Table Of Contents

Example

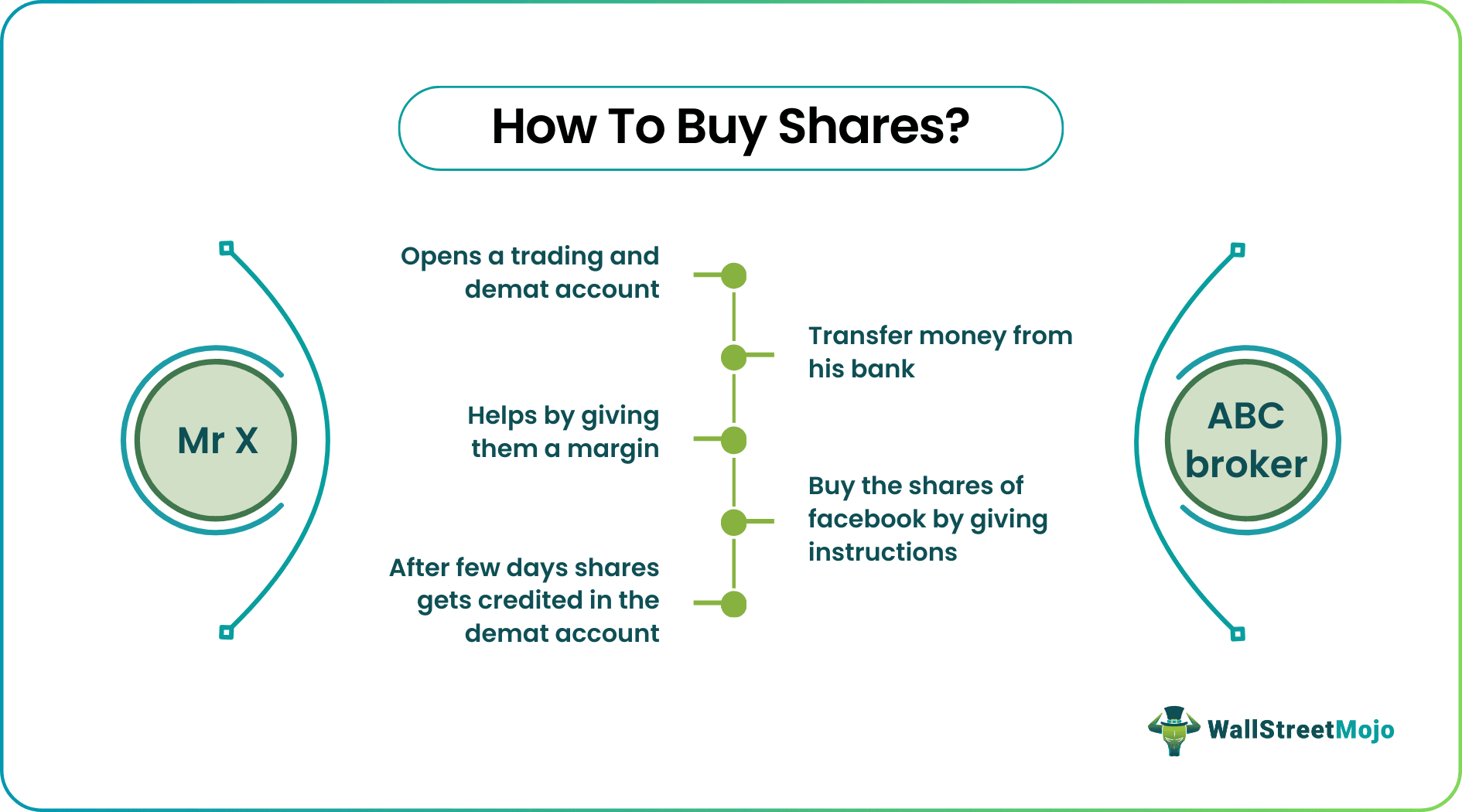

Mr. X wants to purchase Facebook shares, which are trading at $207. How will he do that?

Solution

Step 1: Mr. X will open a brokerage account. Mr. X chooses ABC as the broker and sets up a trading account. Every broker has ties with depository banks, and the broker will help Mr. X open an account with the depository bank.

Step 2: Mr. X will transfer money from his bank to the broker account. The broker also helps clients by giving them a margin. They can buy shares more than the money they have in a broker’s account and pay back the broker later.

Step 3: Now, Mr. X will have to buy the shares of Facebook using his online trading platform or by giving instructions to a broker on the client's behalf. If Mr. X wants shares at a fixed price, he will provide limit orders. However, if he wants to buy shares at any price prevailing in the market, he can give a market order.

Step 4: Once bought, he will use money from his brokerage account. Depending on the market, the shares take a few days to credit to the brokerage account.

Advantages & Disadvantages

While buying shares has a lot of advantages for the companies issuing the shares and the individuals and entities buying them, it also has some risks associated with it. One of them is to be well aware of the market fluctuations to book the right share transaction deals at the right time.

Benefits

- Shares are a great way to gain exposure to the equity market. The equity market has several sectors that comprise a country's economy. So, if a person feels that the auto sector is going to rise, that person should purchase a share of a company from the auto sector or invest in an ETF.

- Systematic investment in shares for a longer period has always been beneficial. If you analyze data from the past 20 years, you will see that, on average, the equity market has provided more returns than the debt market.

- If one has faith in a company and they like how the company has been performing, buying a share is the easiest way to involve with the company. It offers investors buying ownership in a particular company.

Risks

- Market fluctuation, as discussed earlier, is the main risk. One never knows when the prices of the stocks in question would increase or decrease.

- The level of company risk is high. In case, the company suffers and incurs a loss, it will affect the share prices. This deterioration in the prices affects the investors automatically as they are the share buyers.

- There are rules to follow to ensure buying shares remains an ethically and legally sound process.

Frequently Asked Questions (FAQs)

One must place a pre-market order with the calculation at 9.00 AM. One must calculate the current market price X 1.05 = buy share price.

One must invest in the top unlisted public company by investing in start-ups and intermediaries, purchasing ESOPs directly from promoters or employees. In addition, one must invest in PMS and AIF schemes that raise unlisted shares. Illiquidity, capital loss, no dividends risk, and dilution risk are involved in purchasing an unlisted public company.

By funding start-ups and intermediaries, purchasing ESOPs directly from employees or promoters, or contributing to AIF and PMS plans that unlisted purchase shares, one can invest in the top unlisted companies in India. Illiquidity, capital loss, a lack of dividends, and dilution risk are some of the dangers.

Recommended Articles

This article is a guide to Buying Shares meaning. Here, we explain how to buy shares along with the advantages, disadvantages, and an example. You may learn more about financing from the following articles: -