Table Of Contents

Idaho CPA Exam License

Idaho Certified Public Accountant (CPA) license is a must-have to practice as a CPA in the U.S. jurisdiction of Idaho. Like other states, Idaho too has state-specific education, CPA Exam, experience, and ethics requirements to earn the license.

Idaho is a one-tier state. So, you must pass the CPA Exam and gain relevant experience before submitting your licensure application. The Idaho State Board of Accountancy (ISBA) issues the license to qualified candidates on fulfilling all requirements.

Here are the licensing requirements in brief.

| Particulars | Requirements |

|---|---|

| Age | At least 18 years |

| U.S. Citizenship | Not required |

| Residency | Required |

| Social Security number | Required |

| Education requirement for CPA Exam | A bachelor’s degree (including 30 semester hours in the business including 20 semester hours in accounting) |

| Education requirement for licensure | 150 semester hours |

| Experience requirement for licensure | 1 year (minimum 2000 hours) |

| Ethics exam | AICPA Professional Ethics Exam |

Please note that all applicants must be current or former Idaho residents. Besides, candidates who intend to attain long-term residency immediately can also apply. Note that Idaho does not participate in the International Exam Program.

Now, let’s dive further and take a look at the Idaho CPA Exam and license requirements in detail.

Table of Contents

Idaho CPA License Requirements

Idaho CPA Exam Requirements

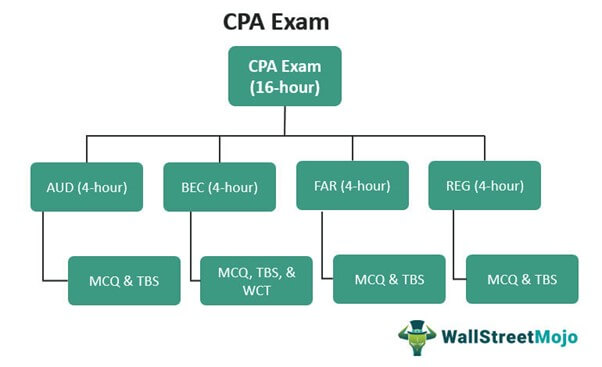

The Uniform CPA Examination is a 16-hour, computerized series of tests developed to evaluate your accounting expertise and skills. Passing it is one of the foremost requirements for acquiring a CPA license.

The American Institute of Certified Public Accountants (AICPA) conducts the exam in association with the National Association of State Boards of Accountancy (NASBA).

The applicants in Idaho must pass all four exam sections within the 18 months from the date of taking the first passed section. Or else, they will lose the credit for any section passed outside of the testing period and must re-take it.

Ensure to score at least 75 points on a scale of 0-99 in each section:

- Auditing & Attestation (AUD Section)

- Regulation (REG Section)

- Business Environment & Concepts (BEC Section)

- Financial Accounting & Reporting (FAR Section)

All the sections include five testlets of multiple-choice questions (MCQs) and task-based simulations (TBSs). Only BEC has an additional question type of written communication tasks (WCTs).

#1 - Exam Eligibility Requirements

Here are three standard requirements for Idaho candidates:

- At least 18 years of age

- Good moral character (sign the Idaho Department of Law Enforcement Criminal History Records Check form and submit with application)

- Idaho resident (current, former, or planning for long-term residency immediately)

#2 - Education Requirements

Candidates must acquire a bachelor’s degree (or equivalent) from an ISBA-authorized college/university. It must include a minimum of 30 semester/45 quarter hours in business administration subjects (with 20 semester/30 quarter hours in accounting subjects).

#3 - Application Requirements

The first-time and transfer candidates must fill out the CPA Exam Application Packet. At the same time, the re-exam candidates are required to fill out the Re-exam Application Form. Kindly visit the ISBA website to know the Exam application process.

Ensure officially sealed transcripts are submitted to ISBA from your college or university directly. Also, ensure the Registrar or another official institution representative sign them before submission.

Foreign transcripts must be evaluated by the NASBA International Evaluation Services (NIES). Please note that ISBA complies with the Americans with Disabilities Act. Hence, candidates requiring testing accommodations may submit their request on the Board-provided form.

#4 - Required Fees

First-time applicants

| Particulars | Amount | ||||

| Application Fees (initial or transfer candidates) | $100 | ||||

| Testing fees | AUD | BEC | FAR | REG | $904.60 |

| AICPA | $110 | $110 | $110 | $110 | |

| Prometric | $84.84 | $84.84 | $84.84 | $84.84 | |

| Photo | $6.31 | $6.31 | $6.31 | $6.31 | |

| NASBA | $25 | $25 | $25 | $25 | |

| Total | $226.15 | $226.15 | $226.15 | $226.15 | |

| Total fees | $1004.6 |

Re-examination candidates

| Particulars | Amount | ||||

| Application fees (initial or transfer candidates) | $50 | ||||

| Testing fees | AUD | BEC | FAR | REG | $904.60 |

| AICPA | $110 | $110 | $110 | $110 | |

| Prometric | $84.84 | $84.84 | $84.84 | $84.84 | |

| Photo | $6.31 | $6.31 | $6.31 | $6.31 | |

| NASBA | $25 | $25 | $25 | $25 | |

| Total | $226.15 | $226.15 | $226.15 | $226.1 | |

| Total fees | $954.6 |

The CPA exam application fees are non-refundable. So, you must pay the testing fees to NASBA for the sections you can take within the next six months.

Idaho CPA License Requirements

The following are the Idaho licensure requirements:

- Earn a Bachelor’s Degree with 150 semester hours

- Pass the Uniform CPA Exam with at least 75 points in each section

- Gain one year of work experience (at least 2000 hours)

- Pass the Ethics exam with at least 90%

You must be at least 18 years old to apply for the license. Also, ensure to obtain Idaho residency and a valid Social Security number. Furthermore, check out the ISBA website for the complete license application process.

#1 - Education Requirements

Applicants in Idaho must earn 150 semester hours (225 quarter hours) of education from an accredited college/university. Please note that the initial 120 credit hours are required to sit for the CPA exam. Hence, the additional 30 credit hours are for successful licensure.

Scenarios to fulfill the education requirements

- A graduate degree with a concentration in accounting

- A graduate degree from a business-accredited program with

- 24 semester hours in accounting (undergraduate level), or

- 15 semester hours (graduate level), or

- An equivalent mix

The program must include financial accounting, auditing, taxation, and management accounting subjects.

- A bachelor’s degree at an ISBA-approved institution or from a business-accredited program with

- 24 semester hours in business, excluding accounting courses (undergraduate or graduate level)

- 24 semester hours in accounting

The coursework must include management accounting, taxation, auditing, and financial accounting subjects.

As specified above, candidates with foreign education credentials may avail of NIES services. This will help them complete the formal evaluation process efficiently.

#2 - Exam Requirements

You must pass the Uniform CPA exam within the 18-month testing period. Ensure to score at least 75 points in each section to qualify for CPA licensure. Furthermore, look for the CPA Exam Requirements section for more details.

#3 - Experience Requirements

You must gain one year of full-time or part-time work experience. This includes at least 2000 hours earned within 12 to 36 months. Also, an active CPA should verify your experience.

Ensure to obtain the experience within the ten years immediately before the CPA licensure application. After acquiring the necessary experience, fill out and submit your experience form to ISBA.

#4 - Ethics Requirements

Finally, candidates are required to complete the AICPA Ethics Course. They must pass with at least 90% to qualify for CPA licensure. For more details, check the AICPA website.

| Particulars | Details |

| What to study | Professional Ethics: AICPA’s Comprehensive Course |

| Cost |

|

| Topics covered |

|

| How to study |

|

| Exam Format/Type/Questions |

|

| Minimum Passing Mark (for licensure) | 90% |

Continuing Professional Education (CPE)

Idaho candidates must sustain their CPA license with at least 80 CPE and four ethics credit hours in the rolling two-year period. Besides, new licensees must also enroll for at least a two-hour state-specific ethics course in the same year they obtain the CPA license.

Idaho State Specific Ethics course covers aspects of the Idaho Accountancy Act and Rules. Please note that the AICPA Ethics course and exam taken for CPA licensure do not count toward the CPE requirement.

| Particulars | Details |

| License renewal date | June 30 every year |

| CPE reporting period | Jan 1 – December 31 (Biennially) |

| CPE requirements | 80 CPE hours every two years with

|

| Ethics requirement | 4 CPE credits every two years, including

|

| Annual license renewal fees |

|

Now that you know what it takes to be a CPA in Idaho, start gearing up ASAP! Set goals, stay focused, and use suitable study materials. Also, visit only the authorized websites (AICPA, NASBA, and ISBA) to look for any changes in the exam content. Lastly, ensure your license renewal every two years.

Idaho CPA Exam Information and Resources

1. Idaho Prometric Testing Centers

- Idaho State University - Meridian

1311 East Central Dr

Meridian, Idaho 83642

Phone: 208-373-1815

- Idaho State University - Pocatello

1001 South 8th Avenue

Pocatello, Idaho 83209

Phone: 208-282-4506

2. Idaho State Board of Accountancy

11351 W Chinden, Building #6, Boise, ID 83714

Phone: (208) 334-2490

Fax: (208) 334-2615

Email: isba@isba.idaho.gov

3. Idaho Society of CPAs

1649 W Shoreline Drive, Suite 202, Boise, ID 83702

Phone – 208-344-6261

Fax – 208-344-8984

Email – Info@idcpa.org

Recommended Articles

This article has been a guide to Idaho CPA Exam & License Requirements. Here we discuss Idaho CPA requirements and license requirements with CPE requirements. You may also refer to