How To Make Smart Investments: From Research to Paperwork

Table Of Contents

Introduction

Making investments to make as much profit as one can has become a new norm today, given the rising standard of living and transforming lifestyle preferences. However, investment made, if not smart, would only lead to losses. You might have planned to make investments at frequent intervals, but did you ever wonder whether the investments you are about to make would prove right or not?

For you as an investor, the right investments would help you generate a smart yield in return, while the wrong one would lead you to heavy financial losses. Hence, among the millions of investment options online, you must know where to start from.

This blog will guide you on how to make smart investments for yourself from research to entire paperwork. Not just that, it will also get you equipped with the art of choosing top notch investments and similar opportunities.

Making Smart Investments: From Research to Paperwork

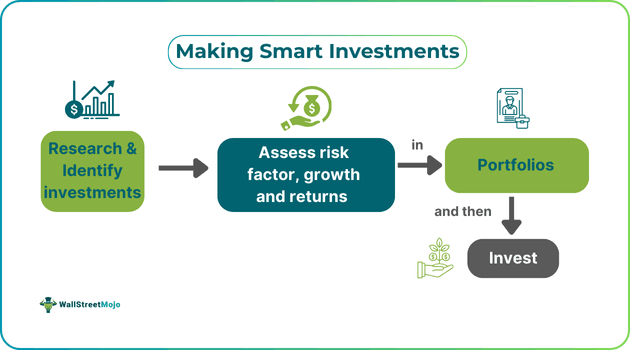

The art of making investments starts with capital. But, the art of making smart investments begins with in-depth research and identification of one’s goals. There are multiple instruments traded in the market, but choosing the right one needs some effort.

Below are the pointers that can guide you make investments in the right way. Let us look at them:

#1 - Preliminary Research for Smart Investments:

The primary step in making investments is research. The preliminary research helps bring you close to investment opportunities, which are likely to yield sufficient returns. Be it any instrument (equity, stocks, bonds, real estate, currency), researching them can help in understanding the risk and return prospects associated with them. It is better and vital to know about the ins and outs of making a smart decision. For instance, you may be a conservative investor and investing in stocks, despite them being profitable, might not seem suitable for your risky profile. Likewise, if you wish to invest in any company, you may require access to an investment agreement template, mentioning the terms and conditions associated with an investment.

#2 - Identifying Good Investment Opportunities:

Many people stumble on this question quite often, but fail to realize that good investments lie in the house of many members. You, as an investor, cannot rely on just the instrument alone, there is risk, market trends, analysis, and return rate generated by each.

Some popular investment options include stocks, equity, bonds, mutual funds, gold, real estate, fixed deposits (FDs), currencies, and exchange-traded funds (ETFs). Running behind each or putting entire capital in just one option does not help. It is wise to consider tracking the trending instruments among all, assessing risks and returns, and then investing smartly.

#3 - Assessing Risks and Returns:

Factually, no investment comes with zero risk. There is minimal or high risk associated with all instruments. What comes unannounced is the returns associated with them. Not always the returns are positive, as there is always a certain level of volatility in the market. A wrong move can potentially ruin your portfolio and attract extensive risk. It is, therefore, important to determine your risk profile and invest accordingly.

There are three types of investments namely conservative, moderate, and aggressive portfolio. If you have enough capital to lose on some percentage for high returns, you can choose to diversify your portfolio in high-risk investments. Likewise, an investor looking for an optimal balance of both risk and return can opt for a moderate portfolio. It focuses on stable instruments that come with minimal risk and adequate returns, like bonds, T-bills, debt funds, and more. On the other hand, if you cannot risk losing invested capital, low–risk instruments like fixed deposits, national savings certificates, and mutual funds are some of the most suitable options.

The Role of Financial Advisors

An overwhelming situation is always created when people think of the returns receivable on investments. But, when they sit down to actually invest, most of them are totally clueless. In fact, many are struggling with debt management. And that is where the role of financial advisor comes into play. They provide various services like;

- Investment advising

- Budget assistance

- Tax management

- Financial planning

- Debt management

- Retirement planning

- Estate planning, and more.

These advisors are experts in their field and always try to help you with your financial struggles. They hold much more market knowledge than assumed. You can approach them for financial assistance regardless of your identity or wealth. They will then assess your current situation, financial goals, risk tolerance level, and retirement plans as well. Moreover, you can also expect a deeper analysis of the situations where you can save on taxes, how estate planning can further help in your retirement planning, and eventually assist in insurance and future medical bills.

Do You Need a Financial Advisor?

Now when you know the benefits of approaching an advisor, do you really think you need a financial advisor? Hiring a financial advisor can be fruitful if you do not have any financial knowledge. But, if you already know the ins and outs of the investments, you may not require one.

The need for financial advisors arises when there are certain events (marriage, divorce), responsibilities (becoming a parent), and debt pondering your shoulders. At that stage, you might need someone more professional to help manage all these monetary hustles. Some basic investment paperwork and you can fulfill the investment needs via a professional. They will save time and effort and help you find the best investment opportunity.

Conclusion

Navigating through multiple investments can be a confusing experience for many investors. But basic research, assessment, and knowing your assets and debt can definitely help in understanding the right option for oneself. Also, you can consult any financial advisor and elevate your existing portfolio. They can guide you through the world of investments and paperwork involved, and you can definitely pick the best, and most importantly, the smartest investment for yourself. Take this chance to make the next intelligent move for your portfolio and your dreams!

Head on to this journey of smart investments today!