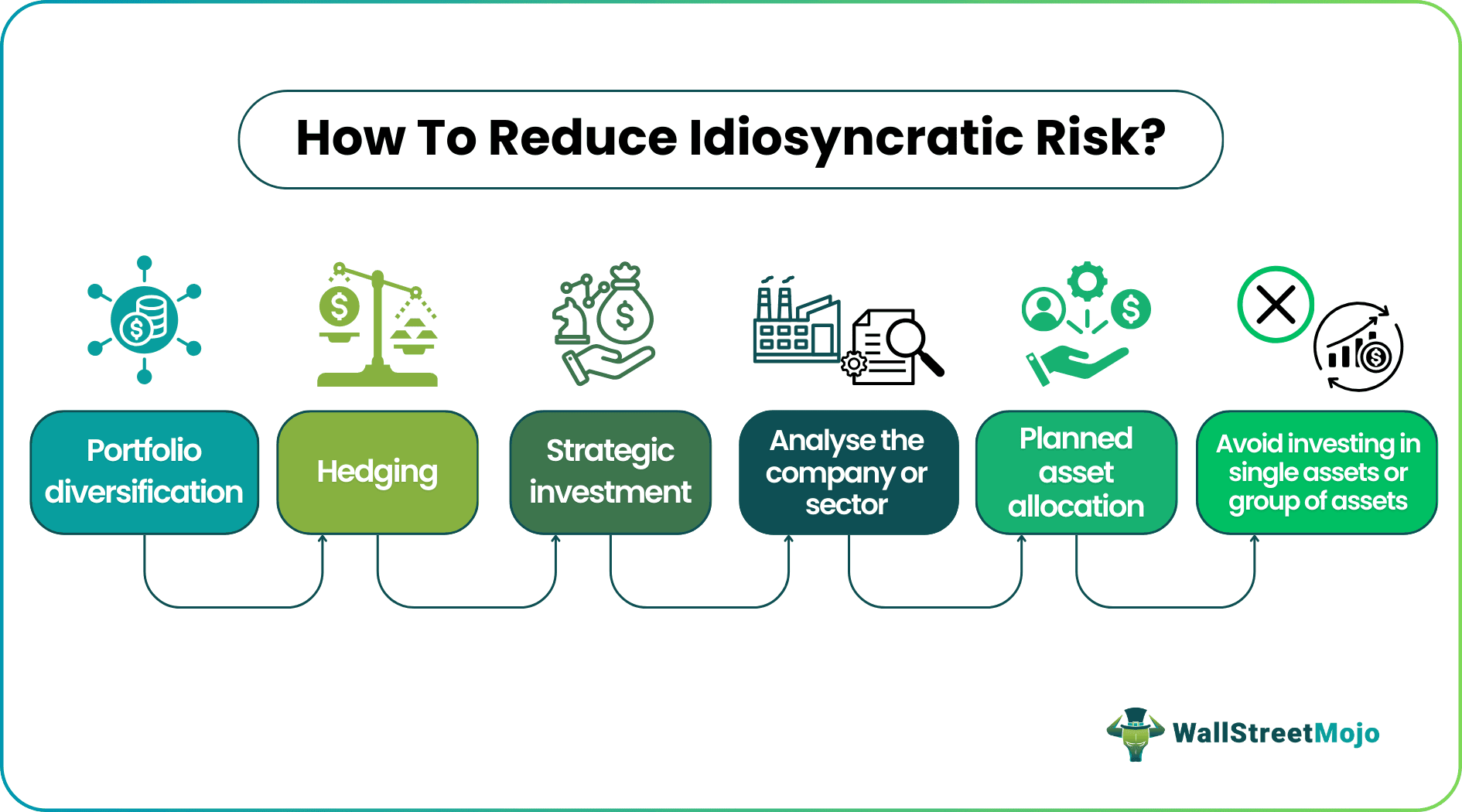

- Portfolio diversification, hedging, strategic investment, and the study of the business or sector can help reduce the risk.

- Unsystematic risk is not the same as systematic risk, which occurs at the macroeconomic level and affects all assets and the entire market or industry.

Understanding Idiosyncratic Risk

Idiosyncratic risk definition refers to a type of risk limited to individual investments in an asset or a group of assets of a particular corporation or industry. It is not, however, tied to general market risk. Instead, it is linked to unforeseen and uncertain circumstances surrounding a business or sector that affect asset prices. Also, it occurs at the microeconomic level rather than the macroeconomic level and has little impact on the overall economy. Short-term stock price fluctuations indicate this type of risk.

Idiosyncratic risk can result from new market rivalry, business news, rumors, strike, change in investment policies, strategies, interest rates, operations, culture, legal procedures, supply and demand chain failure, or inventory shortages of a company or sector. Individual investors usually face this risk due to microeconomic forces causing a price variation in the asset(s) and underlying business.

While every investor is prone to systematic risk, idiosyncratic risk is exclusive to a particular company or industry. Therefore, experts suggest investors diversify or hedge their portfolios and make strategic investment decisions to avoid the risk. Besides, they should not aggressively invest in a single asset or group of assets. Another pro advice is to analyze the business or sector to anticipate the risk and its negative impact on the investment portfolio. Investors can calculate unsystematic risk by deducting the systematic risk from the total risk.

Idiosyncratic Risk Examples

Let us look at the following examples to understand the concept even better:

Example #1

Simon has invested in the stocks of three separate companies - a fast moving consumer goods company, an automobile company, and a bank. They are all part of three different industries. Everything was going well, and Simon was enjoying his balanced investment portfolio.

One day, laborers of the automotive firm, stocks of which, Simon owned went on an indefinite strike for some reason. It led to a substantial decline in automobile production and sales. As the news of the strike spread, the company stock prices started to decline for a week before stabilizing in a price range, thus bringing loss to Simon.

It is clear from this example that the idiosyncratic risk only affected the automobile company and its stocks, not the entire market or sector.

Example #2

Another idiosyncratic risk example is the largest oil spill in the history of oil drilling. On April 20, 2010, the oil drilling rig Deepwater Horizon, operated by BP PLC on the Macondo Prospect in the Gulf of Mexico, exploded and sank. Following the explosion, the oil continued to flow in the seawater until it was capped on July 15, 2010. As a result, the unsystematic risk that happened during those 87 days had a detrimental impact on the company's stock values rather than the whole market or industry.

Idiosyncratic Risk vs Systematic Risk

An example of each can help understand the distinction between idiosyncratic and systematic risk:

Assume there is a smartphone firm that has a global monopoly. Suddenly, the company's sales plummet due to a new competitor entering the market that offers the same sort and quality of mobile phones at a lower price. Eventually, it results in a decline in the company’s stock prices. It is a simple idiosyncratic risk example.

The COVID-19 pandemic had a significant impact on many global economies. People lost their employment, most companies went out of business, and schools and universities closed permanently. All of this had an impact on all stock exchanges and overall financial markets. It resulted in the 2020 stock market crisis, which lasted almost a couple of months. It is a good illustration of systematic risk.

Here are a few key differences that distinguish idiosyncratic risk from systematic risk:

| Idiosyncratic Risk | Systematic Risk |

|---|---|

| Affects the asset prices of a particular company or sector | Impacts all assets and causes fluctuation in the broader markets |

| Examples include market rivalry and business news, strike, change in investment policies, strategies, interest rates, operations, laws about a company or sector | Includes variation in stock prices, recession, inflation, market correction, taxation policy, and change of interest rates |

| Inherent with individual investment in the asset or the security | Affects the entire investment portfolio consisting of several securities |

| Occurs at the microeconomic level | Occurs at the macroeconomic level |

| Diversification, hedging, and careful business or industry analysis can mitigate the risk | Portfolio diversification cannot minimize the risk |